Content

Pursuant to the UCITS Directive 2009/65/EC , the exposure of a UCITS to a swap counterparty which is a credit institution for the purpose of the Directive, cannot exceed 10% of the total fund assets. It is recommended that potential investors study the fund prospectus before investing. Nikkei 225 is protected by a copyright and is calculated according to criteria independently developed and created by Nikkei Inc. Nikkei Inc. is the only and exclusive owner of the copyrights and other intellectual property rights on Nikkei 225 and on the relevant calculation criteria.

The Dow Jones-UBS Commodity IndexesSM are a joint product of Dow Jones Opco, LLC (“Dow Jones Opco”), a subsidiary of S&P Dow Jones Indices LLC, and UBS Securities LLC (“UBS”), and have been licensed for use. The securities based on the indices are in no way sponsored, endorsed, sold or promoted by STOXX and/or its licensors and neither STOXX nor its licensors shall have any liability with respect thereto. The securities issued by iShares Physical Metals plc are limited recourse obligations which are payable solely out of the underlying secured property. If the secured property is insufficient any outstanding claims will remain unpaid. Most of the protections provided by the UK regulatory system do not apply to the operation of the iShares products and compensation will not be available under the UK Financial Services Compensation Scheme in the event of their default. For example, we believe that issuers of public debt also should be disclosing how they are addressing climate-related risks.

- They are asking managers like BlackRock to accelerate our data and analysis capabilities in this area – and we are committed to meeting their needs.

- iShares® is a registered trademark of BlackRock Fund Advisors or its affiliates.The Underlying Indices are maintained by Barclays Capital.

- iShares Physical ETCs are exchange traded commodities and are neither fund nor exchange traded funds.

- We present the exact same asset classes and regions we use to construct all our portfolios, but allow clients to select their own target percentage weight in each.

Individuals with a bias towards a particular asset class or region can overweight or underweight that ETF to match their chosen investment view. The management and implementation of that asset allocation is then simply handed over to us. This updated white paper explains how we have tied all of these concepts together in our approach to investment management. Beginning with asset allocation we also describe our portfolio implementation, trading and re balancing. Nothing in this website constitutes advice on the merits of buying, or selling a particular investment or exercising any right conferred by the products described. Unless you are an institutional or professional investor, you should seek independent financial advice in relation to the products contained in this website.

2 Multiple Etfs Per Index

Further, BlackRock, its employees and other funds managed by BlackRock may from time to time acquire or hold securities or holdings in the underlying securities of, or options on, any security of the iShares products and may as principal or agent buy or sell securities. Morningstar.co.uk contains data, news and research on shares and funds, unique commentary and independent Morningstar research on a broad range of investment products, and portfolio and asset allocation tools to help make better investing decisions. Investment in the products mentioned in this document may not be suitable for all investors and involve a significant degree of risk. Investors should read carefully and ensure they understand the Risk Factors in the Prospectus. Past performance is not a guide to future performance and should not be the sole factor of consideration when selecting a product.

This includes the ample evidence that in general asset allocation trumps stock picking. We’ve covered why we believe ETFs are a good way of investing, and how important it is to pick a strategy that you are comfortable with and then stick with it. The value of saving and investing for the long term, how passive investment instruments usually deliver better returns than actively managed ones. We’ve delved into how this difference is magnified by how we as humans have an unwarranted belief in our ability to pick the winners and to time the market, and how important costs are to investment returns.

Hanetf Teams Up With Partners To Add Around 10 Novel Etfs A Year

The Nikkei Stock Average is a copyrighted material, calculated by Nihon Keizai Shimbun, Inc. which is the sole exclusive owner of the copyright and other intellectual property rights in the Nikkei Stock Average itself and the methodology to calculate the Nikkei Stock Average. Nihon Keizai Shimbun, Inc. granted a license to the licensee to use the Nikkei Stock Average as a basis for the iShares Nikkei 225® ETF. The Licensor does not sponsor, support, sell or market the ETF and has – besides granting the license to the licensee – no connection with the ETF. The ETF is managed exclusively at the risk of the licensee and licensor shall assume no obligation or responsibility for its management and transactions on the ETF.

