Content

And it’s perfectly normal when you look at how many cryptocurrencies there are on the market – 6900 according to CoinMarketCap. The price of cryptocurrencies is volatile; some can go bust, others could be scams, and occasionally one may increase in value and produce a return for investors. Bank of England governor Andrew Bailey recently said he was “very nervous” about people using bitcoin for payments. He has previously warned that cryptocurrency investors should be prepared to “lose all their money”. Rapid City in America has some of the craziest weather in the world – a bit like how volatile crypto prices can beIf you do invest, be prepared to lose some or all of your money.

The lucrative world of cryptocurrency no longer has to be a mystery. Discover what cryptocurrency is all about and how to make a lot of money investing and trading in them. Not so with options trading, which, as the name implies, provides you with the option, not the obligation, to carry through on what you have started. Whether you’re new to the cryptocurrency market or an experienced trader, there are numerous ways you can make money with Bitcoin. Just make sure you assess the risks and level of knowledge required before you take the plunge.

If you’ve already got a strategy that works, then a cryptocurrency trading robot may be worth considering. Once you’ve programmed your strategy, the bot will get to work, automatically executing trades when the pre-determined criteria are met. On top of the possibility of complicated reporting procedures, new regulations can also impact your tax obligations.

Is There A Less Risky Way Of Investing In Crypto?

This commission acts essentially as a service fee for brokering a trade between buyer and seller. Cryptocurrencies are a completely different class of asset and one that is still largely misunderstood, even by those in the market. However, getting started with crypto is fairly straightforward, though it is fairly different from other financial instruments. There are a few ways to get exposure to cryptocurrency with existing investment funds.

The cryptocurrency market is a fluid one that is constantly changing. Each day, new cryptocurrencies are being introduced into the market.

- Cryptocurrencies like Bitcoin and Ethereum have mostly become known for their potential to gain value very quickly.

- Thus, one way of making money from cryptocurrencies is to buy into the market when prices have hit a low when sentiments are down.

- Author Andrew Johnson walks the reader through how to properly invest money and takes the reader through all the other hurdles step by step.

- Some exchanges also allow you to trade based on changes in an underlying asset’s value, like the US dollar/Bitcoin rate.

- Depending on the project, the amount of funding collected may exceed hundreds of thousands of dollars.

In reality, you won’t be able to trade all 1,500 cryptocurrencies. However, you should be able to trade all the major currencies – including bitcoin, bitcoin cash, Ethereum, Ripple XRP and Litecoin – and new currencies are being added all the time. With so many around, it can be best to choose those that you know something about, and become an expert in their price movements, rather than taking a broad-brush approach. If you simply want to trade cryptocurrency you just need a brokerage account, rather than accessing the underlying exchange directly. The broker will be exposed to the underlying market on your behalf. This means you need to create an exchange account and store the cryptocurrency in your digital ‘wallet’. You don’t have to pay capital gains on the profits of trading cryptocurrencies, whereas you do if you profit from buying and selling cryptocurrency direct.

The more accurate your predictions, the greater your chances for profit. Short-term cryptocurrencies are extremely sensitive to relevant news. When news such as government regulations or the hacking of a cryptocurrency exchange comes through, prices tend to plummet. PLATFORM GUIDE Trading on different timeframe charts Trade in the financial markets with a wide range of chart timeframes. Learn how to trade daily, one-hour, 30-minute and one-minute timeframes. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

A cryptocurrency is a new form of digital asset that can be used for online payments. Investing in cryptocurrencies is one of the best decisions you could ever make this year. Even though it is quite risky at first, it offers you more benefits once you mastered how to use it wisely. You can mitigate the risks posed by the cryptos by changing your portfolio and doing extensive research.

Does Your Portfolio Need Bitcoin?

