Content

However, most analysts are in agreement that the crazy money changing hands is likely to settle down. It seems the interest in NFTs could very well be sustainable because it has captured the imaginations of so many. It deals in representations of digital art rather than a passing fad. Larvalabs sells CryptoPunk NFTsAnd now some savvy video game developers are allowing players to purchase assets within a game. This will allow them to forever own the digital rights to that asset or until they decide to sell. CryptoKitties was a game where its players could breed and trade digital cats. Another reason NFTs are generating controversy is the old crypto criticism regarding power usage.

Thus, civil liability may come to the force in case of the misleading marketing materials, activities, or omissions. Any public material that contains misinformation or deceit, leads to criminal and civil liability for an offense deriving from deception or misrepresentation. With regards to specific investments, section 89 and section 90 of the Financial Services Act 2012 cover misleading statements and misleading impressions respectively. These apply to issued whitepapers and any other marketing endeavors partaken by the token issuers. ICO scams come in many shapes and sizes so there’s no shortage of pitfalls to watch out for. As I already mentioned look out for where they’re registered, is it a remote, far flung tax haven, if so what are they hiding exactly?

How Government, Central Banks, Regulators Can Deal With Digital Assets, Crypto

In contrast to ICOs, crowdfunding takes place usually through an intermediating platform. Investments are privately-held and generally there is no secondary market to trade them. Notably, crowdfunding activities rely on recognised instruments and are conducted within a set legal framework. Often crowdfunding does not involve tokens or cryptocurrency at all. In principle, tokens are ‘contracts’ granting certain rights to investors.

The Fourth Anti-Money-Laundering-Directive applies to a wide range of persons or entities including regulated financial institutions. It will therefore depend on the qualification of the token or token offering whether issuers fall within the scope of The MLD 4.

Failure to adhere to the general prohibitions could result in compensatory requirements to be paid out to investors who have purchased tokens. The Financial Conduct Authority does not offer a universal criteria to determine whether an Initial Coin Offering falls under its regulatory reach. According to the FCA, a this can be decided only on a case by case basis. As a result, a multitude of ICOs are not subject to the FCA’s clearance. However, due to a variance in structure, ICOs often involve regulated investments. At the same time, the firms which are a part of the ICO process may also be subject to regulation. Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors.

Some tokens may also constitute transferable securities and therefore may fall within the prospectus regime. The digital token issued may represent a share in a firm, a prepayment voucher for future services or in some cases offer no discernible value at all. The term ICO refers to a digital way of raising funds from the public using a virtual currency, also known as cryptocurrency. IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems. It may be the case that in the volatile, unregulated space of ICOs, the FCA may simply create a new regulated activity of issuing coins, as it did with peer-to-peer lending, so as to bring it within the regulatory perimeter. On this analysis, the DAO ICO would meet the conditions of being a CIS. Of course, not all ICOs will be structured like the DAO and may not meet the conditions to be a CIS.

You should take independent financial advice from a regulated FCA advisor in connection with, or independently research and verify any information that you find on this site, and wish to rely on whether for the purpose of making an investment decision or otherwise. No news or research item is a personal recommendation to deal or invest in any particular company or product, nor does Valuethemarkets.com or Digitonic Ltd endorse any investment or product. Back in 2017, when bitcoin was riding high on a wave of euphoria, initial coin offerings were along for the ride. Anyone and everyone were talking crypto, and then the boom and bust was over in a flash.

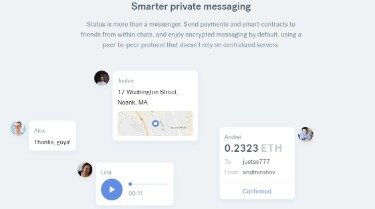

Moreover, a risk disclosure, warnings and disclaimers, as well as the application of legal rules and the designation of a competent court in the EEA should be included. Broadly speaking, payment services are provided if funds are accepted in order to transfer them to another person. Where tokens are offered against legal tender, an intermediate platform through which tokens are acquired or sold may carry out regulated payment services as set out in the PSD 2. In addition, depending on the design of the relevant cryptocurrency, issuers should consider whether the activity could be classified as the issuance of e-money. Non-fungible tokens are the latest digital craze wreaking financial havoc in the real world. From the complex yet transparent world of blockchain, comes an entirely new way of investing in digital goods.

Lets Stop Sacralizing The Tokenization Of Assets On The Blockchain!

All ICO’s comprise the same basic elements, a website offering the coin or token with the basics of the idea being invested in. This is always blockchain related and there are some wacky ideas out there about how blockchains are essential for this particular token to work.

They are used to investing in products on the traditional financial markets but for some time now a few have been in the cryptocurrency market. Many are in Switzerland, for example, but a few French family offices are involved too.

