Content

Ruffer Investment Management is also rumoured to have moved $675 million into Bitcoin, while fund MicroStrategy has bought somewhere in the region of $500 million of bitcoin this year. In October PayPal – which has almost 350 million users – announced it will allow customers to store and spend bitcoin within its service from early 2021.

In many ways, digital gold takes us back to times when currencies were linked to the price of gold. Digital gold combines the historical safety of gold, with the efficiency of digital currency. It can move around the world at speed for free, while stabilising other cryptocurrency transactions. The most popular stable coins are backed by traditional fiat currencies such as the US dollar, British pound or Euro.

The firm also advises Bitcoin exchanges, Bitcoin miners and businesses accepting payment in Bitcoin. The banking sector is often perceived as greedy, incompetent and needlessly bureaucratic and many people are trying to cut out this unpopular middle man. Just as DIY law has gradually become more popular with the increasing availability of technological solutions, it looks like the same effect may be seen in the banking sector. Whatever happens to Bitcoin, it’s unlikely that cryptocurrencies are going to disappear any time soon. In terms of Bitcoin and other cryptocurrencies, the padlock is known as the “public key” and the private key is just that, a “private key”.

In recent months, Stable Coins have seen remarkable growth in both size and variety. Today, with over 120 projects on the market, there is growing thinking that Stable Coins may trigger the mass adoption of cryptocurrency payments, thereby opening the crypto currency market. Even a traditional bank like JP Morgan has entered this market, with their own Stable Coin-like product named JPM Coin. The above review demonstrates that the evolution of stablecoins is being closely watched by numerous regulators in the U.S.

Sentiments Of Investors During Extreme Events

Stable Coins have a fiat backed structure and their operations and working are simple to understand. Since these are backed by a stable fiat currency, there is not much fluctuation in the prices.

- There is a whole range of digital wallets compatible with Bitcoin but one of the easiest to get started with is Multibit – it’s also completely free.

- “Stablecoins” could be a less risky way of investing in cryptocurrency, according to Gavin Brown, associate professor in financial technology at the University of Liverpool.

- For example, Ruffer Investment Company, an investment trust, announced in December 2020 that it had allocated 2.5% of its portfolio to bitcoin.

- The algorithm needs to reduce the number of sellers, but it is these low-confidence sellers who are least likely to buy Basis bonds.

- The first reason as to why Bitcoin is the top choice is because the cryptocurrency is by far the most stable on the market.

If you want to accept Bitcoin payment for your business, you can either do this directly using your digital wallet or you can make use of a range of merchant services. Or you can also choose to convert your bitcoins to pounds by using a Bitcoin exchange such as Bitstamp.

Follow Bank Of England Research On Twitter

Kusama says it offers ‘a proving ground for runtime upgrades, on-chain governance, and parachains’. Kusama is described as a ‘canary network’ for Polkadot, which is a recently developed blockchain offering similar capabilities to Ethereum. HEX is a blockchain based version of a type of fixed term bond, known as a certificate of deposit. A primary function of Ethereum is as a host of ‘smart contracts.’ Running on the platform’s blockchain, they resemble regular contracts, but lack middlemen like lawyers to oversee them. Ethereum hosts ‘decentralised applications’ or Dapps, where people can use Ether to pay for services such as finance, social media, and gaming.

Others include Ripple or Ethereum but literally thousands exist, and they won’t all necessarily behave in the same manner. Bitcoin, along with other cryptocurrencies, is having its time in the spotlight. Some cryptocurrencies have risen in value but many have dropped considerably. Put it this way, you wouldn’t use cryptocurrency to pay for your food shop. In the UK, no major high street shop accepts cryptocurrency as payment.

They are touted as the easy and fast way for new users to purchase various cryptocurrencies such as bitcoin. Other ways to buy include the digital currency app Ziglu and on the investment platform eToro. Bank of England governor Andrew Bailey recently said he was “very nervous” about people using bitcoin for payments.

