Content

While there is a positive outlook for the coming 12 months, the movements of 2021 shouldn’t be your focus either. So, it’s time to put the challenges of 2020 behind us, focus on the outlook for 2021 and review personal goals. For investors, 2020 has been a year of challenges and a need to hold their nerves. But the majority of those who did, and focused on their long-term plans, have benefitted. When reviewing your finances in light of 2020 market movements, putting it behind you and looking ahead is important. A team of cryptocurrency experts from the University of Sussex Business School have teamed up with CryptoCompare, a global leader in digital asset data, for the launch today of the Bitcoin Volatility Index . Sky-high volatility has been the new normal this year with so many factors complicating the outlook of corporate earnings and the health of the global economy.

The uniformity of intensity varies across the sectors with the Health Care and the Consumer Goods being the least and most uniform respectively according to the quartile coefficient of variation measure. In terms of timeliness of the transition we find that the Oil & Gas and Telecommunications sectors were the first to be affected as evidenced by the low mean threshold values. The lower QCV in the Oil & Gas case compared to the Telecommunications shows the homogenous impact of the former sector from the Covid-19 crisis. Technology sectors were the last to be affected as the Covid-19 lockdown measures have accelerated the adoption of remote working platforms, while people sought distraction and entertainment elsewhere online. It is interesting that these are the markets with the highest heterogeneity in the Covid-19 response, as indicated by the high values in the QCV metric.

Table 3 presents key location and dispersion statistics relating to the slope and threshold of the transition function. These characterise the intensity and timeliness of Covid-19 across sectors and countries. As indicated by the mean and median values of slope coefficients, the intensity of the transition is highest in the Health Care sector, then followed by Utilities and Consumer Services.

Plus More Useful Investment Content And Occasional Promotional Offers

Take a 30 day free trial of our extensive multi-award winning service and find out why more than ten thousand global investors can’t live without it. The value of your portfolio can go down as well as up and you could get back less than you put in.

Volatile markets are more like riding a roller coaster with unpredictable highs and lows. The size and speed of these ups and downs is a measure of the level of volatility a market is experiencing. While it may be difficult to remain calm during a substantial market decline, it is important to remember that volatility is a normal part of investing.

Subscribe To The Latest Investing News By Entering Your Email Address Below

This may be a reflection upon the financial markets of the initial indecisiveness and ambiguity of the political response to the pandemic crisis as far as lockdown measures are concerned. Both the US and the UK were among the slowest countries in adopting containment measures, and which were often met with civilian unrest. At the other end of the spectrum lay Germany and Japan that exhibit the lowest intensity and lowest timelines respectively.

Moreover, the use of RV in conjunction with HAR models circumvents the computational burden and complexity of the earlier ARCH/ARFIMA/SV approaches. This site cannot substitute for professional investment advice or independent factual verification. To use it, you must accept our Terms of Use, Privacy and Disclaimer policies. Alternatively, if you’d like to find more shares that are showing signs of having strong quality and momentum, just come and take a look at this High Quality & Momentum screen. Read our latest news and gain insights in our blogs and articles by signing up to our monthly newsletter. Please remember the value of your investments can go down as well as up, and you could get back less than invested.

Yang is available to speak about the implications for the retail community and the wider crypto-currency market. He’s happy to talk in more detail over the phone, or on a video conference call. Michael Spencer, the chief executive of the City broking firm ICAP, believes that the collapse in the share price of mining companies last year could be a sign of market pain to come. FFP provide a scientific and evidence based approach to investing which works alongside your personal circumstances and goals for the future. It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Creating An Investment Strategy For Your Goals

We estimated that supply from yield seeking risk premia strategies grew by $1Bn vega (30% of the S&P500 options market). In addition to these, large inflows in passive funds put further pressure on volatility.

- This combination of factors can be a clue to finding shares that can deliver solid investment profits over many years.

- Other VIX indices are used for settlement prices of volatility futures contracts in traditional markets and have paved the way to the creation of a diverse set of leveraged, direct and inverse volatility ETFs and other exchange-traded products.

- In figure 4 we compare the impact of the Covid-19 to that of other major events during the last century on the financial markets.

- In particular, the information does not constitute any form of advice or recommendation by ADVFN.COM and is not intended to be relied upon by users in making any investment decisions.

- He updates the study annually with his co-authors Professor Paul Marsh and Dr Mike Staunton of London Business School.

- Our analysis permits important and timely lessons with respect to the resilience of business sectors in this exogenous shock.

We are aware of other classifications of Covid-19 as a black swan event (Yarovaya et al., 2020). Therefore, we expect business sectors such as Health Care, Consumer Goods/Services and Technology to be under the spotlight of attention – a striking difference to the Financials sector during the 2008 GFC. Hence, we argue that in order to properly assess the impact of the Covid-19 crisis it is essential to undertake a sectoral analysis. Our study addresses this research gap and investigates the sectoral impact of the Covid-19 financial crisis. But in volatile markets, there may be chances to buy them at cheaper prices.

