Content

On the left hand side of the screen, the view is split into two sections. The top section lists all the prices people are willing to buy the selected crypto at, and underneath is the full list of prices people are willing to sell at. At the bottom of the screen, in the center, are two large boxes, allowing you to quickly and easily buy or sell the cryptocurrency you have chosen. These are large and color coded, allowing you to avoid any mishaps in the heat of the moment.

You will have to comply with all the stipulations of this deal throughout your trading process. To shift funds, you will head over to the wallet tab where you will choose the margin option and click on transfer. Add the number of funds you want to shift as a result you will be able to shift funds from your normal Binance wallet to the Margin Trading wallet. According to various reports, Binance is working towards creating a decentralized exchange but its current exchange platform is centralized.

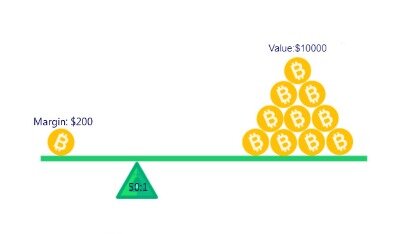

Margin trading is especially popular in low volatile markets since you almost need some leverage to receive any movements. Such markets are fiat forex markets and sometimes commodities. Margin trading, or leverage trading, amplifies trading results in both directions. This results in larger potential profits but to a higher risk. Binance is one of the top Bitcoin trading sites and this is the place you want to be if you are about to do margin trading. Cryptocurrency is horrendously volatile and because of that, you do not need leverage. So leverage was really made for the traditional markets, things like 4 X, the indices stocks things that don’t really move all that much in terms of price.

So if you have an account then Login, if you don’t have an account so first you have create to click on this link. You buy something and someone sells something like goods or any kind of services. Subscribe to the latest TradeSanta articles to receive the latest news and insights on automated trading. When you withdraw money from Binance, you will have to complete the verification process, which includes KYC. Now you have 30,000 USDT to trade, meaning you could make more profit as you trade higher volumes. We’ll go back to those risks in the case study section, but let’s start with the basic terms. When I entered the trading business I was my own teacher.

What Is The Maximum Leverage At Binance?

While your gains will be amplified if you correctly predict the direction of the market, losses can add up very quickly if the market moves against you. If your margin level gets too low, your position will be liquidated – you will lose all the funds you posted as margin to enter the leveraged position. This ability to expand trading results makes margin trading especially popular in low-volatility markets, especially in the international Forex market.

But whatever the situation is it is important to make your decisions wisely and be patient. To be a successful trader on this platform you must invest your money on the right currency and follow all the necessary tips that assist you in earning great profits on Binance. Binance futures allows the traders to up their antique and can select leverage up to 125x on all the trades they carry out in the future. This step will attract more and more traders to the platform.

How To Withdraw From Binance?

Select the “Portfolio” option and choose the cryptocurrency you want to send to the Binance wallet. Press “send”, specify the amount and the address corresponding to the wallet of such cryptocurrency in Binance and confirm the transaction. The speed of the deposits will depend on the cryptocurrency that is being deposited. For cryptocurrencies like Ethereum, Litecoin and / or BAT it is a matter of minutes, while others like BCH takes approximately 2 and a half hours. Binance will send you an email advising you that your transaction has been valid and that you have these tokens in your wallet. It is basically the same procedure as with any other cryptocurrency.

Binance margin trading fees are separated by maker and taker fee. First, make sure you are in the margin trading screen by checking the either Cross 3x or Isolated 10x is colored yellow. There are a few steps you need to accomplish before you can start with margin trading at Binance.

How To Be A Successful Trader On Binance?

After all, a trading exchange is only as good as the trades it allows you to make. If there is a particular coin you are looking to trade via Binance, you absolutely need to take the time to check it’s on offer before the process of creating an account.

- Add the number of funds you want to shift as a result you will be able to shift funds from your normal Binance wallet to the Margin Trading wallet.

- But if they know some hacks then they could end up paying very low or even zero fees.

- The exchange or other traders would provide you with the funds instead, allowing them to earn interest based on market demand for this feature.

Binance is not the only cryptocurrency exchange that allow you to use a margin trading strategy. Here’s a quick look at other platforms that offer the same feature. In other words, margin trading lets traders “amplify trading results” by being able to “realize” greater returns on “successful trades”, Binance’s management wrote. According to the Malta- based digital asset exchange, margin trading is a widely-used trading method in low-volatility markets – including international Forex, stock, and commodity markets. In the case of crypto, money is borrowed from the exchange and the crypto trading does offer highly.

You need to know that your money will be stored safely, and that top-quality processes are in place to help protect your crypto trades. To trade long on Binance, place yourself on Margin and borrow a cryptocurrency loan that you think will go up. The exchange will give you this “line of credit” and you can sell the tokens when they reach the target price you want. Binance charts express how the crypto market behaves like any other exchange would, although it has a very good combination of colors and indicators.

