Content

Finally, keep aware of regional differences in rules and taxes, you don’t want to lose profit to unforeseen regulations. Once you’ve decided on a broker, got familiar with your platform and funded your account, it’s time to start trading. You’ll need to utilise an effective strategy in line with an efficient money management system to make a profit. Below is an example of a straightforward cryptocurrency strategy. The cryptocurrency trading platform you sign up for will be where you spend a considerable amount of time each day, so look for one that suits your trading style and needs. Exchanges like Coinbase offer in-depth platforms, such as their Global Digital Asset Exchange . It’s always worth setting up a demo account first to make sure the exchange has the technical tools and resources you need.

The amount you may lose may be greater than your initial investment. Before trading security futures, read the Security Futures Risk Disclosure Statement. Structured products and fixed income products such as bonds are complex products that are more risky and are not suitable for all investors. Before trading, please read the Risk Warning and Disclosure Statement. Log into Account Management and sign up for Crypto on the trading permission page under Futures. If you already have futures trading permissions, you can immediately trade. If you don’t have future trading permissions you will need to wait for overnight approval.

Whilst this means risk is high, it also means the potential for profit is great too. It’s always sensible to check the volatility of the exchange you decide to go with.

The laws of England and Wales apply to these terms and conditions. Revolut and you are able to terminate this agreement by giving 30 business days’ written notice of such termination. This agreement will continue to apply to you until such time as 30 business days has passed from the date on which any notice of termination is given. We may also decide to close or suspend your account for other reasons.

Some of the common options you should consider include eToro and Coinmama. Different Bitcoin brokers will charge a different amount for buying Bitcoin. This is because any commission charged by a platform will be included in the advertised price, referred to as spread. To find the best rate it’s a good idea to compare multiple platforms. There are a variety of differences between online Bitcoin brokers, so it’s important to find one that suits your needs. Some brokers will be more beginner-friendly, but charge higher fees; some will accept payment methods such as PayPal, but have a limited range of coins; some will have well-designed mobile apps, but low transfer limits.

Price

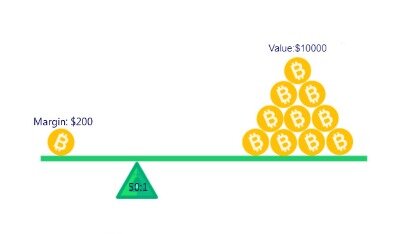

These are great especially if you just live in an apartment complex with no place to put your grill in. By using live market data, our set of calculators allows traders to always get the most accurate results possible, and they work with most FX pairs, metals and even cryptocurrencies. Also, these great calculators are translated into 23 different languages including Arabic, Russian, Japanese and Chinese. allows a trader to control a larger position using less money and therefore greatly amplifies both profits and losses. Use this handy Forex Margin Calculator to calculate accurately the amount of funds required to open a trading position, or used to open a new trade, based on the lot size and the available leverage offered by your broker. By looking at the number of wallets vs the number of active wallets and the current trading volume, you can attempt to give a specific currency a current value. You can then make informed decisions based on today’s market price.

It has become increasingly popular in recent years because unlike regular trading, margin trading allows you to gain access to larger sums of capital and leverage your position. In other words, margin trading gives you the opportunity to make larger profits when you make successful trades. In the same vein, however, the potential for loss is also greater. If you want to learn more about how leverage and margin trading works, how you could profit, as well as the risks involved, read on for a step-by-step guide. You will be able to request to cancel your Order instructed outside of Market Hours at any time before the opening of the relevant exchange.

If you are uncertain as to whether an Instrument is appropriate for your individual circumstances or needs you should seek independent professional advice. Order transmission services in Investments are provided by Revolut Trading Ltd (FRN. ). Revolut Trading Ltd is a wholly owned subsidiary of Revolut Ltd. Yes, we can provide you with an account in our sandbox environment. You can connect to us via REST, WebSocket and FIX APIs, in addition to via web interface or voice trading. We are also integrated with the major liquidity hubs including AlgoTrader,, Caspian, Celertech, Deltix, FlexTrade, Gold-i, MT4/5, oneZero, PrimeXM, SFOX, Simplex Inc, SmartTrade, TradAir and Trading Screen. No, third party transfers are strictly forbidden due to our anti-money laundering obligations.

