Content

Bots make use of data and past performance to make predictive trades but it’s important to remember that they are not intelligent in their own right. They use APIs to read data directly from the exchanges and can therefore make trades far more quickly than a human. Automating these tasks can free up your time and make trades that generate micro-profits worthwhile. This is a subject that is pretty complex and Antony made it simple to understand. Aside from the Bitcoin and Blockchain information, the beginning of the audiobook is an excellent introduction into the basics of how money “works” and “moves.” A complete step-by-step guide that will take you from beginner to successful trader.

It’s essential that you thoroughly research any bot before use to help safeguard your funds against scammers. For example, if you come across a bot that promises “guaranteed” substantial gains, this should sound alarm bells. Cryptocurrency markets can shift extremely quickly, and some opportunities last only seconds. Bots can automatically process and act on information that humans can’t. Some bots have pre-programmed strategies set up and ready to go while others allow you to program them however you want so you can implement your own strategy. The right platform for you may depend on your level of trading and coding knowledge, so make sure any program you choose is easy to understand and use.

- Below are some useful cryptocurrency tips to bear in mind.

- They were supplied with all the fixture and fittings- and some heavy duty additional bolts that were not part of the order.

- Cryptography secures the interactions and then stores them publicly.

- This helps in spreading risks and also having several trading options.

- Potential flaws in cryptocurrency code could also lead to an instant price crash.

Manually entering trade details yourself always introduces the risk of human error. By automating trade execution via a bot, this risk is reduced. Just make sure you don’t make any mistakes while setting up the bot. Crypto bots can offer a number of advantages over manual trading.

Top Risk Management Strategies In Forex Trading

Signing up with a crypto broker is a fast and easy process. First, choose a broker that offers a secure platform, low transaction costs, and narrow price spreads. You’ll need to provide some contact and security information to confirm your account, similar to when you open other kinds of online accounts. Exchange– A cryptocurrency exchange is a platform that enables you to trade crypto as Bitcoin in exchange for other currencies, be it fiat currency or other cryptocurrencies. Exchanges are recommended for more advanced traders, though, as they’re not always easy for beginners to navigate.

Each countries cryptocurrency tax requirements are different, and many will change as they adapt to the evolving market. Before you start trading, do your homework and find out what type of tax you’ll pay and how much.

What Is The Most Popular Cryptocurrency Pair To Trade?

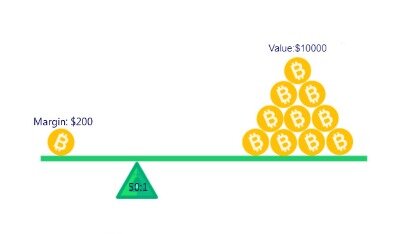

So, whilst bots can help increase your end of day cryptocurrency profit, there are no free rides in life and you need to be aware of the risks. Perhaps then, they are the best asset when you already have an established and effective strategy, that can simply be automated. If you anticipate a particular price shift, trading on margin will enable you to borrow money to increase your potential profit if your prediction materialises. Exchanges have different margin requirements and offer varying rates, so doing your homework first is advisable. Bitfinex and Huobi are two of the more popular margin platforms. Even with the right broker, software, capital and strategy, there are a number of general tips that can help increase your profit margin and minimise losses. Below are some useful cryptocurrency tips to bear in mind.

It can be daunting to customise your trading bot, especially if you’re a novice trader. Buying strategies and templates from a marketplace tied to your bot of choice simplifies this process. Following the templates you can set your bot to follow a certain strategy.

That’s why it’s important to arm yourself with high-quality information before diving into the crypto market. Cryptocurrency is a digital asset that you are going to use when you are working on the blockchain. There are a lot of cryptocurrencies that you are going to be able to invest in, but you are also going to want to understand how cryptocurrencies work. This book is going to walk you through bitcoin as well as Ethereum and how the cryptocurrency works – and how to invest with them.

The best times to look for divergences are when the price is in either the oversold or overbought areas. The RSI divergence strategy is more advanced than this and can be used to identify when the price trend will change direction before it happens.

It works by looking for discrepancies between the price and the RSI indicator. Normally, both the price and the RSI move in roughly the same direction. However, there are times when the price is falling but the RSI is rising, and vice versa. This only happens when there’s a subtle shift in buying or selling volume and is a tell-tale sign that momentum is in the early stages of reversing. The RSI divergence strategy is a more technical strategy but can be used to great effect for timing trend reversals before they happen.