However, there are cases where the mining reward is low and the transaction may be pending for a few hours. Binance supports AUD, ARS, BRL, CAD, CNY, COP, EUR, GBP, HKD, IDR, INR, KES, KZT, MXN, MYR, NGN, PHP, PEN, RUB, SAR, SGD, THB, TWD, TRY, UAH, USD, VND and ZAR for crypto/fiat transactions.

Binance users are now able to trade some cryptos on margin, using the exchange’s newly launched trading platform. The new service is paired with the existing cryptocurrency exchange under one platform, labeled Binance 2.0. Money comes from taking advantage of market’s price movements. Only investing in a cryptocurrency that will go into an bull trend in the short term will make you earn money.

Use always difference 1 Satoshi, USDT or your preferable currency to but a stop loss or stop limit. Then click on any cryptocurrency on the home page, and go to the corresponding spot trading page. For Spot trading and Margin trading you have to Login or create an account on any exchange which is suitable for you. So the exchanges are come here who were done this work for us. The exchange main work is that to create a platform where the buyer and seller are exchange or buy and sell their goods easily. It is the reason why an American consumer can pick between a Japanese, German, or American car.

When users are surveying different markets to invest, they look for markets that facilitate them to trade many currencies under one roof. With approximately 150 choices of cryptocurrencies to choose from, Binance offers a wide and diverse market for its users. This means that its market is stable allowing its users to quickly get hold of or sell their cryptocurrencies. But, one straight up disadvantage of this sort of an order is the fact that the likelihood of trade to occur becomes low.

Cryptomargintrading.info is an independent blog about cryptocurrency margin trading . Our Interest Level does not constitute financial or investment advice.

What Is Binance Launchpad?

If you’ve spent any time at all around the world of crypto, you’ll know that safety isn’t always what it should be. values for your chosen crypto, along with a full trading history underneath. If you want to add funds into your Binance account, there are a couple of ways you can do that. The fact you can make them even cheaper by using the Binance Coin is an excellent an innovative option. The one downside here is the fact that Binance choose to charge a withdrawal fee, as this isn’t the case with some other trading exchanges. You won’t be charged a fee for depositing money into your Binance account. However, to remove deposit and withdrawal restrictions, you will need to verify your account through a standard KYC process.

Go to your Binance wallet and select the cryptocurrency you want to send to Coinbase, BTC for example. Once inside your BTC wallet, press “Withdrawal” and specify the amount of BTC you want to send. Write the BTC address belonging to your Coinbase wallet and proceed to make the withdrawal. Confirm the transaction from your email and wait approximately an hour for your funds to arrive successfully. Log into your Coinbase account and go to the Portfolio. Once there, you will see the cryptocurrencies and your available funds displayed.

The right section of this page also has two portions. The top portion of this section displays the other cryptocurrencies on offer which can be traded while the lower portion provides the trader with the trading that is going on in the market.

Excluding the interest rate on the loaned amount we would have taken home a minimum of $90,000. This is more than seven times the amount we could have received from normal trade. So, this is a massive plus point of the margin trading as it helps in elevating our trade to a scale unachievable by a normal trade. If you wish to get rid of any of your cryptocurrency then you will do it by following the same procedure by just changing the market or limit buy order to market or limit sell order. However, the center of this page is the most important component of this page as here the actual trade will take place. This is the place where you will decide what sort of order you want to place. If you want to purchase your crypto share at the market rate then you will proceed with a market order, this order will also increase the likelihood of the trade to happen.

This allows you to quickly and easily select the timeframe of the data shown, allowing you to see data by the minute, or over a larger time period such as over the week. Usually the network can be affected by over-traffic or small problems within the platform. However, Binance has an excellent support team that deals quickly with these situations. Binance DEX charges a standard flat listing fee of 1,000 BNB, making this one of the cheapest on the market. There have been cases of collections of $15 million USD.

The company has been operating successfully since its inception and has maintained an excellent reputation to this day. Now you can see your order in open order and after execution the order you have put the stop loss to select the stop market in sell with repayment option. First you have to LOGIN or create your account on binance. If you don’t have an account in binance so click here to create your account on binance. You have to login in your account and go to the the home page of the the exchange. So, after returning your debt to the exchange, you’ll be left with roughly 4,000 USDT, meaning you lost more than 50% of your funds.

Underneath this is a full trade history screen, allowing you to keep your finger on the pulse of what is currently happening in the market. Binance is well aware that every trader has a different level of background knowledge and experience.

The response time for support to get back to you is average. There are faster exchange support services out there, but there are definitely slower ones as well. The responses themselves tend to be accurate and useful. When it comes to Binance, there are a lot of encouraging signs in place that they respond to well to security and safety concerns. They responded by beefing up their security measures, and replacing any funds users had lost. It’s inevitable in a high tech, high value world such as that of crypto trading, that attempted hacks will happen. It’s not so much about hacks taking place as it is about how the companies respond.