To deposit funds, one would need to purchase BTC, ETH or any other deposit cryptocurrency from third-party sources and have it transferred to their third-party wallet. The funds are then transferred from this wallet to the wallet provided by the crypto exchange for depositing that cryptocurrency. If you choose to use this method, you should ensure to enter the wallet addresses properly when conducting the transactions, as any crypto transferred to a wrong address cannot be recovered.

This audio book explains various governments stand on trading of cryptocurrecies. Actually, this is a new digital currencies system and what impact can create a present and future. So I think, It’s a real beginner guide who are interested to learn Cryptocurrency’s idea.If you want to learn about cryptocurrency then get this book.

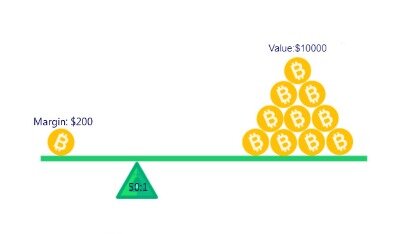

With trading, you only have to put up a small proportion of your total position size. This allows you to take a leveraged position on the price, gaining a greater exposure than might otherwise be available with your investment amount. This approach can also be cheaper – investors don’t have deposit or withdrawal fees to access the currency, for example. You can decide to own units of cryptocurrency, or to trade on the price of cryptocurrency. By trading, you can speculate on the price without ever taking ownership, using derivatives trading instruments called cryptocurrency CFDs. Take note that any form of cryptocurrency is commonly used around the world and can be transferred easily.

Those two points are the very basics that you should expect an exchange to utilize, but several other issues related to the technology you should investigate further. They charge a percentage of total proceeds as a fee when they collect funds on behalf of the company. It could mean a significant payout to the hosting exchange, depending on the total amount raised. This is a way of doing business that is unethical and exploits those just starting out trading more often than not.

Binance Coin or BNB is an altcoin that has seen rapid price appreciation in recent times. Thus, for the savvy investor, this represents an opportunity to capitalise on burgeoning cryptocurrencies. While Bitcoin may be the gold standard for crypto at the moment, there are dozens of alternative cryptocurrencies on the market. Back in 2018, Bitcoin prices were at an all-time low at around $3,000 per BTC since the 2017 price boom and many were expecting the market to collapse. However, in the 2nd quarter of 2019 Bitcoin prices began to rally and as of the time of writing, Bitcoin has soared to more than $10,000 per BTC. For the savvy investor however, this new relatively explored market is indeed worth exploring.

There are a number of strategies you can use for trading cryptocurrency in 2017. Whichever one you opt for, make sure technical analysis and the news play important roles. Finally, keep aware of regional differences in rules and taxes, you don’t want to lose profit to unforeseen regulations. Once you’ve decided on a broker, got familiar with your platform and funded your account, it’s time to start trading. You’ll need to utilise an effective strategy in line with an efficient money management system to make a profit.

However, despite global popularity, cryptocurrencies have not become mainstream and a majority of people still do not know how to turn their crypto investments into a profitable venture. Cryptocurrencies are virtual currencies that work on the paradigm of the highly-secured, transparent, and immutable technology, the blockchain. The industry came into existence with the launch of its first offering, Bitcoin in 2009.Paypal, known as the most used method of transaction in the world, was founded in 1998. Ever since then, the crypto domain has evolved and advanced in multiple surprising ways. But don’t worry, this article will explore the various ways in which you can put your crypto assets on the working roller and reap in the maximum benefits.

Times Money Mentor has been created by The Times and The Sunday Times with the aim of empowering our readers to make better financial decisions for themselves. We do this by giving you the tools and information you need to understand the options available. We do not make, nor do we seek to make, any recommendations in relation to regulated activities. Since we’re not regulated by the Financial Conduct Authority, we’re not authorised to give you this sort of advice. In some cases, we may provide links where you may, if you choose, purchase a product from a regulated provider with whom we have a commercial relationship. If you do purchase a product using a link, we will receive a payment. This will help us to support the content of this website and to continue to invest in our award-winning journalism.

