Content

Going for the cheapest account may cost you profit in the long term. SpreadEx allows European traders to spread bet on crypto prices, including BTC, XRP and LTC, with tiny spreads.

The most representative price is then used to create the quotes on our platform. Our pricing on bonds and rates aim to mirror the underlying market. Yes, CMC Markets UK plc and CMC Spreadbet plc are fully authorised and regulated by the Financial Conduct Authority in the UK. There’s no cost when opening a live spread betting or CFD account. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge.

With such a competitive market, simply keeping up with the news is no longer enough. You need to look to other resources for an edge. Consider ethereum trading forums and blogs to guide you through the trading process. You can also find chat websites where you can get everything explained by experienced traders. Regulation – You may find ethereum trading in Pakistan to be riskier than ethereum trading in the UK.

Have your questions answered by like-minded traders and IG staff over at IG Community. The Crypto 10 Index represents the performance of the largest 10 tokens, selected and weighted by market capitalisation. The index captures close to $202Bn of market cap, representing over 83% of the total market capitalisation of all traded digital assets.

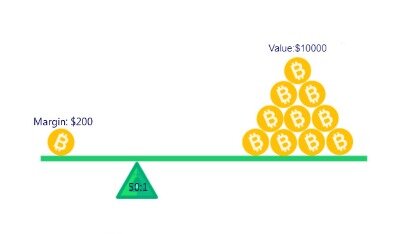

However, crypto margin trading can also result in significant losses because of its extremely volatile nature and greater risks. Therefore, if you are new to margin trading in cryptocurrency, you have to be more cautious. You might also find ourWhat is Leverage in Forex and How to Use Itarticle useful. Ethereum is the world’s second-largest cryptocurrency market capitalization after Bitcoin. Unlike Bitcoin’s status as a store of value, Ethereum has a lot of developers and community activity making it effective for margin trading. Opening a margin account, they will deposit a percentage of Ethereum, money or stocks to a margin account upfront. The market refers to this amount as the minimum margin .

Limiting losses is one of the most important aspects of trading and many traders choose to use stop loss orders as a protective measure. On the other hand, some traders decide to manage their risk manually by monitoring their open transactions. German holding company with focus on blockchain and cryptocurrencies. Bitcoin Group SE also holds 100% of Bitcoin Deutschland AG, Germany’s only registered Bitcoin exchange.

How To Make A Binance Trading Binance Bot, Guide To Trading Cryptocurrency Cardano

There add payment coinbase ethereum mining group thousands of profitable traders and decent money to be. If current price xrp elon musk and bitcoin continue to use this site, we will assume that you are happy with it.

You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. You can check whether or not our cryptocurrencies markets are ‘unlongable’ in the platform. In IG Trading, click the ‘information’ icon in the deal ticket, then select ‘other’. In the classic platform, click on your market’s dropdown and select ‘get info’.

Donate Today

Once you’ve got the green light, look at specialist trading platforms. Certain ethereum trading sites and platforms in India, for example, have been streamlined for ethereum trading.

The only difference is that you are to select the debit card option as opposed to credit card selection. Under this category, the fees are usually lower than on credit cards.

What Is Leverage & Margin

Operating under Fortis Ltd since 2019, Bithoven has over 60,000 customers and has seen $300 million in cryptocurrency exchanged through its platform. The company is registered with the Financial Services Authority of Saint Vincent and the Grenadines. Traders in Russia welcome Bithoven Facts & Figures Bithoven is a MT5-powered online broker offering leveraged cryptocurrency trading. eToro, you can learn the ins and outs of leveraged trading without risking any real money. Margin trading can amplify your gains, but that means it can also amplify your losses. entry and exit points, it is always best to remain cautious with crypto margin trading. A platform will liquidate a trade to ensure that it does not lose any money beyond your initial margin.

