Content

The next four that most people use are Binance, based in Malta, Kraken, also in San Francisco, Bittrex in Seattle and Bitfinex, Hong Kong – the only other firms to score above 10 per cent. Coinbase is by far the most popular exchange to use – 63 per cent of those who have bought crypto used the San Francisco based firm. Last month saw the announcement that PayPal will begin supporting bitcoin transactions – which may change all that.

- He has previously been a full-time investor, founder of a technology company which was floated on the NASDAQ, and a director of a PR company specialising in IT.

- BITCOIN will rise to a value of $1million (£738,000), an expert tells Express.co.uk, as Elon Musk and Tesla spark cryptocurrency surge.

- In 2011, a transaction of 550,000 bitcoins was recorded on the blockchain, though at the time this amount of cryptocurrency was only worth around $1.6 million.

Unlike in the past, Bitcoin is no longer considered a fad, but a cryptocurrency with the potential to stick around much longer. Amidst the bullish sentiments, Bitcoin still faces an uphill task to replace legacy currencies. The cryptocurrency has experienced a string of micro-bubbles ever since it touched record highs of $20,000. With the price now hovering at the $6,000 level, many people remain skeptical of its ability to find its way back to its record highs let alone the 2030 estimate of $100 Million.

Around £100 billion pounds worth of bitcoin is lost in wallets that cannot be accessed, according to cryptocurrency-data company Chainanalysis. As the infrastructure required to support the cryptocurrency has grown and developed, so has the value of Bitcoin as more and more investors and institutions have bought into the idea of the decentralized currency. After a strong start in 2021, Bitcoin price is still surging and will likely continue doing so. The above vital drivers are inevitable, and Bitcoin price will ultimately rise. If you are new in the cryptocurrency landscape, you are probably wondering where to start?

Who Is A Typical Crypto Holder?

Bitcoin transactions are secure, irreversible, and do not contain sensitive personal information. A common misunderstanding is that Nakamoto is Bitcoin’s core architect, and as a result, this individual controls the network. While Bitcoin and the idea of a social cryptocurrency had been around for nearly two decades, Bitcoin hadn’t really attracted much attention until 2017.

Around 1.9million Britons own cryptocurrencies, according to the new data from the FCA – or nearly 4 per cent of the adult population. A lucky few, likely to have been involved when the price was low and the industry unknown, may have turned a handsome profit. You heard overheard conversations about buying bitcoin, ripple, ethereum and more everywhere. It seemed everyone was piling in, young and old, with the hopes of turning hundreds or thousands of pounds into something more substantial. With prices soaring, many blindly took a punt, worried they would miss out on a chance for a quick and large profit – the only way was up and all that Yazz.

The Bitcoin Mining Process

It’s not just people looking to avoid the high commissions and fees of using credible exchanges; they are actively trying to subvert regulatory compliance. If institutions can’t quickly move a few thousand bitcoin around without worrying about causing market movements, then what good is it? Today’s markets for trading bitcoin are so disorganised and dysfunctional that they are primarily used to arbitrage against each other by and for speculators. Bitcoin may be lacking fundamental characteristics of a Ponzi scheme, but there are plenty of similarities.

Any currency that tries to stand in the way should lose value as bitcoin supplants it. Chinese e-commerce platform Dmall E-commerce Co has hired Bank of America, Goldman Sachs and JPMorgan for a U.S. initial public offering of over $500 million, three people with direct knowledge told Reuters. The six-year-old company, incubated by retailer Wumart Group, has begun preparations for the IPO and the listing could happen in the second half of this year, said one of them. Dmall opted for an IPO over a merger with a special-purpose acquisition company to go public, said two of the people and two separate sources with direct knowledge of the matter.

If you bought £260 worth today, and it did – for whatever reason – rise to $100,000 a coin, it would see the value rise to around £3,000 from that initial investment. According to the study, 78 per cent of all people had heard of bitcoin. The price of bitcoin soared from $1,000 a coin in early 2017 to $20,000 by the end of the year. A further 700,000 people have also held crypto at some point, or 5.35 per cent of Britons – up 2.35 percentage points on a year earlier.

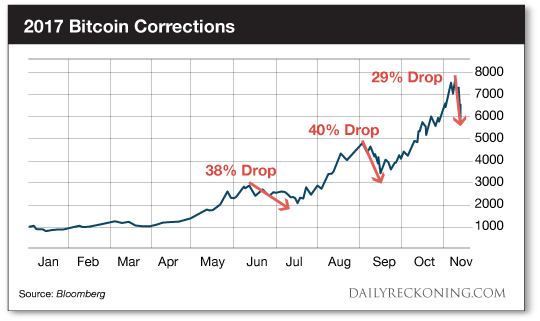

But when he got more interested in the space, in summer 2020, he was “blown away” by the new artists. In 2011, a transaction of 550,000 bitcoins was recorded on the blockchain, though at the time this amount of cryptocurrency was only worth around $1.6 million. The cost of rejecting Bitcoin should exceed the cost of adopting it as more people start to use the cryptocurrency. The digital currency is expected to begin assuming money’s traditional roles helped by widespread adoption and acceptance. Institutional and government support should go a long way in accelerating adoption of the cryptocurrency in the mainstream sector, a feat expected to strengthen its value. In 2017, Bitcoin underwent a majestic bull run that gave investors approximately 1,400 percent returns on investment and a record price of $20,000. However, in 2018 the situation reversed, and the number one cryptocurrency lost 70 percent of its price, dropping from $14,000 to $4,000 by the end of the year.