However, nowadays they are using Advanced Security Features in order to avoid hacking. If you are going to use Poloniex Cryptocurrency Exchanges, try to limit the amount of time you keep money on the Exchange.

The information does not usually directly identify you, but can provide a personalized browsing experience. Because we respect your right to privacy, you can choose not to allow some types of cookies and web beacons. Please click on the different category headings to find out more and change our default settings. However, blocking some types of cookies may impact your experience on our website and limit the services we can offer. If you are an institution, click below to learn more about our offerings for RIAs, Hedge Funds, Compliance Officers and more. XTB Limited is authorised and regulated by the UK Financial Conduct Authority with its registered and trading office at Level 9, One Canada Square, Canary Wharf, E14 5AA, London, United Kingdom . Instrument which price is based on quotations of Ethereum to Bitcoin.

What Is Leverage & Margin

The main problem is that in the past, the biggest Cryptocurrency Exchanges that dealt exclusively with Altcoins, have all run away with customer money. Poloniex is the largest Cryptocurrency Market Exchange in terms of Volume, thus having good liquidity for BTC pairs. You can Buy and Trade almost every Major top 10 Cryptocurrency using this platform. At LocalBitcoins.com, people from different countries can exchange their local currency into Bitcoins. The site allows users to post Crypto Exchanges advertisements, where they give Cryptocurrency Exchanges Rate and Payment Methods for Buying or Selling Bitcoins.

- Order transmission services in Investments are provided by Revolut Trading Ltd (FRN. ).

- It has become increasingly popular in recent years because unlike regular trading, margin trading allows you to gain access to larger sums of capital and leverage your position.

- If you are uncertain as to whether an Instrument is appropriate for your individual circumstances or needs you should seek independent professional advice.

- AlphaTrader modular infrastructure is fully integrated with the LMAX Global FIX and API, enabling clients to seamlessly benefit from low latency, exchange style execution on LMAX Global.

- Where we are subject to such obligations, we will inform you and request such information from you as we deem necessary in order to perform an appropriateness assessment.

Yes, however you must first sell your BTC value back to fiat such as GBP or USD. Many top Bitcoin brokers allow payments to and from PayPal – so check this before deciding which one to sign up for. In the UK cryptocurrencies are classed as an asset, more info here. This means you have to pay capital gains tax of between 10 and 20% on any money made over £11,700 a year. In other countries this varies, especially depending on whether Bitcoin is legal or not. Check the tax requirements of Bitcoin in your country before initiating any transaction.

This market data may include historical data about prices of Instruments, industry and sector trends and analysis on various companies and Instruments. Past performance is not a reliable indicator of future performance. In no circumstances should any of this information be construed or interpreted as us giving you advice or providing you with a recommendation of any kind.

The Best Bitcoin Trading Platforms For Beginners, Traders, And Long

Deposit & Withdrawal fees – This is how much you’ll be charged when you want to deposit and withdraw money from the exchange. Using debit/credit will usually come with a 3.99% charge, a bank account will usually incur a 1.5% charge. Trade fees – This is how much you’ll be charged to trade between currencies on their exchange. Always check reviews to make sure the cryptocurrency exchange is secure.

The latter are more complex trading platforms that allow users to trade against the value of Bitcoin in real-time using CFDs. Contracts for Difference let traders buy and sell Bitcoin without ever taking ownership of the coins. This means trades can be placed faster and also enables leveraged trading.

Let’s say on your cryptocurrency chart at 250-minute candles, you see 25 candles where the price stays within a 100 point range. If the price contracted to a daily move of just 20 points, you’d be seriously interested and alert. This tells you there is a substantial chance the price is going to continue into the trend. If you want to own the actual cryptocurrency, rather than speculate on the price, you need to store it. The price of Bitcoin, for example, went from $3,000 down to $2,000 and then leapt up to nearly $5,000, all within three months in 2017.

The more accurate your predictions, the greater your chances for profit. Short-term cryptocurrencies are extremely sensitive to relevant news.

Once you’ve trialled your strategy and ironed out any creases, then start executing trades with real money. So, whilst bots can help increase your end of day cryptocurrency profit, there are no free rides in life and you need to be aware of the risks. Perhaps then, they are the best asset when you already have an established and effective strategy, that can simply be automated.