Thus, one way of making money from cryptocurrencies is to buy into the market when prices have hit a low when sentiments are down. The early phases of younger cryptocurrency exchanges are inevitably characterized by minimal volume. Due to this, these exchanges cannot rely exclusively on commission revenue during their growth phase. The digital asset exchanges may also offer a service that allows users to list tokens and coins to drive initial revenues. With some of the most famous exchanges facilitating volumes of billions of dollars, it becomes apparent how lucrative these ventures will become.

Great For Traders

This could be the easiest and simplest strategy that you can do to make money with cryptos. There are several ways you can do to earn some bucks in cryptocurrencies, which include a direct partnership or investment, Initial Coin Offering , and exchanges. Cryptocurrencies can be used in multiple ways for generating incomes just like any other traditional financial source. They are secured, transparent, and are simple to operate as they do not involve complicated procedural requirements.

Please contact your financial professional before making an investment decision. Countries around the world are scrambling to develop a policy response to Bitcoin mania. Nigeria has banned crypto trading outright, while in the UK the Financial Conduct Authority’s ban on cryptocurrency derivatives came into force last month.

When you are day trading you will be entering and exiting positions often. This book gives you the kind of basic step-by-step information you’ve been looking for to make an informed decision about day trading. By laying out the process you need to go through in a practical and no-nonsense way, you get a clear idea of just exactly what you’ll be getting into when you start day trading. This bundle is made up of Andrew Johnson’s masterpieces on day trading. Likewise, there are certain strategies you should know in order to give yourself a fighting chance. When it comes to having a little wiggle room in the stock market, options trading can’t be beaten. With that being said, however, in order to maximize your options trading experience, you need to be able to rely on successful strategies you can count on when the going gets tough.

The idea is you keep a close eye out for a correction in a trend and then catch the ‘swing’ out of the correction and back into the trend. You’ll find trending prices move quickly, but corrections, on the other hand, will not.

Work For Cryptocurrencies

Though both ICOs and STOs can be a good option to catch extra earnings, it is also important to be vigilant while making choices. The market witnesses the entry of new projects promising lucrative returns, every day. The cryptocurrency trading platform you sign up for will be where you spend a considerable amount of time each day, so look for one that suits your trading style and needs. Exchanges like Coinbase offer in-depth platforms, such as their Global Digital Asset Exchange .

All contents on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalised advice before you make any trading or investing decisions. Daytrading.com may receive compensation from the brands or services mentioned on this website.

The pleasant manner in which the instruction is presented, goes through the basics in a very understandable manner. But also giving you the knowledge you need on why certain choices you will have to make, need to be considered. All 5 of the cryptocurrencies Ethereum , Binance Coin , NEO, EOS, Ethereum Classic , are often make 5%-10% moves in just a few hours.

High volatility and trading volume in cryptocurrencies suit short-term trading very well. We also list the top crypto brokers in 2021 and show how to compare brokers to find the best one for you. PLATFORM GUIDE Client sentiment indicator It is important to gauge market sentiment when trading financial instruments, such as shares or indices. Learn how to use our client sentiment tool, which gives an overview of what traders are investing in right now. PLATFORM GUIDE Trading and price alerts Find out how to activate trading alerts on our customisable platform, including economic news, execution orders and price alerts for the financial markets. You will be charged a deposit fee every time you want to add money to your account.

Gold Price: Recent Movement And Trading ..

There are various means by which an exchange can cheat you out of your money when looking to raise funds. Therefore when using one, common sense and vigilance are recommended. Also, adding an IEO module to the exchange platform can help drive revenue. This idea creates a similar system to crowdfunding works by allowing contributors to get tokens for ETH or BTC before they go to an exchange. This is called a deposit fee, which is different from the transaction fee you pay when you make a sale or purchase through the exchange. Next, you have to learn how to read charts, because you’re going to be looking at a lot of those when investing in crypto. You need to understand candlestick figures in particular, and also how to use technical indicators like the RSI and the Stochastic.