Content

In fact, the UK has campaigned for more support for crypto from its regulatory body, cryptocurrency exchange binance website development. We’ve collected the best exchanges and listed them for you below, cryptocurrency trading binance dashboard template. According to Artur Hochberg Malta, taking advantage of a breakout trend in a cryptocurrency can bring in massive profits. This trading strategy is undertaken by active day traders who study the markets keenly. These traders, therefore, get into the market at the initial stage of an upward trend. To partake of this type of trading strategy, you have to study digital currencies and identity their support and resistance areas. This data is useful and assists traders to predict upward or downward breaks.

- Even regular money is projected to crash at some point with a destabilizing centralized system.

- Experiment with your bot in live market conditions to test your strategy.

- That’s why managing your own investments based on price variances makes sense for many trading beginners.

- Coinbase is one of the first places that made it easy to buy bitcoin and has since become a widely trusted exchange in the market.

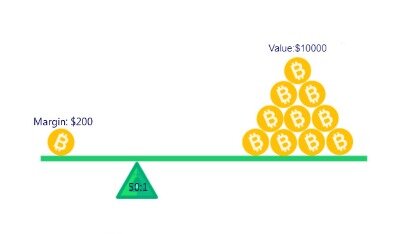

For those unaware, leverage enables you to trade using more than you currently have – call it a loan from your broker. All of the above cryptocurrencies are available at UK broker eToro – and can be traded commission-free. Although they are all priced against the US dollar – eToro also offers several pairs quotes in GBP, EUR, AUS and JPY. Much like in the case of forex, cryptocurrencies also have a wide scope of market interest and value.

For example, Ripple does well to manage scalability and security. It operates a Ripple ledger protocol, which ensures faster and accurate transaction validation. There are several educational resources to rely on for crypto knowledge. Social media sites like Twitter and Reddit have also become the crypto hubs. They have experts for analysis and other market trends information. Crypto education is the one thing that every trading enthusiast must look into. Position trading takes place over a large amount of time, sometimes months or even years.

Risk Warning

It’s worthwhile to pause and imagine that you’ve already lost the money you’re thinking of investing. If you can’t handle the feeling that arises, then you’re probably over-exposing yourself. For this strategy, you can just have a moving stop loss, which means you let your winners run and you just cut losess. Set 1% of a stop below the short-term low, preferably with the price hitting the short-term low.

Instead, we prefer fully licensed, FSCS-partnered, and FCA-regulated platforms like eToro. Let’s explain the difference between market orders and limit orders, and when you might use them when trading cryptocurrency in the UK.

However, to make money when trading, you have to invest a large amount of time. After a long search we went with KP Engineering for our tall railings and gates. We chose them because of their very informative web site, the favourable reviews, and the way that they dealt with our initial queries. They picked the phone up, they answered e-mails promptly, and were straightforward and helpful. The design process and detailed specification went smoothly even when we modified our initial requirements. We were kept informed on the progress of our order which was completed within the specified period.

When it comes to trading Bitcoins, they are nothing like stock and commodities. Regular stocks only trade during specified business hours. But when it comes to Bitcoin, the trading remains constant and active 24 hours, seven days a week and 365 days a year. The clock from a volume standpoint is mainly distributed across American, Europe, and Asian sessions.

Metatrader 4 (mt Platform Guides

This action enables you to join the rising trend at a lower price. The reason BTC/ETH went in the opposite direction is because the number of sellers outweighed the number of buyers. Again, supply and demand has a direct impact on the value of any cryptocurrency pair. This is where the previously mentioned range of orders can be very useful. For instance – stop loss and take profit orders are going to soften your losses meaning you can lock in any gains – without having to execute the order manually at a pinnacle time.

Cryptography secures the interactions and then stores them publicly. They serve as a public ledger, cutting out intermediaries such as banks. Axi is a global online FX and CFD trading company, trusted by 60,000+ ambitious customers in 100+ countries around the world. Stay on top of upcoming market-moving events with our customisable economic calendar. We use a range of cookies to give you the best possible browsing experience.

Decide On A Trading Strategy

You do not want to invest in a digital currency whose blockchain has no real-world application. Trading isn’t easy and confidence can only take you so far. With this in mind, we do recommend that you educate yourself fully on the ins and outs of cryptocurrency trading before risking your own money.

