Content

China bitcoin volumes used to represent 18% of world volumes, it now represents 5%. We think it is much harder to completely eradicate due to its pseudonymous features – hence why we call it a non-sovereign store of value. But it could be effectively banned for any investor operating in a standard regulatory regime. The gold ban of the 1930s was quite unconstitutional and was a deeply political move – it was an attempt to prevent bank runs with huge penalties for hoarding it. PS If you haven’t taken a look at Charlie’s “Money Map” yet, you should give it a look. Market navigation is becoming ever harder in these trying times – but Charlie knows how to chart the right course.

People see that BTC has twice surpassed the memorable peak of $20,000 and potentially experienced the characteristic FOMO effect inherent in their nature. This effect has been known for a long time, in particular, it is described in the book “Madness of Crowds” by Charles Mackay . from the point of view of the analysis of trading volumes in interaction with the price. Citi analysts predict the price of Bitcoin at the level of $300,000 at the end of 2021. Although JPMorgan does not give exact numbers, it confirms that Bitcoin has the potential for further growth, as it competes with gold as an alternative means for storing capital.

The World Bank Political stability index versus bitcoin volume growth helps strengthen this theory. Global searches on Google for the phrase bitcoin highlighted that 2017 was the year that bitcoin entered the broader public consciousness. Since then, searches for bitcoin have declined and not really picked-up during this more recent rally. In economically weak and authoritarian regimes we have seen a rise in searches for bitcoin. Take Argentina as an example, where there has been a sharp decline in the Peso in recent years, there has also been a corresponding rise in searches for bitcoin.

Latest News On Exchange Rates Uk

What is the outlook for the next couple of weeks, and can we clear up some of the fundamental differences and similarities between both?

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. The more eminent financiers, central bankers and economists doom bitcoin to failure, the more it seems to rise. At the weekend the world’s most popular digital currency broke through $58,000 for the first time, meaning it had doubled in value since the start of the year. Despite their recent gains, bitcoin and ethereum remain a long way off the highs of late 2017 and early 2018, when one bitcoin was worth more than twice its current value.

And yes, positive momentum reflecting the higher highs with multiple 1-2 patterns causes me to believe that this one is going higher. After a week with plenty to talk about, John Stepek looks at how the events of the last seven days have affected the charts that matter most to the global economy. The ratio between BTCUSD and XAUUSD shows that the year 2000 started with one bitcoin enabling the purchase of 4.7 ounces of gold. Today, the same bitcoin buys 5.91 ounces, and that is a gain of 25.68% in favour of Bitcoin. Bitcoin and Gold prices are both having a good year as people flock to them to hedge against possible inflation driven by central bank quantitative easing. The ongoing coronavirus crisis is also pushing investors towards these assets. Some of the other most famous gold coins include the Gold Eagle , Maple Leaf , Krugerrands , Gold Panda and Vienna Philharmonic .

Bitcoin, which has hit record highs in recent months after a rollercoaster ride over the past decade, has also drawn support from major financial institutions this year. It comes days after Mr Musk added “#bitcoin” to his Twitter profile page, which drove up the price.

The advice provided on this website is general advice only and does not constitute as a financial recommendation. Any news, opinions, research, analysis, values or other information contained on this story, by Exchange Rates UK, its employees, partners or contributors, is provided as general market commentary. Exchange Rates UK will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. This year we have seen cumulative flows into digital asset investment products rise from US$1.35bn at the start of the year to US$6.1bn today, with only 24 days of outflows for a total of 241 trading days this year. Investors are buying and holding, a good indicator that it is slowly developing into a store of value. As understanding of bitcoin improves, clients have grasped that bitcoin has a limited supply and fulfils this role as an anchor for your assets while fiat is being debased. In the 1970s, as the US dollar was forced to devalue against gold, the inflation that followed saw gold surge 27-fold.

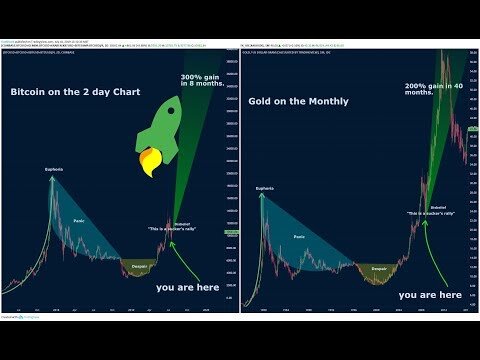

Starting from April to December, the index has increased at a stable moderate rate, being in the middle zone. But then the “explosion” followed, and the growth accelerated.

Cryptocurrency Price Analysis For Btc, Eth, Ada, Xrp, And Zrx

Investors flocked to gold to protect themselves from devaluation. In 2020, with the monetary system unstable for different reasons, there is a sense that another major debasement is underway.

This is why gold can help in building a more stable investment portfolio that doesn’t rely upon stocks and share alone, as investors can minimise the risk of all their assets rising and falling simultaneously. In a stock market filing, Tesla said it “updated its investment policy” in January and now wanted to invest in “reserve assets” such as digital currencies, gold bullion or gold exchange-traded funds. This has been why gold has traditionally performed well during times of economic uncertainty, however market data suggests that the finite supply of bitcoin means it is increasingly being viewed as a safe haven asset. It is only the third time a halving has happened in bitcoin’s 11-year history and some market analysts believe it could push the cryptocurrency’s price to new all-time highs this year. See live prices and historical data on all the cryptocurrencies we track.

How Much Does Trading Cost?