For instance, there are investors who would rather not hand over ID, or would like to access super high leverage. Some traders look to offshore broker platforms, not bound to the strict limits of UK regulation. As we touched on earlier on, if you think the value of a crypto pair is going to fall – you can simply place a sell order. You just don’t have that option when investing in stocks.

trading platform you chose, and elect to open an account. Because you are joining a regulated cryptocurrency broker, then you are going to need to provide your full name, residential address, date of birth, mobile number and email address. The majority of online brokers enable clients to trade using ‘paper funds’. cryptocurrency traders won’t keep their trade open for longer than a single trading day.

The crypto market is constantly evolving and trading strategies need to keep adapting to achieve success. If you choose a bot with an outdated or simply inadequate strategy, or match the wrong bot and signals, program it incorrectly or otherwise make mistakes, expect to lose money. You need to top your crypto day trading strategy for 2021 by mastering trading psychology. You have to understand the thought process of how traders make investment decisions.

However, by at least trying to gain a firm understanding of the most important tools – you will find the decision-making process of cryptocurrency trading in the UK a lot easier. Any experienced UK trader will tell you that technical analysis and indicators are a superb way of revealing the market sentiment of crypto pairs. It’s great for new traders, as well as people who just prefer to trade on a short-term basis. However that’s not all, behind every good cryptocurrency trader is a good strategy – or several. Below we have detailed some of the most useful and popular strategies utilised by crypto traders today. When it comes to cryptocurrency trading in the UK – you can benefit either way by opting to go long or short.

Bot Trading Safety Tips

There is no need to write a single line of code, and a variety of learning sources are available on their website. Your automated trading software should complement your trading style. Before buying, make sure you go to the review website and check whether it has any useful feedback. Market-making bots make quick gains by placing different long and short orders at a single time. For example, to realize a profit of 0.02, the bot will create a buy for 1.99$ and sell for 2.01$. The robot can boast various trading options like running multiple orders in parallel, accessing different indicators, and implementing numerous trading strategies. This is a hardware device not connected to the Internet that will store your private keys away from danger.

In the same way, you have to know the pros and cons, then develop the trading psychology. You can also use this strategy to find smaller changes in a trend – for instance, spotting a pullback in a downward trend. If we look at the circled area more closely on the 30-minute chart, we can see there was another divergence that showed momentum was changing back to bullish. RSI stands for “Relative Strength Index,” which is a chart indicator that measures momentum by calculating the average number of gains and losses over a 14-day period. When the indicator line breaks out of the channel above 70, the asset is considered “overbought” and the price will likely come back down.

Copy trade features, such as is found on a platform like eToro, is an example of a trading bot. In this case the bots just automatically mimics other traders. Some platforms will also let you use copy trade bots to get the same functionality on other exchanges. There are two different ways of getting and using a crypto trading bot. So the first challenge is to know which kind of strategy to use at different times.

Compare And Learn About Cryptocurrency Trading Bots

We’ve said you will need to predict whether a crypto pair will rise or fall in value later down the line. We’ve also told you that this price can shift on a second by the second basis. After all, one of the primary driving factors in the value of an asset is supply and demand.

This website uses cookies to obtain information about your general internet usage. Removal of cookies may affect the operation of certain parts of this website. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License. PLATFORM GUIDE MT4 indicators and add-ons Enhance your trading experience on the MetaTrader 4 platform with key insights from a large range of free indicators and add-ons. We also host the internationally-recognised trading platform, MT4. This platform allows for automated trading strategies with the help of Expert Advisors , where users can create, customise and download indicators. PLATFORM GUIDE Limit orders Learn about what a limit order is, along with the difference between buy and sell limit orders.

Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. CFDs and FX are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. BinaryCent are a new broker and have fully embraced Cryptocurrencies.

It’s the most secure option available for crypto storage. It’s usually relatively easy, though different platforms will have different policies on withdrawals.

Blocks can contain Conditions, Technical Indicators and Notifications, to name but a few. No coding knowledge is required to build a comprehensive strategy and you can back-test your creation with up to 24 months of data. This service needs a certain degree of experience with coding in setting up your own strategy to get the best results.

The idea is you keep a close eye out for a correction in a trend and then catch the ‘swing’ out of the correction and back into the trend. A correction is simply when candles or price bars overlap.

Alternatively, you can pick up a strategy designed by other users through their marketplace. Some bots operate a system by which users can sign up to receive “Signals” from experienced traders, which the bot will then follow. This is normally tied to the Telegraph platform and you can buy into receiving signals from traders who have a similar focus to you or perceived market success. This is a social media tool, which allows you to research the Signallers before signing up to them. The opposite of Stop Loss, you set a level at which to sell your position and realise profits from a rising “bull” market. The bot will then automatically make that trade when the threshold.

The benefits of this last approach are discussed in number eight of our bitcoin trading tips. Day traders enter and exit the market within 24 hours, taking advantage of short term market movements. Technical analysis is a key research skill so take the time to practice reading charts and identifying patterns to inform your trading strategies.