Ultimately, decentralised Stable Coins may pave the way for a new and modern financial infrastructure that will remove inefficiencies, reduce risk stemming from centralised parties and change the way we transact. It is also very likely that we will see more non-USD Stable Coins being tailor-made for Asia. The emergence of more non-USD Stable Coins will signal that the market is maturing further and ready for the benefits of Stable Coins globally. According to a recent report by Remitscope, more than 50 percent of remittance flows worldwide could be attributed to countries from the Asia Region. Current traditional money transfers however are far from instantaneous or frictionless and often result in the end customer paying unnecessary transaction costs. Stable Coins are looking to become a more attractive crypto solution, particularly in the Asia Region. If Stable Coins are classified as regulated securities or swaps, there could be serious consequences for a large segment of the crypto industry.

Bitcoin Price: Is The Cryptocurrency Bull Run Over?

Even in times when Bitcoin was going through a downfall, it remained the top choice for many traders and maintained a high value. This was in 2018 and halfway through 2019, after the cryptocurrency collapsed and had a value of around $5,000. Now, that value is below Bitcoin standards, which is why we stated that it was a downfall, but it was still well-beyond all other cryptocurrencies. Since Bitcoin was introduced in 2009, it went from being a virtually unknown technical experiment to a darling of financial speculators – and then experiencing a financial car crash. The volatility of the currency has prompted warnings from the research unit of Goldman Sachs. The reason for this roller-coaster effect may be largely down to the experimental nature of Bitcoin and the fact that it’s such a new form of currency.

According to Brown, it could also be less risky to make long-term investments in the companies associated with cryptocurrencies. For example, shares in Facebook, which is planning to launch a currency called Diem , JPMorgan, which has the digital JPM coin that is equal in value to the US dollar, and the bank Wells Fargo, which is developing a US dollar-linked stablecoin. A Stable Coin is a cryptocurrency with all its intrinsic functionality, but does not suffer from the vulnerabilities of market fluctuations and price volatilities. They fall into the category of payment tokens, whose main purposes are store of value, medium of exchange, or unit of account. Like other cryptocurrencies, Stable Coins aim to become global, fiat-free money that is programmatically issued and tracked with the use of blockchain technology. The new Louisiana regime which took effect August 1, 2020 is similar to New York’s. States that expressly regulate virtual currency activity as money transmission.

Whilst algorithmic stablecoins like Basis manage to eliminate the need for trust in a third party, they instead end up being heavily dependent on investor belief and confidence. As long as all users believethat the coin will be stable, their behaviour ensures that it will be stable, but if some users start to lose confidence and sell, the coin risks falling into a downward spiral. The problem is that the Basis white paper assumes that the algorithm can push up the price by simply reducing the total stock of Basis coins . But in reality the price is determined not by the total stock of coins, but by the balance of sellers and buyers in the market. The algorithm needs to reduce the number of sellers, but it is these low-confidence sellers who are least likely to buy Basis bonds. Meanwhile the high-confidence coin-holders, who might be tempted to swap their coins for bonds, are the ones least likely to be sellers in the first place. Consequently Basis bonds are not an effective way to reduce selling pressure on the market.

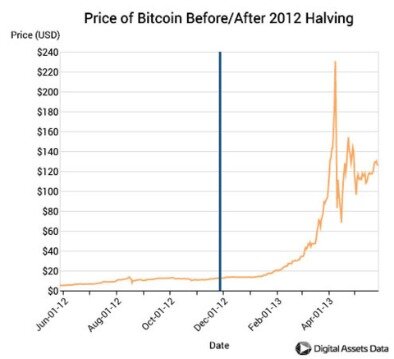

Before 2017, bitcoin’s last major price spike came in 2013, when its value rose from below $100 to above $1,000 in the space of just a few months. There followed a brief price crash before a sustained period of steady losses and market stagnation that saw bitcoin trade between $200 and $600 for more than two years. According to Mr McLeod, however, the big price gains will come from one of bitcoin’s rivals, such as ethereum or stellar. Bitcoin’s most sustained period of price stability in its history is about to come to an abrupt end, cryptocurrency experts have warned. JP Morgan analysts have said people who previously invested in gold are seeing bitcoin as a modern alternative. The cryptocurrency, which caused a ‘gold-rush’ style surge of investments in 2017, rose by more than 6 per cent on Wednesday to reach $20,632 (£15,283) against the dollar. DeFi is unregulated and there is no way to get your money back if something goes wrong so as with all cryptocurrency related things, it should be approached with caution and following plenty of research.

