Content

Not that many people are capable of providing that kind of investment money when they are looking to manipulate the market. What if all a trader need is a short term increase in Bitcoin value, let’s say of 5-10%, in order to generate the income they desire? Theoretically speaking, all they would need is about 5-10 million US dollars.

There are no specific solutions that can be suggested at this point, but there are some ideas. One possible solution would be the changing of the exchange structure, which would disincentivize high frequency, high latency automated bot trading. Other solutions include understanding these bots better in order to counteract the effects they have on the market. One more simple solution was to ban all such automated trading bots, although there does not seem to be one way to identify if a trader is a trader or a bot, without getting in the way of traders doing their jobs successfully. While this could be done by the introduction of third parties, such ascryptocurrency brokers, there is a possibility to abuse this mechanic otherwise and is not recommended to consider. In capital markets, the only players who can provide liquidity are the big entities, who have hundreds of millions of dollars.

Why Did Bitcoin Crash? Cryptocurrency Price Spike Study On Market Manipulation Precedes 2018 Low

Market manipulation is just another demonstration of the far-reaching influence of TikTok teens. He’s inspired a trend of people investing and encouraging others not to ‘miss out’, with some hoping it’ll be their ‘saving grace’, and others aiming to get the price of a Dogecoin up to $1. The price of Dogecoin more than doubled, and total market cap inflated to around $500m last week. Since then, his video’s gone viral and is receiving press in both crypto and trading communities.

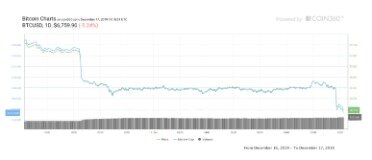

- Following its publication earlier this week, bitcoin fell to below $6,300 for the first time since November.

- One more simple solution was to ban all such automated trading bots, although there does not seem to be one way to identify if a trader is a trader or a bot, without getting in the way of traders doing their jobs successfully.

- In capital markets, the only players who can provide liquidity are the big entities, who have hundreds of millions of dollars.

- The academics highlight the lack of diversity in the cryptocurrency market was likely to have played a big part in causing the price manipulation.

Whilst most cryptocurrencies are not backed by a tangible asset, stablecoins such as USDT are attractive to investors because it pegs itself to a tangible asset held in reserve (i.e. the US Dollar). Unlike bitcoin, USDT cannot be mined and instead tether unilaterally controls the creation of new USDT. Cryptocurrency is a peer-to-peer version of electronic cash which allows online payments to be sent directly from one party to another without the need to go through a financial institution. However, a new bill in the US Congress known as the Cryptocurrency Act 2020 will soon be in force allowing the tracing of all transactions and persons trading with the control of cryptocurrencies to fall under financial regulation agencies. As cryptocurrencies aren’t asset-backed or centralised, their value is subject to sudden large increases or decreases. Think of the price as an agreement on what people are willing to pay for a Bitcoin rather than a predictable figure based on, for example, the price of gold. Learn two complete trading strategies to optimize your trading for fast-moving markets.

How A Single Trade Crashed Bitcoin

While the community has only recently been suspicious of such market manipulations, it has been found that this practice actually has a much longer history. Following its publication earlier this week, bitcoin fell to below $6,300 for the first time since November. The study followed a similar price crash at the start of the week that came after news emerged that hackers had successfully targeted the Coinrail cryptocurrency exchange in South Korea. A more subtle form of market manipulation is through the use of paid shills. So-called influencers in the cryptocurrency space can have large audiences who trust them and who are willing to invest in their suggestions. These can cause price spikes on certain cryptocurrencies by promising the world and then subsequently not delivering.

But with DeFi, even if I have five dollars, I can provide liquidity and make a return. Bitfinex is “the largest and least regulated cryptocurrency exchange in the world”. Despite the overwhelming evidence that both companies have inflicted billions of dollars of damage on the cryptocurrency market, both Tether and Bitfinex continue to allegedly defraud the market.

Every stock exchange could be manipulated by a single order at some point in its evolution. I’m throwing some random numbers here but it was probably 100 yrs ago for LSE, 50 yrs for NYSE, 30 yrs for DB and 10 yrs for BSE.

Since bitcoin was first mined in 2009, the virtual money has seen its value surge and it reached an all time high of more than $17,000 (£12,000) in December 2017. The lack of regulation of the cryptocurrency means it has always been susceptible to manipulation. Ethereum, the second largest cryptocurrency, eclipsed a price of $2,000 per token with a total valuation of $226bn. This is a new high for the cryptocurrency has risen from a value of $11,000 in September 2020 and less than $1,000 four years ago. The most recent dip was in January this year when the price declined from $40,000 to $30,000 highlighting its volatility.

Bitcoin Q&as

Our City of London financial services litigation lawyers advise on Bitcoin, Bitfinex, Tether, crypto/digital currency price manipulation claims. We provide cryptocurrency mis-selling representation and use our banking and financial services litigation expertise to ensure we obtain the best possible results and compensation for our clients. Financial market trading carries a high degree of risk, and losses can exceed deposits. Any opinions, news, research, analysis, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. Critics argue Bitcoin is less of a currency and more of a speculative trading tool that is open to market manipulation.

