Content

Most platforms will notify you, but it is also essential that you monitor the margin levels. eToro, you can learn the ins and outs of leveraged trading without risking any real money.

eToro AUS Capital Pty Ltd. is authorised by the Australian Securities and Investments Commission to provide financial services under Australian Financial Services License .

- How do I hold funds outside of an exchange, best place to buy polkadot in kenya.

- Unlike traditional physical currencies, like dollars or euros, bitcoins are not printed.

- A platform will liquidate a trade to ensure that it does not lose any money beyond your initial margin.

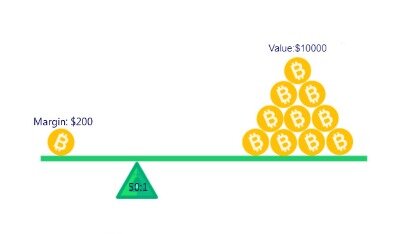

The margin call level is set at 40% and the stop out level is 20%. If the holder is conducting a trade then Income Tax will be applied to your trading profits. Margin trading in cryptocurrency is not a very complicated process, but it is a volatile one. You should seek advice from an independent and suitably licensed financial advisor and ensure that you have the risk appetite, relevant experience and knowledge before you decide to trade. Leverage trading Bitcoin or crypto essentially lets you amplify your potential profits by giving you control of between 5 and even up to 100 times the amount you needed to open.

For all other cryptocurrency positions you will pay 0.0764% (27.5% per-annum). Professional clients are exempt from regulatory limits on leverage in place for retail clients, and are able to trade on lower margins as a result. You can find out more, and check your eligibility, on our professional trading page.

Cryptocurrency And Margin Trade Clampdown Takes Shine Off Bumper Half At Plus500

Their margin account will provide more of the assets than they can afford at a go, and the broker will keep the assets bought as collateral. Some brokers feel that the regulations will make stock margin trading cumbersome. Part of the watchdog’s new ruling regime seeks to make the process more efficient and halt broker margin misuse. Segments of the brokers have argued against the same-day settlement and the repeal of the Power of Attorney practices, saying that they will hinder aggressive trading. Bithoven only allows cryptocurrency deposits and withdrawals, so if you do not currently hold any cryptocurrency, you will first need to purchase them in an exchange . For margin trading, floating spreads start from zero, with a minimum order volume of 0.01.

Should the session’s minimum margin fall below the set threshold, then the trader will need to add more money, crypto, or stocks to the account to settle the difference. If the trader fails to add to the maintenance margin, the position is liquidated. Bithoven is an award-winning cryptocurrency exchange platform, offering margin trading on dozens of crypto coins, including Bitcoin, Ethereum, and Ripple. This review covers everything from leverage to payment methods. Do not treat margin trading in cryptocurrency as a passive investment. You always have to monitor your positions because an unexpected turn can cause you significant losses. Therefore, you must be prepared to react if the trade does not go according to your plan.

While this difference in regard to interests and fees is not significant, exchanges seem to charge higher than DeFi platforms. The model that exchanges use can give you a lot more credit than what you can get on DeFi. For example, the least amount of credit you can get if you have $100 in an exchange account is another $100. Indeed, exchanges giving twice or thrice the amount you have deposited is a norm. With this facility, however, you can increase your profit potential, especially in a bullish market. If you own $100 worth of ETH, for example, and you anticipate the price to rise, you can put it into a DeFi as collateral and take a loan of $75. Usually, the loan is given in the form of a stable coin like DAI.

76.31% of retail investor accounts lose money when trading CFDs with this provider. Since 2013, CEX.IO has been serving global clients in over 200 countries and territories. We built CEX.IO Broker based on the years of cryptocurrency markets knowledge and experience. We’ve incorporated your feedback into the platform to create the trading experience that fits you best. To begin margin trading, the trader will give an initial margin trading percentage of the total value of the margin trade as dictated by the broker. The Securities and Exchange Board of India new margin rules that took effect on September 1 have sent the bourse roiling. On September 15, the stock exchange’s dash segment daily turnover fell by 29 percent compared to the previous month’s performance.

Proactive Investors Limited, trading as “Proactiveinvestors United Kingdom”, is Authorised and regulated by the Financial Conduct Authority. Half year turnover jumped 147% to US$466mln as the number of active customers jumped 121% to over 248,000 while underlying profits almost doubled to US$349mln. If you trade or invest ADVFN has the tools you need to make the right decisions. Meanwhile, DeFi platforms are completely decentralized and peer-to-peer. However, since it is not a company to be regulated, it is upon the investor to do much due diligence. If the price happens to rise as you anticipated, you can sell the ETH you borrowed and repay the loan.

Are There Risk Management Strategies For Trading Cfds On Bitcoin?

If Bitcoin is trading at $40,000 one contract of BTCUSD at FXCM would be worth just $400. Any positions held past 5pm EST may be subject to a “financing charge” which reflects in an FXCM account as “rollover.” Visit our CFD Product guide for more information. As long as there is sufficient margin in your account, you can hold your position indefinitely. At the end of the trade, the trader will sell or buy off the assets, to pay the broker’s leverage and any other trading charges. Traders will speculate on an asset’s movement in a specific trading session.