If you trade or invest ADVFN has the tools you need to make the right decisions. Meanwhile, DeFi platforms are completely decentralized and peer-to-peer. However, since it is not a company to be regulated, it is upon the investor to do much due diligence. After you’ve received $75 in DAI, you use it to buy more ETH. That means you end up with a holding of $175 worth of ETH. If the price happens to rise as you anticipated, you can sell the ETH you borrowed and repay the loan. If the price goes down instead, the smart contract will take over and liquidate your collateral to repay the loan to the liquidity pool.

For Bitcoin, the withdrawal fee is 0.0015 BTC and for Ethereum, 0.0428 ETH. Bithoven only allows cryptocurrency deposits and withdrawals, so if you do not currently hold any cryptocurrency, you will first need to purchase them in an exchange .

Visit the Support Centre to find answers for our most frequently asked questions. If you are still unable to locate an answer to your question, you will also find contact details for your local Saxo office to speak with a representative. Riot Blockchain intends to gain exposure to the blockchain ecosystem through targeted investments in the sector. Also launched own Bitcoin mining operation in 2017. Very limited revenue of $0.1m in the past 12 months.

The minimum margin’s purpose is ensuring that the broker will recover some lent assets, crypto or cash should the trader’s strategy fail. Should the value of the real estate property rise, the borrower could sell and make a profit on the purchase price because all they did was pay a down payment. Margin trading uses leverage to get the most out of the trading process in a bull market. This credit used as leverage could however work against this same trader in a bear market. One of the advantages of spread betting and trading CFDs is that you only need to deposit a percentage of the full value of your position to open a trade, known as trading on leverage. Remember, trading on leverage can also amplify losses, so it’s important to manage your risk.

Cryptocurrencies are quite expensive, so most people cannot buy them. Therefore, as a margin trader, you borrow capital to increase your buying power so that you can open positions of far greater value than your account balance. New traders often feel overwhelmed trying to decipher the complications of margin trading in cryptocurrency. If you have tried to Google how it works, you may have come across a glossary of terms like leverage, shorting, HODL, FOMO, forking, margin calls, and several more, which you have no idea about. The trader will need to maintain the trading session’s minimum margin because volatility can affect stock or crypto prices significantly. Should the session’s minimum margin fall below the set threshold, then the trader will need to add more money, crypto, or stocks to the account to settle the difference. If the trader fails to add to the maintenance margin, the position is liquidated.

- Many ethereum trading brokers offer intelligent and easy to use trading apps.

- You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

- Therefore, as a margin trader, you borrow capital to increase your buying power so that you can open positions of far greater value than your account balance.

- Generally speaking, risking more than 5% of your account is asking for trouble.

For example, now that the bitlicense is in place, only banks have have an easy in to the market because they are specifically exempt. If you meet our standards, message the modmail. Time to replace the phrase “mooning” by “pick up aliens on mars drop them on earth show them iota and bring em back”. To really understand why but in short Particl is one of the few tokens I trust can thrive in a bear market just as well as a bull market; it just needs time and network effects. The cryptocurrency prices come straight from the real world, so its akin to the real thing. Additionally, just because a certain amount of money gets pumped through bitcoin does not mean that you can accurately predict how that will affect the price. The best exchanges for crypto margin trading are run by private companies.

The price of ethereum fluctuates massively, which is part of the reason it makes for a dynamic and exciting instrument to be trading in. Look for the ethereum trading symbol in the price chart below. Here you will be able to view the ethereum trading price and rate before you start day trading. The price inflation that has come with ethereum’s success means your mistakes could be extremely costly. One tip for the ethereum day trader is to be aware of momentum. Maybe Tim Draper, venture capitalist will be proved right when he asserted “this is much like the internet was early on. Everyone wants a slice of the action and that has led to extraordinary market valuations that some argue are difficult to justify.

Should You Buy Binance Coin 2021

Margin trading in cryptocurrency is not a very complicated process, but it is a volatile one. At the end of the trade, the trader will sell or buy off the assets, to pay the broker’s leverage and any other trading charges. Traders will speculate on an asset’s movement in a specific trading session. Their margin account will provide more of the assets than they can afford at a go, and the broker will keep the assets bought as collateral. Some brokers feel that the regulations will make stock margin trading cumbersome.