Content

Bitcoin has made transactions more secure and faster to establish itself as the ideal medium of exchange. Ethereum, Ripple, and other virtual currencies are also taking up the other space. The popularity of cryptos has also made it teachable in schools. Some traditional universities are offering courses on crypto. Undoubtedly the most popular crypto pair is the Bitcoin against the US dollar.

Exchanges have different margin requirements and offer varying rates, so doing your homework first is advisable. Bitfinex and Huobi are two of the more popular margin platforms. Do the maths, read reviews and trial the exchange and software first. Coinbase is widely regarded as one of the most trusted exchanges, but trading cryptocurrency on Bittrex is also a sensible choice. CEX.IO, Coinmama, Kraken and Bitstamp are other popular options.

- When choosing your broker and platform, consider ease of use, security and their fee structure.

- Using anything more complicated than your expertise may prove to be harmful to your consistency in markets.

- The traders have better chances of profiting in the short run—this beat holding the coins when you don’t know if they will crash and even disappear.

This happens when buyers return to the market and drive prices higher. Divergences are a signal of the opposite, that short-term momentum is falling compared to the long-term momentum. Divergences arise when large numbers of traders decide to exit the market and sell their assets. This means all you need to do is deposit funds, tell the trading bot what you want to trade and when to trade it, and let it do all the hard work for you. Crypto assets are a high-risk investment, and trading them without a plan in place can often lead to a loss of invested capital.

» Visit Review 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. Secondly, automated software allows you to trade across multiple currencies and assets at a time. That means greater potential profit and all without you having to do any heavy lifting. You won’t have to stare at charts all day, looking for opportunities. Trade execution speeds should also be enhanced as no manual inputting will be needed.

Swing Crypto Trading

Again, this is a long-term strategy and works best over a period of at least 18 months and can be combined with other indicators to deliver better results. The main difference between day trading and swing trading cryptos is the time frame used to execute trades.

As well as utilising buy and sell orders, there are other orders which can enhance your trading strategies. Buy and sell orders are something you will execute on a regular basis when trading crypto pairs. We’ve said you will need to predict whether a crypto pair will rise or fall in value later down the line.

Remember, you can run through the purchase or sale of cryptocurrencies on a broker demo account. PLATFORM GUIDE Trading on different timeframe charts Trade in the financial markets with a wide range of chart timeframes.

So in this situation, you could see support start to muster up for crypto markets. Keeping tabs on the news may be the most essential component for keeping yourself informed on the market. Maybe a promising new cryptocurrency arises, offering many valuable new features.

Many new crypto coins were introduced into the market and most of the popular cryptocurrency exchange platforms saw an increase in its user base. Put very simply, a trading algorithm or strategy is a set of rules that, together, define when trades should take place. The algorithm helps a cryptocurrency trader to either buy, or sell, at the right time. This enables them either to minimise losses and take profits. Only the most experienced traders with sound market knowledge should adopt leverage as part of their bitcoin trading strategy. It’s worth noting that this crypto trading method is most effective in a highly volatile market . When the market moves sideways, however, it can trigger multiple buy and sell signals as the two moving average lines converge and diverge more frequently.

Coinrule is both educational and gamified helping deliver financial inclusion for all by giving everyone the tools to compete in a new world of trading. You can sign up for free or choose which of the three pricing plans work best for you, based on your trading budget, template strategies and required execution speed. If you have the time – a lot – and the analytical skills, you may not need a trading algorithm and you can go back to trading manually.

So, whilst bots can help increase your end of day cryptocurrency profit, there are no free rides in life and you need to be aware of the risks. Perhaps then, they are the best asset when you already have an established and effective strategy, that can simply be automated. Many governments are unsure of what to class cryptocurrencies as, currency or property. The U.S in 2014 introduced cryptocurrency trading rules that mean digital currencies will fall under the umbrella of property. Traders will then be classed as investors and will have to conform to complex reporting requirements. Details of which can be found by heading to the IRS notice . The digital market is relatively new, so countries and governments are scrambling to bring in cryptocurrency taxes and rules to regulate these new currencies.

What Affects The Price Of Cryptocurrencies?

Trading isn’t easy and confidence can only take you so far. With this in mind, we do recommend that you educate yourself fully on the ins and outs of cryptocurrency trading before risking your own money. feature offered by a few trading platforms is a game changer. The feature essentially allows you to choose a cryptocurrency trader with a good track record, and copy their portfolio like for like. With that in mind, we recommend perhaps taking a cryptocurrency trading course, or reading one of the hundreds of books focussed on this market. Now, your cryptocurrency software will buy and sell cryptocurrency pairs so that you don’t have to.