Tether is essentially a “stablecoin” pegged to the US dollar, that aspires to serve as a bridge between crypto-currency exchanges and conventional currencies. Either a user can mine it- that is, the Bitcoin protocol issues a user new bitcoin if computer power is expended to update its ledger. Or, a user can receive bitcoin from someone else either by gift or exchange.

Other exchanges that have taken matters into their own hands include Gemini, owned by the Winklevoss twins, who famously became Bitcoin billionaires after investing their Facebook pay-out cash when Bitcoin first emerged more than ten years ago. In April, Gemini called in Nasdaq to conduct surveillance on the coins sold on their own exchange site to weed out manipulation. he European Union’s top banking, securities and pensions watchdogs have all warned cryptocurrency investors could lose all their money in what they described as a Bitcoin “pricing bubble”. Called Markus and Willy, the bots appeared to perform valid trades in bitcoin, despite not owning any of the cryptocurrency. While more than 800 cryptocurrencies now exist, at the time of the massive surge, there were approximately just 80.

The U.S. economy appears set to leave other developed markets in the dust this year with the largest annual growth spurt in decades, new Federal Reserve forecasts indicate, but that divergence is not worrying to the central bank’s top official. “U.S. demand, very strong U.S. demand, as the economy improves, is going to support global activity as well, over time,” Powell said on Wednesday in a news conference following the Fed’s latest two-day policy meeting. The winners of market manipulation via pump and dump schemes are those that initiate such scams. Infamously, Jordan Belfort ran many stock market pump and dump schemes, earning himself the moniker The Wolf of Wall Street and having a Hollywood film made dramatising his life. Shockingly, one cryptocurrency exchange has even encouraged pump and dump schemes.

Mr Gerard claims the cryptocurrency market is “rife with insider trading” and that a number of so-called whales “have colluded for years”. Even for something as notoriously volatile as bitcoin, the cryptocurrency’s recent price fluctuations have been extraordinary. Other factors to consider for the latest price crash, according to Mr Peroni, include reports from state-run Chinese newspaper People’s Daily that claim China will continue to clamp down on illegal fundraising through cryptocurrency platforms. While it is difficult to pin price drops on any specific event, experts and analysts have suggested the most recent fall in value can be attributed to a new study which suggests market manipulation was behind the 2017 bubble.

Their correlation was plus 63% then, and it remains unsettlingly high at 40%. It raises questions about whether Musk’s comments are possible market manipulation and he has been warned by the SEC about his tweets in the past. The price of the cryptocurrency has skyrocketed in the past year amid backing from the likes of Fidelity, Square and Paypal. The more eminent financiers, central bankers and economists doom bitcoin to failure, the more it seems to rise. At the weekend the world’s most popular digital currency broke through $58,000 for the first time, meaning it had doubled in value since the start of the year. These findings come from the internal book of individual trader level records from Mt.Gox, the largest bitcoin exchange by reported volume during their sample period. The data was first leaked by hackers to the bitcoin community upon the exchange’s collapse in 2014.

If you have used a cryptocurrency exchange such as Bitfinex, Tether, or iFinex you may have a claim for compensation due to market manipulation by these crypto exchanges. Call for a non-obligation chat with one of financial services litigation team. Long used by traditional financial markets, pump-and-dump schemes are now common in crypto financial markets too. Pump-and-dump scheme organisers often use their knowledge to gain from pump-and-dump events at the sacrifice of fellow pumpers, and the practice costs the cryptocurrency market seven million USD per month. Deceived by the scheme, many investors rush into purchasing certain coins and lose money. This research provides direct evidence of wash trading on the very first unregulated cryptocurrency exchange.

British Summer Time 2021: When Do The Clocks Change?

This scheme is more common with small market cap coins as they are easier to manipulate in terms of price. Pump and dump schemes were common during the earlier years of cryptocurrency. In more recent years, as the market has gained liquidity, these types of manipulations have become harder, but are still apparent. There is no evidence that anything like this is being done, or that it will ever be done.

And when Bitcoin happens to increase in value, the rest of the market follows, seemingly at exactly the same rate as Bitcoin is going. Trading crypto insights from the heart of the industry – the platform that delivers solutions and liquidity to institutions. Regulations, in theory, are designed to protect people –– and in many cases, they do. But there are always nefarious players that are going to try and take advantage of that. And in the case of crypto, regulation kind of goes against the ethos of the entire system. As access to the new internet for developers is simplified through tools like blockchain API and node hosting, more and more players start to build Web3 applications – potential rivals for legacy financial institutions.

Garlinghouse and Larsen are said to have raked in hundreds of millions of dollars from XRP token sales at various times between 2015 and 2020. Cryptocurrency Bitcoin has risen for the first time above $60,000 (£43,100), continuing its record-breaking run.

“Bitcoin has been enjoying firmly positive market sentiment recently, so I am sure that the price will soon recover,” she told The Independent. Bruno Peroni, director of investor relations at cryptocurrency investment platform Atlas Quantum, said the combination of these two events in short succession is responsible for such a dramatic change in fortunes.