They can also be expensive to set up if you have to pay someone to programme your bot. On top of that, you’ll need to pay to have your bot updated as the market changes. On the flip side, if a big company announces they’ll be incorporating the use of a currency into their business, prices can climb quickly. If you’re aware of any news and can react rapidly, you’ll have an edge over the rest of the market.

This will be charged in USD using the FX rate at time of receiving the order. Whilst we and the Third Party Broker will do our best to execute your Order as quickly as we can, the prices of Instruments can move quickly. This means that the price at which you submitted your Order may not be the price at which your Order is in fact executed. In some circumstances, your Order may be executed at a “better” price and in other circumstances it may be executed at a “worse” price than the price quoted to you via the Revolut App. If your order is executed at a “worse” price than the price of the Instrument at the time you submitted the Order, we have no liability to you to provide you with the difference in those prices. There may also be circumstances in which we are required by a third-party, such as by the underlying market on which an Instrument is listed or by a regulatory authority, to cancel your Orders.

We hold ourselves accountable to the high standards mandated by the regulatory requirements. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. Secondly, automated software allows you to trade across multiple currencies and assets at a time. That means greater potential profit and all without you having to do any heavy lifting.

The proprietary ThinkLiquidity enterprise risk engines allow for real time A book, B book and C book management and trade execution. ThinkLiquidity is an international technology firm specializing in the foreign exchange and CFD markets and is built from the ground up with a focus on maximizing brokerage revenue. Being an US-based cryptocurrency, it is regulated and licensed, which means that its security levels are very high and that you can feel safe while you trade on it. At the moment, the platform only supports Bitcoin and Ethereum, the two currently most popular cryptocurrencies. Gemini is an online exchange for cryptos established by Bitcoin millionaires known as the Winklevoss twins .

You should also be aware that there may also be instances where we or the Third Party Broker are required by a third-party to cancel your Positions. We, and the Third Party Broker, have the final say on whether or not an Order submitted by you is accepted.

Clients can trade in any size from small 0.01 BTC trades to multi-million dollar blocks. The maximum trade size is negotiated individually with each client. If the rate is positive, clients with a long position will pay an overnight interest rate and clients with a short position will receive the rate. B2C2 currently applies a flat fee of 2% per annum on both long and short positions. Proactive Investors Limited, trading as “Proactiveinvestors United Kingdom”, is Authorised and regulated by the Financial Conduct Authority. The firm added that its equipment leasing agreement with fellow crypto firm Celsius Network, which is scheduled to deliver 4,500 Bitmain Antminer S19 and S19 Pro mining machines, is on schedule and expected to be operational by February. In an update on its operations, the firm reported revenues for the month of £1.63mln, up from £1.48mln in November, which was generated with an average monthly mining margin of around 60% compared to 57% in the prior month.

To invest in Bitcoin, you’ll need to sign up to a trading broker. This page lists the top Bitcoin trading platforms to use, and guides you through how to choose between them. It is not directed at residents of any jurisdiction where FX trading and/or CFD trading is restricted or prohibited by local laws or regulations.

The most useful cryptocurrency trading tutorial you can go on is the one you can give yourself, with a demo account. Firstly, you will you get the opportunity to trial your potential brokerage and platform before you buy. If you anticipate a particular price shift, trading on margin will enable you to borrow money to increase your potential profit if your prediction materialises. Exchanges have different margin requirements and offer varying rates, so doing your homework first is advisable. Bitfinex and Huobi are two of the more popular margin platforms. Which cryptocurrency platform you opt to do your trading on is one of the most important decisions you’ll make. The exchange will act as a digital wallet for your cryptocurrencies, so don’t dive in without considering the factors below first.

We deliver fast, secure and flexible access to help optimise trading. Get fast, mobile access to all LMAX Global markets, pricing and up-to-the-minute FX news. Understand you will be charged an inactivity fee if the minimum trading thresholds are not met.

Binance Mobile Margin Trading Binance, Binance Mobile Stop Loss

This is different to brokers, which set a price at which you can buy Bitcoin from them. If you want an easy and seamless way to capitalise on the growth and price fluctuations of Bitcoin, then brokers offer the simplest option. Generally, this convenience comes at the cost of slightly higher fees than you’ll find on an exchange, though.