Regardless, it still has its risks that investors should appreciate. Ordinary people can learn how to trade from the comfort of their homes. The Gamestop phenomenon is the boldest representation of the cultural shifts in market participation.

Cryptocurrency Trading For Beginners

You can also program bots to suit your preferences, based on volume, orders, time and price, for example. There is also a greater emphasis on technical analysis in day trading, whereas swing traders tend to focus heavily on fundamentals. In fact, some crypto investors may base their analysis solely on fundamental events. Successful crypto swing traders typically use technical analysis to observe short to medium time frame charts in order to catch daily and weekly trends. The use of fundamental analysis is also essential, as economic events can often occur over days or weeks. Which cryptocurrency platform you opt to do your trading on is one of the most important decisions you’ll make. The exchange will act as a digital wallet for your cryptocurrencies, so don’t dive in without considering the factors below first.

As we explained in more detail earlier on – cryptocurrencies are not legal tender which has been circulated by a monetary authority. This means that the value of crypto assets is determined by supply and demand in that particular market. The reason to avoid CFDs when using a long-term trading strategy is due to leaving positions open for long periods at a time. This type of trading invites daily overnight financing fees which add up. When it comes to trading, it is to each their own – meaning, as people are different, so are traders.

Learn how to trade daily, one-hour, 30-minute and one-minute timeframes. PLATFORM GUIDE Client sentiment indicator It is important to gauge market sentiment when trading financial instruments, such as shares or indices. Learn how to use our client sentiment tool, which gives an overview of what traders are investing in right now. This process first calls for the correct identification of opportunities. The next step is to define trade parameters and enter the market.

Swing Trading

The indicator is hugely popular amongst seasoned UK traders and is superb for aiding you in spotting profit-making opportunities. For instance, BTC/USD could stay on a upward or downward trend for a lengthy amount of time. If the feeling is that BTC/USD is bullish – you would want to keep your trade open throughout the upward trajectory. ’ order when the market correction on the BTC/ETH is actioned. This action enables you to join the rising trend at a lower price. The reason BTC/ETH went in the opposite direction is because the number of sellers outweighed the number of buyers. Again, supply and demand has a direct impact on the value of any cryptocurrency pair.

Exchange fees – This is how much you’ll be charged to use their cryptocurrency software. What currency and coins you’re trading can influence the rate. Trading crypto generally revolves around speculating on it’s price, rather than owning any of the actual coins. For this reason, brokers offering forex and CFDs are generally an easier introduction for beginners, than the alternative of buying real currency via an exchange.

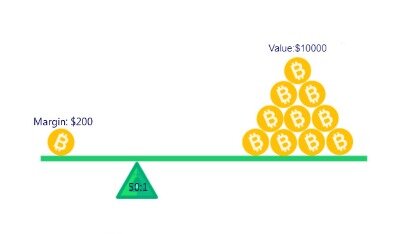

Before you start trading, do your homework and find out what type of tax you’ll pay and how much. If you anticipate a particular price shift, trading on margin will enable you to borrow money to increase your potential profit if your prediction materialises.

As a result, they are more active than swing traders and typically do not leave their positions open for longer than one day. Swing trading strategies work well with trending markets, including forex, stocks and cryptocurrencies.

You’ve done your research, picked a trading platform, deposited money into your account, and selected your preferred method for trading cryptocurrencies. Each of these strategies offers certain advantages to crypto traders. Consider how short you want your trading time horizon to be and whether you want to place your own crypto trades or have a machine do it when deciding which trading method to use. If you’d rather buy and hold crypto, that falls more under the category of investing than trading, and can be a profitable venture in its own right if done correctly.

With certain exceptions , this service is available across the globe, cryptocurrency trading technical analysis masterclass 2021. Please note, while your purchase is immediate, funding your wallet may not be. Many remain bullish despite Bitcoin dropping US$1,000 in less than 90 minutes.

With Coinrule, you can choose among 150 trading strategies to compliment you in trading. There is no need to write a single line of code, and a variety of learning sources are available on their website. Since its foundation in 2009, ROFX has provided exceptional services to its customers through its automatic trading software. There are no risks involved in investing alongside the EA as the company covered all the losses.