There Is No Reason To Sell What Will Happen To Bitcoin And Ethereum?

Research from the Cambridge Centre for Alternative Finance suggests that the number of global crypto users has increased from 35 million in 2018 to 101 million in 2020. A closer approximation would be an American up-and-in barrier call option on a basiscoin, expiring in five years, with rebate equal to the strike price received at touch, and with the barrier dependent on how many bonds are ahead of you in the queue.

They started trading with this cryptocurrency in hopes that it will bring a profit to them. Thanks to the institutional interest and its legality, Bitcoin is far more stable, thus having increased value, thus being the better option for almost every trader.

Bitcoin Price: Why The Cryptocurrency Reached An All

Band Protocol says it ‘ensures interoperability between smart contracts and the rest of the world.’ In simpler terms it uses blockchain tech to deliver live data to smart contracts running on Ethereum. For example, the live price of a particular commodity being sent into a DeFi smart contact. Users can lend and borrow money through using the protocol, without having to go through a bank. According to cryptocurrency site Nomics.com you could have made a remarkable 11,450 per cent if you had bought HEX a year ago, while several others also achieved percentage gains in the thousands. Take an example of someone seeking to raise money for an animal welfare charity. On a crowdfunding website like Kickstarter, they would set a fundraising target and hope people donate enough money to hit that goal. Both use blockchains, the digital ledger technology where transactions are recorded and validated using a peer-to-peer network of computers rather than a single organisation.

Setting up a global payment web, like Facebook plans to do, would simply not be possible if cryptocurrency volatility was still an issue. Luckily for Facebook, Visa, Mastercard, and about a million other businesses, stablecoins brings a new, non-volatile solution to the table. It is an exciting moment in time, and the opportunity ahead for all has serious value. Bitcoin is used by millions of people around the world, which makes it the most dominant cryptocurrency on the market. In a world where there are thousands of currencies just as Bitcoin, many wonder how does this one remain the top choice for so many people.

If Bitcoin is on a bull run, then Ethereum usually experiences the same phenomenon. And when the price of the former goes down, the latter drops likewise. Recently, Ethereum launched a new blockchain known as the ‘Beacon Chain’ that uses a proof-of-stake consensus algorithm to run Ethereum 2.0. This version is said to use up far less energy than the original and can be scaled up better.

Regarding Bitcoin, it is worth to note that we should not expect a strong correction,FXOpen experts say. First, large crypto investors do not sell their coins, but on the contrary, withdraw liquidity from exchanges, which has a positive effect on the price. Secondly, despite the rather strong information noise around Bitcoin, the number of daily new BTC addresses has still not reached the level of 2017. Third, the boom in open purchases of Bitcoin by institutional investors has pushed the rate up quite strongly, but in addition to large funds, the creation of reserves in Bitcoin by government agencies has begun. The regulations implementing the BSA define “money transmission services” as the acceptance of funds from one person and the transmission of those funds to another location or person by any means. Anexchangeris a person engaged as a business in the exchange of virtual currency for real currency, funds, or other virtual currency. Anadministratoris a person engaged as a business in issuing a virtual currency, and who has the authority to redeem such virtual currency.

Notable examples include HEX, which has seen the fastest rise in price of any cryptocurrency over the past 12 months, climbing over 11,000 per cent according to cryptocurrency data site Nomics. It allows users to deposit cryptocurrencies that are then borrowed by other people who pay interest to the lenders.

They are now supported by more cryptocurrency service providers than ever before, with a market capitalisation of just under $ 25 billion. However, the Basis bond is not truly a bond in the textbook sense of the word. It only pays out if the price rises above US$1 within the next 5 years. There is no coupon and bonds that aren’t repaid after 5 years are cancelled. Bond holders risk a 100% loss of capital in exchange for a possibly small and uncertain profit. Only investors who have high confidence in the Basis price returning to US$1 will be willing to buy bonds with this balance of risk and reward.