The most likely explanation is that the coins are flowing on a large scale from professionals to the mass of newcomers who rushed to buy cryptocurrencies under the influence of emotions. The fact that the market is overheated is also indicated by the Google Trends chart. The world is experiencing the similar interest in the growth of Bitcoins, which was last seen in December 2017 .

That proved particularly useful when communications were poor, money was weighed, and information was exchanged by ship. Exchange rates were fixed to gold, because gold is gold, wherever you are. The three-year consolidation following the price surge in 2017 is over. Bitcoin has found its feet, and a new bull market is underway. Just as investors flock to gold when they see it outperforming the stockmarket, I believe bitcoin will attract capital from tech; and there is plenty of it. The ratio is now nearing the February 2020 high of 6.70 ounces of gold per Bitcoin, a breach to this level could lift the ratio to 8.12 ounces. In other words, bitcoin prices stand to gain more than gold prices on a break to 6.70.

Bitcoin attained a major 2019 swing high on June 25th, 2019, while Gold and Silver didn’t reach their major 2019 swing highs until early September. December 17th, 2018, was near the bear market and 2018 low for Bitcoin, but that for Bitcoin was also a higher swing low for Gold and a pre-breakout low for Silver. The condition that is the most dominant on all three of these charts is the existence of a long-running bullish continuation pattern known as a bull flag. Financial market trading carries a high degree of risk, and losses can exceed deposits. Any opinions, news, research, analysis, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. The price of gold tends to move in the opposite direction to the stock market, and does so just less than 50% of the time. If you compare the 12-month interaction between gold and the S&P 500 Index over the last five decades, it averages at zero.

If bitcoin were to take 5%, we estimate, its price would equate to US$31,880 . We believe the increasing trend of legitimisation and corporate adoption are the likely reasons for bitcoin’s recent price rise. Some fund newsletters also suggest a trend of investors selling gold positions and diversifying their hedges by adding bitcoin. Until recently, bitcoin and gold fund flows had been following a similar path. Since the beginning of the year, a combination of loose monetary policy and a weak economy precipitated by COVID-19 led to fund inflows into both gold and bitcoin. However, following the news of a vaccine and consequent hopes of an improving economy, we have seen gold prices fall and gold fund outflows. Conversely, bitcoin prices have continued to rise alongside inflows of US$2.5bn over the last 9 weeks .

Until that point, the rate looks to remain range-bound between the July lows of 5 and 6.70. A breach to 5 ounces per Bitcoin would trigger a slide to the April low at 3.78, i.e. gold prices here would outperform Bitcoin. As well as setting the price of gold, the LBMA also set the standard for gold quality (or ‘good delivery’ standard),which includes a minimum purity of 99.5%.

“As things stand we are in line to post a 182 per cent rise for bitcoin since the lows of December 2018, and the surge we are currently seeing paints a bullish picture for the months following this third halving. Bitcoin’s recovery comes less than two weeks ahead of a rare event known as a halving, whereby the number of new bitcoins created will fall by 50 per cent. Save money on your currency transfers with TorFX, voted International Money Transfer Provider of the Year . Their goal is to connect clients with ultra competitive exchange rates and a uniquely dedicated service whether they choose to trade online or over the telephone.

This coupled with the onset of COVID-19 makes it much easier for central banks to enforce negative yields on the ordinary person if they choose to. We believe this is due to individuals looking for a non-sovereign store of value that is easily accessible and provides an anchor relative to their native currency.

- Track the latest spot price for gold with our real-time updates 24 hours a day and track the London Bullion Market Association gold price, which is updated twice daily and widely considered to be the industry benchmark.

- The three-year consolidation following the price surge in 2017 is over.

- At around $18,000 (£13,500) it is approaching its all-time high of a shade under $20,000 of December 2019.

- Exchange Rates UK will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

- The world’s biggest money manager, Blackrock, recently changed a handful of investment mandates to allow some of its funds to invest in the currency.

The twice daily fixed prices, however, is always based on pure gold. It should be noted that, while gold has been known to hold its value even in the face of economic downturn, like any investment it can be unpredictable and will always fluctuate in price. Unlike listed companies there is little underlying information to go on and why prices rise and fall largely remains a mystery – though it is my suspicion the same type of person who buys into gold is attracted to Bitcoin. In summary, we believe 2021 will be a pivotal year for bitcoin, with much greater institutional investor and corporate adoption. We expect there to be much hype and confusion on the timing and implementation of CBDCs but ultimately CBDCs and bitcoin are very different.

You will find more information by going to one of the sections on this page including historical data, charts, converter, Technical analysis, news, and more. Merryn talks to Raoul Pal of GMI and Real Vision fame about bitcoin, gold, what the GameStop and Robinhood shenanigans have taught us about the fragile state of the market, and much much more. (And please do leave a review if you can – I realise that will depend on how you listen to the podcast, but if you have the option, it’s always great to get your feedback).

We expect volatility in bitcoin to continue to decline over the course of 2021. For it suggests that if this bull run continues, that we’ve yet to see the really frothy action arrive in the market – when speculation gets out of hand and prices become unsustainable. What you’re looking at there is not the price of bitcoin, but how much its price is deviating from its short- and long-term average (30-day moving average in black and the 200-day moving average in red). To put it in simpler terms, a chart like this will tell you if recent behaviour of an asset is out of the ordinary. Information about the XAU BTC (Gold Spot vs. Bitcoin) is available here.

The MACD has just provided a bearish cross, and the RSI topped out, along with the price, showing there is momentum in the move lower in price. Perhaps the intuitive and impulsive response is gold, which could be seen as a cause for the rally in the cryptocurrency. However, gold is already in the thick of a hot rally and perhaps has exhausted itself, at least for now, while Bitcoin is just getting started.