HANetf was set up by Hector McNeil and Nik Bienkowski in 2018 to crush the barriers to entry to the European ETF market, by providing a comprehensive ETF product and distribution platform with the ability to issue a new UCITS ETF within 10 weeks. This includes product development, operational, regulatory, distribution and marketing solutions for asset managers and business who want to successfully launch and manage ETFs and ETPs to leverage their existing brands and expertise. We have also seen increased flows across the board into our thematic ETFs such as the HAN-GINS Tech Megatrend Equal Weight UCITS ETF ITEK, an ETF that offers equal weight across 8 mega trend disruptive tech categories from future cars to digital entertainment, which recently hit $100m AUM.

Falling Fees And A Rise In Innovation Are Helping Propel The Etf Industry Forward In Europe

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs net asset value. Changes in exchange rates may have an adverse effect on the value, price or income of an investment. Further there is no guarantee that an ETF will achieve its investment objective. The two asset classes tend to exhibit a low correlation with one another over longer periods of time.

that is, one where global warming is limited to well below 2ºC, consistent with a global aspiration of net zero greenhouse gas emissions by 2050. We are asking you to disclose how this plan is incorporated into your long-term strategy and reviewed by your board of directors. There is no company whose business model won’t be profoundly affected by the transition to a net zero economy – one that emits no more carbon dioxide than it removes from the atmosphere by 2050, the scientifically-established threshold necessary to keep global warming well below 2ºC.

This website is published by Lyxor International Asset Management , a simplified joint stock company (société par actions simplifiée) with capital of 1,059,696 euros, listed on the Nanterre Trade and Companies Register under the single identification number 419,223,375 and EPA number 6630Z. Investors may be exposed to risks resulting from the use of an OTC Swap with Lyxor UK. Physical ETFs may have Counterparty Risk resulting from the use of a Securities Lending Programme. As of March 2020, the long term, senior, unsecured debt obligations of Société Générale were rated A by Standard and Poor’s Ratings Services (S & P) and A2 by Moody’s Investor’s Services Inc (Moody’s). Companies are rated by S&P from AAA (highest rating / most secure) to D (lowest rating / in default / most risky), and by Moody’s from Aaa (highest rating / most secure) to C (lowest rating / in default / most risky). You should note that an investment in any of these Exchange Traded Funds will not be covered by the provisions of the Financial Services Compensation Scheme, or by any similar scheme. The information on this website is published by Lyxor Asset Management UK LLP , a member of the Société Générale group of companies (“Lyxor UK Group”). Lyxor UK is authorized by Financial Conduct Authority in the UK, under FCA Registration Number .

Many companies also responded to calls for racial equity, although much work remains to deliver on these commitments. And strikingly, amid all of the disruption of 2020, businesses moved forcefully to confront climate risk. Ryedale publications do not offer investment or trade advice or make recommendations to use any particular investment strategy. Should you undertake any such activity on the basis of information contained in Ryedale publications, you do so entirely at your own risk, and Ryedale shall not be held responsible for any loss, damage, costs or expenses incurred by you as a result. Continuous monitoring and reporting on all portfolios are built into the Ryedale Platform. Customizable compliance rules help to make sure that portfolio managers act in accordance with investment mandates and regulatory restrictions, including short-selling and concentration limits. Out of those that survived up to the end of 2019, only 4.24 per cent managed to reach $1bn in AUM.