Catherine Wood said that as institutional demand for Bitcoin could drive Bitcoin’s price to $500,000. Moreover, a senior analyst at U.S.-based financial giant Citibank Tom Fitzpatrick has written a report outlining similarities between the 1970s gold market and Bitcoin. Estes predicts bitcoin could hit between $100,000 and $288,000 by the very end of 2021. Furthermore, Brian Estes, chief investment officer at hedge fund Off The Chain Capital, said that for Bitcoin going from $18,000 to $100,000 in one year is not a stretch. As we mentioned above, Bitcoin halving occurred on May 11, 2020, restricting supply even more by decreasing the rate at which new coins are being created.

Cryptocurrency Advocate Says ‘bitcoin Will Be About A 5 Per Cent Market Share Of The Earth’

A number of countries have already banned the virtual currencies even as other pass stringent regulations designed to limit its use as a legal tender. Something like 20% of Bitcoin total supply will be missing or lost in the future, which means there will only be about 16.8 million coins in circulation.

The first real mention and concept of a so-called cryptocurrency was published in 1998. The cypherpunks mailing list’s Wei Dai suggested the idea of a new form of money that uses cryptography to control its creation. It took a decade for this idea to gain traction and become a workable idea.

With Hyperbitcoinization, Bitcoin should change people’s relationship with money. The fact that people will own their money and be in total control of its value is seen as one of the attributes that will make most people shun fiat currencies. With halving that happened in May 2020, Paypal introducing cryptocurrencies to its platform and institutional investments, Bitcoin’s price is expected to soar towards new records. Bitcoin’s price has risen dramatically, reaching an all-time high at $41,941 on January 08, 2021, as big companies have invested large sums of money. However, it should be mentioned that no one can know precisely what the price of Bitcoin may reach in the future, although the above BTC predictions come from credible financial analysts. Considering the demand by institutional investors and the way the market is developing, it is possible for Bitcoin to reach the above figures.

It’s estimated that today there are more than 1 million Bitcoin miners in operation, all competing for that next block to add to the chain every 10 minutes. This has sparked a bit of a Bitcoin arms race where companies worldwide are spending more and more money to develop faster chips and faster mining equipment. Bitcoin mining is the process that creates the cryptocurrency and it is resource-intensive, to control the number of Bitcoins in circulation.

The global adoption of the largest cryptocurrency in the world is expanding. From a technical point of view, the Bitcoin network is designed to have an infinite number of addresses. The reason behind this is to make it difficult for hackers to pinpoint one address and hack it. However, the most important number is the number of active Bitcoin addresses. In 2020, that number registered a year-over-year rise of more than 1 million addresses. The digital currency that most will be familiar with is free from government interference and can be shared instantly online. According to Google Trends, worldwide searches for bitcoin reached their highest amount since the halcyon days of late 2017 and early 2018, when crypto chat became all the rage.

Mr Pal claimed that his significant investment in Bitcoin could expose him to a big downward dip in profits, but argued the potential upside is “much bigger”. Raoul Pal, who has allocated more than 50 percent of his capital to Bitcoin, argued that prices could breach the million mark in five years. However, a former Goldman-Sachs hedge fund chief claimed that Bitcoin will reach a value of $1million (£738,000) in the long term – suggesting that there could still be profit to be made for investors. BITCOIN’s value could surge to a value of $1million (£738,000) according to one expert, who believes an “enormous wall of money” is around the corner. Britain’s Financial Conduct Authority warned investors of the risks that come with Bitcoin following the recent slump.

That is why central banks try to expand the money supply by creating low-interest rates. They figure that low-interest rates will encourage more borrowing, boosting the money supply.

This will also remove any price alerts you have set for this investment. Michael is an economics, investment and technology writer, known for his entertaining style. He has previously been a full-time investor, founder of a technology company which was floated on the NASDAQ, and a director of a PR company specialising in IT. All the above assumes bitcoin will become a kind of currency monopoly. Of course, if bitcoin becomes the de facto global currency, its value could rise even further.

Programmer Stefan Thomas’s lost password will let him unlock a hard drive containing £175m ($240m) worth of bitcoin. Bitcoin are so dull and boring that $1.1Bn worth of BTC has now been “wrapped” so they can run over and play DeFi games. I regularly get approached to ask if I know someone who will do a deal for thousands – or even millions – of Pounds Sterling for BTC. And from the way the conversations go, it feels like a back-alley drug deal.

Speaking at the Salt Conference in Las Vegas, Mr Draper once again outlined his belief that bitcoin can keep growing in value and reach well beyond its $20,000 peak that it reached in December 2017. Bitcoin has since experienced a remarkable price recovery, rising from below $4,000 at the start of 2019 to today’s price of $8,100.

He further elaborated that printing money is going to increase inflation, which could push investors to buy more Bitcoin. Mining computers authenticate blocks of transactions by competing to solve complicated mathematical problems every 10 minutes. The first miner to solve the problem and clear the transaction gets rewarded with new bitcoins. So, the more demand there will be, the more the price will increase. Differently called “The King of cryptocurrencies” in 2020 and at the beginning of 2021, Bitcoin has reached prices never seen before in its history of existence. Seeing figures in the millions might make you tempted to invest in the cryptocurrency. An entrepreneur from Barbados lost 800 bitcoins after a colleague reformatted a laptop containing the private keys to his wallet.

Their so-called “fundamentals” and price predictions, including those which applied to real businesses and real commodities, come from assumptions which are either never disclosed or easily disproved. A major Tesla investor predicts the price to between $50,000 and $500,000 in the next five years.