The author does a great job first explaining important concepts in a simple, straightforward, and clear manner. Another difference is that an ICO is the electronic and cryptographic counterpart of the IPO to the extent that it results in the funding of a company through the issuance of tokens, but those tokens do not represent shares or equity in the company. Where a share indicates some form of ownership of the company, a token only represents the ability to buy something the company is selling using that token, or to sell that token to someone who is looking to transact with that company.

Successful Icos

Reasonable expectation of profits — investors buy into a common enterprise, with the expectation that the purchase of tokens would yield returns in the form of cryptocurrency from the DAO’s ventures. On Nov. 14, 2017, the FCA addressed the risks inherent in investing in cryptocurrency contracts for differences — citing price volatility and price transparency, among other concerns. While it will be some time before member states are obliged to address at least the money laundering risks of the product, there is nothing to stop any jurisdiction, whether an EU member or not, from taking earlier action.

- Of course, not all ICOs will be structured like the DAO and may not meet the conditions to be a CIS.

- With regards to specific investments, section 89 and section 90 of the Financial Services Act 2012 cover misleading statements and misleading impressions respectively.

- Each one offers to place a minimum number of ethers, and when this involves dozens of people, the numbers can soon mount up.

- This short article is a warning to investors to employ extra due diligence prior to making any investment in initial coin offerings or token offerings as they are sometimes called.

- Your white paper will explain the product you are attempting to raise money for, as well as market opportunities for your blockchain application.

Further, it is fair to say that there is no established market practice for ICOs. The act of generating and offering tokens is also referred to as ‘crowd-sale’, ‘token sale’ or ‘token generation event’, which is structured typically as an auction process through the internet. The issuer or offeror puts tokens for sale in exchange for a so-called fiat currency such as the Euro, or, more often, for a virtual currency . Typically, tokens are bilateral arrangements which are not issued in the form of a security / certificate or similar type of transferable instrument, although some tokens, depending on their structure, can be sold on specific exchanges specialising in such transactions. This article does not provide any financial advice and is not a recommendation to deal in any securities or product. Investments may fall in value and an investor may lose some or all of their investment. You can purchase limited edition digital artworks by many famous artists.

ICO participants often see a lack of regulatory barriers as a primary attraction of carrying out the ICO in the UK. Whilst the ICO regulatory framework in the UK is non-existent , the perception that all ICOs are unregulated is a misconception.

Even providing functional code will provide evidence for your skills as a developer and the likelihood of a successful product launch. Be detailed and provide market based evidence for your technology. Thin content will be not perceived well by investors and cost you your ICO. Create a strong mission and value statement that can both be marketed to investors, as well as customers. Consider that anyone can create a landing page with a white paper and scam investors. What investors want to see are legitimate industry players actively involved in your project.

Typically, the investor sends the cryptocurrency to the token seller and the underlying smart contract technology sends the purchased tokens to the investor’s wallet address immediately. After the issuance, the tokens can be traded in, or exchanged for, fiat or virtual currencies on specific exchanges that allow the sale and purchase of tokens by the general public. On the back of the rise of cryptocurrencies, initial coin offerings have become an attractive means of fundraising, especially over the last year. The emergent phenomenon of ICOs could prove a viable alternative to venture debt or equity financing.

There are numerous ICOs out there and all of them claim to be the next best thing and promise huge returns on investment, however, this is rarely the case. Last year in 2017 nearly half of all ICOs have already failed and many of the remaining ones are failures in the making. Therefore, it’s important to know what to look for when choosing an ICO. The blockchain industry and number of cryptocurrencies has grown exponentially since Bitcoin’s inception in 2009. Much of this growth was only recently realized in the past few years due to the influx of ICOs . In 2017 alone, more than $4 billion was raised from hundreds of ICOs and 2018 is expected to be even bigger. It will be interesting to see what 2018 holds for issuers, investors and regulators alike.

They will be in exchange for your investment, so it will be like buying shares in an Initial Public Offering and trade them on crypto exchanges from end of Q1 2019. Organicco tokens are considered as security tokens (sometimes called equity/Asset tokens). We have applied to US SEC for exemption and now working on FINMA registration. Prior to an ICO, issuers should analyse carefully whether the ICO could be subject to regulatory or capital market restrictions. Even if no prospectus is required to be prepared, issuers should provide potential investors with detailed information on the project or investment eg in form of a White Paper.

And each will have a “white paper” a document explaining in detail the principles of the concept, how it will work and, in some cases, showing projected return on investment. The white paper may show projected stepping stones and time lines for development but importantly it will relate to activity that may take place in the future. An ICO is a method of fundraising for a new project utilizing cryptocurrency or digital tokens in their underlying product or business. The ICO is commenced by these new projects by selling their cryptocurrency or token to investors who believe in the project or the investment opportunity it presents.