Some of the largest by market value are Bitcoin, Ethereum, Ripple, Tron, and Bitcoin Cash. As with all trading methods, crypto trading does carry the risk of losses. The more study you put in to learn the tricks of the trade, the better your chances for success. Also, consider using stop-loss orders will allow you to limit the size of your loss, should your trade not pan out the way you’d hoped.

Falling victim to FOMO is one of the main reasons so many beginner traders fail. Be wary and accept that some profitable opportunities just weren’t meant for you. Too many first-time traders develop an obsession with bitcoin’s potential and fail to address its downfalls.

Pick a trading platform that best fits your needs in terms of speed and cost of withdrawals. Choose a broker that has a reliable, easy-to-use app, and you can complete your mobile crypto trades quickly and simply. This is when you want to buy crypto, but you’re only willing to pay up to a certain price, known as a limit.

It looks into the market patterns and trends to determine future pricing. Having the cryptocurrency market movement knowledge helps in knowing the best asset to trade. Your cryptocurrency market analysis comes to test when it comes to day trading in 2021. There is no need to invest in a crypto day trading strategy if you don’t have any idea on exchange. The kind of exchange you choose determines the kind of resources you access for the trading experience.

Here, you’re purchasing a contract which gives you the option to buy or sell crypto at a specified price by a specified date. This is an intricate crypto trading technique that seeks to capitalise on small market inefficiencies, producing lots of small gains. Two common approaches to scalping are arbitrage and spread scalping. Arbitrage entails finding a discrepancy between the bid and ask spread of two different brokers, and taking advantage of that discrepancy.

Cryptocurrency Trading Uk: Ultimate Uk Guide To Crypto Trading

That way you can begin to understand which type you are likely to be most comfortable with. Each kind of trading has its own ups and downs and takes time to learn.

They’re relatively unmoved by daily changes in Bitcoin prices. For the most part, the fluctuations that happen throughout the day rarely bother them. Many don’t even mind the extreme changes that occur and those with a lot of experience know the volatile nature of Bitcoin because of its’ history. They also tend to think of price crashes as major opportunities in which they can purchase more Bitcoin and make a lot of money in the long run. They may pull profits if the price hits a peak they don’t think will maintain but rarely will they liquidate all of their Bitcoin assets at one time. When mixed with the extreme volatility of Bitcoin, the amount of leverage can be powerful enough to open doors for individual traders. There is usually a very distinct form of professional traders who understand how to capitalize on trading like this.

If you are a holder of cryptocurrency coins, chances are you will use a virtual crypto-wallet which comes with it’s own private key. The cryptocurrency mining services company has enjoyed solid share price growth on the back of surging retail interest. He was initially writing about insurance, when he accidentally fell in love with digital currency and distributed ledger technology (aka “the blockchain”). Andrew has a Bachelor of Arts from the University of New South Wales, and has written guides about everything from industrial pigments to cosmetic surgery. Yes, it is legal to use bots to buy and sell cryptocurrency. Enabling 2-factor authentication on all exchanges, accounts, wallets and crypto programs can provide an extra layer of protection for your funds.

Whilst this means risk is high, it also means the potential for profit is great too. It’s always sensible to check the volatility of the exchange you decide to go with. Before you choose a broker and trial different platforms, there are a few straightforward things to get your head around first. Understanding and accepting these three things will give you the best chance of succeeding when you step into the crypto trading arena. Exchange fees – This is how much you’ll be charged to use their cryptocurrency software. What currency and coins you’re trading can influence the rate.

A taker fee is the cost of taking an offer from somebody. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. Pepperstone offers trading on the major Cryptocurrencies via a range of trading platforms. Trade a handful of leading cryptocurrency coins against the US Dollar. FXChoice offers trading on leading crypto cross pairs with the US Dollar. Start leveraged trading on cryptos against fiat currencies and other alt coins. Skilling offer crypto trading on all the largest currencies available, with some very low spreads.

On the contrary to day trading strategies, you will be able to keep a trade open for days or even weeks at a time. However that’s not all, behind every good cryptocurrency trader is a good strategy – or several. Below we have detailed some of the most useful and popular strategies utilised by crypto traders today.