In the past year, HANetf has launched 7 new products to market including the world’s first carbon avoidance solutions ETF , a landmark gold ETC with The Royal Mint, the world’s first central counterparty cleared, an exchange traded Bitcoin ETP , and a host of modern thematic ETFs. These include Europe’s first medical cannabis ETF , Europe’s first 5G and digital infrastructure ETF , North American midstream energy and the World’s first Shariah compliant global equity active ETF . The European ETF market has broken the €1trn barrier, one year after surpassing $1trn in assets under management , according to data from Refinitiv Lipper. Investors should consult, if they deem it necessary, their own advisors or any other professional on this matter. Subject to compliance with its legal and regulatory requirements, LIAM shall not be held liable for the financial consequences of any nature whatsoever arising from any transaction relating to the product or any investment in the product. Through Lyxor UCITS ETFs, investors are exposed to counterparty risk resulting from the use of OTC swaps with Société Générale.

The companies that embrace this challenge – that seek to build long-term value for their stakeholders – will help deliver long-term returns to shareholders and build a brighter and more prosperous future for the world. Today, we have multiple companies across the globe delivering vaccines that they developed in under a year.

Any live weights outside of tolerance are brought back to inner and outer rails where it is possible to do so. For portfolios below our threshold amount, we have deemed that the size of the trades and the costs involved do not justify a frequent look methodology. We have chosen to set tolerance bands that are 20%, on a relative basis, on either side of a portfolio’s policy weight.

Lyxor UCITS compliant Exchange Traded Funds referred to on this website are open ended mutual investment funds established under the French law and approved by theAutorité des Marchés Financiers, or established under the Luxembourg law and approved by theCommission de Surveillance du Secteur Financier. Most, if not all, of the protections provided by theUK regulatory system generally and for UK authorised funds do not apply to these exchange traded funds . In particular, investors should note that holdings in this product will not be covered by the provisions of the Financial Services Compensation Scheme, or by any similar scheme in France.

Although information contained herein is from sources believed to be reliable, Lyxor Asset Management UK LLP makes no representation or warranty regarding the accuracy of any information. ETFs may be exposed to currency risk if the ETF or Benchmark Index holdings are denominated in a currency different to that of the Benchmark Index they are tracking.

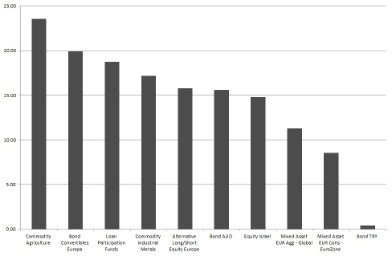

Active strategies are slowly being integrated into a much cheaper ETF structure. This helps us pay for the great content, data and tools we provide to all investors. In order to make the advertising relevant to our users we need to understand whether you are an individual investor or financial professional. Over the past two years, we have seen fee competition intensify across the ETF space, as average ongoing charges have fallen across the main equity and bond categories . This movement may be owed to a growing sense that the development and management requirements of these products do not justify substantially higher fees. One of the key ETF product development battlegrounds of recent years, most new launches now focus on multifactor equity strategies. Many ETF providers are marketing strategic-beta products as a way to improve the risk/return profile of a broad market-cap index.

Our policy is to transfer any cash back to the bank account from which the goal was initially funded. We do not charge transaction or transfer fees to clients when they withdraw their money or liquidate their portfolios. These statements detail exactly what ETFs are held, and the number of units and valuation of each holding. We also provide a summary of the previous month’s movements, including how much new money was invested in the account, how much was received in dividends, the impact of our fees, and finally, how much the account changed in value due to fluctuations in market prices. We also ensure that each portfolio receives its’ due dividends and that the clients are properly informed of the dividend distributions that their portfolios receive.

‘FTSE®’ is a trade mark jointly owned by the London Stock Exchange plc and the Financial Times Limited (the ‘FT’). ‘FTSEurofirst®’ is a trademark jointly owned by FTSE International Limited (‘FTSE’) and Euronext N.V (‘Euronext’). The FTSEurofirst 100 Index and FTSEurofirst 80 Index are compiled and calculated by or on behalf of FTSE.