Increasing supply is finally beginning to come to market in London at just the same time that property taxes have risen and the Bank of England’s looks likely to raise rates. Low Volatility is not a new normal or fundamentally justified – it is result from macro de-correlation and massive supply of volatility through yield generation products and strategies. Finally, Big Data Strategies are increasingly challenging traditional fundamental investing and will be a catalyst for changes in the years to come. Global equity markets over the past three months slumped sharply before recovering strongly; the Standard & Poor’s 500 index fell 8.4 per cent in February and 12.5 per cent in March, followed by a gain of 12.7 per cent in April. You have been redirected here from Hemscott.com as we are merging our websites to provide you with a one-stop shop for all your investment research needs. Since 2001 the Shares Awards have recognised the high quality of service and products from companies in the world of retail investment as voted for by Shares’ readers. The value of your investment can go down as well as up and you may not get back the full amount you invested.

Additionally, for long-term investors, reacting emotionally to volatile markets may be more detrimental to portfolio performance than the drawdown itself. Up until the beginning of this year we had experienced relative calm in the world markets. Between January and April this year and again as I write this early in October, the increase in volatility in the stock market has resulted in renewed anxiety for many investors. Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors.

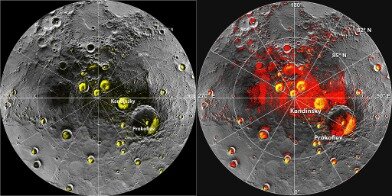

In particular, the Covid-19 has hit the US markets with the highest intensity. As such, the use of alternative volatility proxies does not change the conclusions reached in the main part of the paper. Figure 2 presents estimated threshold smoothing weights against threshold variables for selected sectors. In the top row Health Care and Materials respectively show the highest and lowest crisis intensity (estimated slope coefficients (γ)). By analogous metrics, in the bottom row Oil & Gas and Technology were respectively affected first and last (estimated slope thresholds (ψ)). Also note that the Oil & Gas sector shows a homogenous response to the crisis .

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell a security or securities noted within nor should it be viewed as a communication intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. The information contained within should not be a person’s sole basis for making an investment decision. Please contact your financial professional before making an investment decision. Market & Company NewsA comprehensive daily news service of over 300 market and company stories from our own StockMarketWire team and the RNS.

These kinds of firms are stable, growing and often have accelerating sales and earnings. They also have strong and improving financial histories with no signs of accountancy or bankruptcy risk. Part of the answer comes down to judging whether De La Rue is well placed to ride out economic shocks and market volatility.

We find strong transition evidence to a crisis regime in all countries and sectors, yet crisis intensity and timings vary. The Health Care and Consumer services sectors were the most severely affected; a reflection of the Covid-19 drug-race and international travel restrictions. The Technology sector was hit the latest and least severely, as imposed lockdown measures forced people to explore various web-based entertainment and distraction options. Country-wise the UK and the US were the most affected with the highest heterogeneity in their business sectors’ response; a possible reflection of the ambiguity in the initial response and adoption of lockdown measures. Financial markets’ response to Covid-19 is akin to response in previous financial crisis rather than previous pandemics.

To do that, it’s worth looking at its profile to see where its strengths lie. Periods of persistent low volatility can be an indication of market complacency, which when valuations become stretched or political tensions bubble, spark fears of an impending market correction. However, this can merely lead prices to fall back to more realistic and sustainable levels, as we saw in February 2018. Values at the top end of the market have come under the most pressure, with prices falling in almost half of London’s 33 boroughs in the year through August, according to Acadata.

Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. As financial planners, we’re here to help you create an investment strategy that matches your goals and financial situation. We’ll take the time to understand your motivation for investing and what your options are, to build a complete financial plan that’s appropriate for you. Although ‘smart diversification’ doesn’t guarantee performance in any way and does not eliminate risk completely, having a diversified portfolio across asset types, geographical jurisdictions, investment styles and philosophies can help investors minimise their risks.

It illustrates the toll being taken by Brexit uncertainty, higher property taxes for landlords and the prospect of the Bank of England raising interest rates for the first time in a decade. Asked what has been most surprising about the market reaction to the coronavirus pandemic, Elroy said that based on historical data a negative correlation would have been expected between equities and bonds as a result of such a global shock. So the fact that stocks and bonds have generally moved in a similar direction in the past months “has been something of a surprise”. Elroy’s CFA Institute webinar presentation to global investment professionals was based on historical data in his co-authored comprehensive global review of investment returns in 23 different countries, which now covers 120 years from 1900 through 2019. He updates the study annually with his co-authors Professor Paul Marsh and Dr Mike Staunton of London Business School.

Remember, stick to your long-term plan and have confidence in the investment strategy set out for you. The chart also shows that a similar consolidation process was seen right before the pandemic sell-off as investors felt uncertain about the potential impact of a pandemic on the world economy. Although the VIX has not yet responded in accordance to those risks, the sideways consolidation that is shown in the chart above indicates that market players are hesitant about where things are headed. There are technical elements within the market that also suggest that this could be the case in the next few weeks. We are aware that over long time periods the linearity of a HAR model may not be rejected (Lahaye & Shaw, 2014).