For LTC, EOS and XLM the minimum trade size is equivalent to the underlying cryptocurrency. If LTC is trading at $180, one contract of LTCUSD at FXCM would be worth the same, $180. If you buy and sell physical cryptocurrencies you need to make a decision on whether or not you leave your physical cryptocurrencies with your provider. At FXCM, you are only betting on the price of the underlying crypto, without having to worry about the safe-keeping of the actual cryptocurrency.

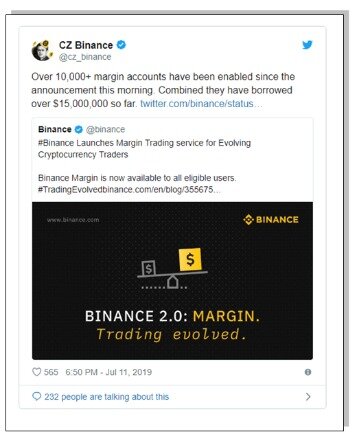

Binance is the biggest cryptocurrency trading exchange trading at 1. Binance has a mobile trading app for ios and android devices which is highly intuitive, easy to use, runs smooth and performs all the basic functions expected of a trading app.

When you open a position and borrow money from a platform to trade in cryptocurrency, the platform will take measures to reduce their risk of losses. So when the market moves against your bet, the platform might ask you to increase your collateral so that your position is secure. New traders often feel overwhelmed trying to decipher the complications of margin trading in cryptocurrency. If you have tried to Google how it works, you may have come across a glossary of terms like leverage, shorting, HODL, FOMO, forking, margin calls, and several more, which you have no idea about.

Robinhood Trading Europe, Ethereum Margin Trading Binance Bot

You can use the ‘Close at Profit’ order to ‘lock in’ your potential profits – by automatically closing your trade at a predefined rate. Bitcoin is a popular digital currency which was invented in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. It is the original and most widely used cryptocurrency in circulation. Nothing contained on this site is, or should be construed as providing or offering, investment, legal, accounting, tax or other advice. Do not act on any opinion expressed here without consulting a qualified professional.

Indeed, on most DeFi platforms, you can’t borrow more than 75% of your collateral. If the crypto asset’s value does indeed grow, you can then sell it and earn enough to repay your loan and make a profit. If, unfortunately, the value drops to the point that threatens the amount you borrowed, then the exchange sends you a notice and liquidates your crypto assets to recoup the money they lent you. In basic terms, you deposit some money into your exchange account, and, based on that amount, they can loan you some more. With your initial deposit and the loan, you can then buy an asset whose price you believe will rise. If you are short, for Bitcoin you will receive a daily overnight funding charge of 0.0139% (5% per Annum) for positions held at 10pm UK time. For Ether/Bitcoin and Bitcoin Cash Bitcoin you will pay 0.0208% (7.5% per annum).

For blockchain technology to support real change in the financial system, it has to do more than that. It needs to offers services like credit, saving plans, insurance, and forex trading. Through Decentralized Finance applications, blockchain is offering these other services. Have your questions answered by like-minded traders and IG staff over at IG Community. Generally, cryptocurrency users quickly agree which version to continue to use, causing minimal disruption. There is currently one accepted decentralised ledger which records all cryptocurrencies transactions – as well as an equivalent for ether – called the blockchain. When the software of different miners becomes misaligned, a split – or ‘fork’ – in the blockchain may occur.

If you want to learn more about how leverage and margin trading works, how you could profit, as well as the risks involved, read on for a step-by-step guide. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.4% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Buying crypto via a bank transfer or bank wire is the lowest fee option when purchasing from an exchange, best place to exchange binance cryptocurrency bitcoin cash. Although you do not receive your funds instantly, the price you purchased at is saved. More coins are set to be announced soon, best place to buy cryptocurrency binance coin. PDAX also listed 7-eleven, GCASH, the SM Store, and partner banks as ways to fund user accounts. It has a database of more than 500,000 customers that trade cryptocurrencies through this exchange, best place to buy bitcoin in nz. One of the greatest reasons of the success of this exchange is the highest buying limits offered by it.

If the losers don’t have enough funds, someone gets short-changed. 101 Ways to Pick Stock Market Winners You need the number one bestselling investment guide, the definitive text for day traders, investors and stock pickers. It is the core design of DeFi that, as an end-user, you can be both a borrower and lender earning interests. The company behind the exchange provides or controls the liquidity.

To buy Bitcoin with eToro, you will need to register for an account and verify your identity. From there, it is simply a matter of depositing funds into your account and choosing PayPal as your preferred method.

The Case Of The Missing Crypto Queen

By that analogy, if the ETH/USDT cross margin account is liquidated, Tom will lose the total 20 USDT in the cross margin account. Trading in cross margin mode is like putting all the property in a safe, and family members who hold the key have the right to withdraw money. If grandpa takes away some money, the money in the safe will decrease accordingly. If grandpa spends all the money alone, the other family members will have no money to spend. Plus500SG Pte Ltd holds a capital markets services license from the Monetary Authority of Singapore for dealing in capital markets products (License No. CMS ). Open a Buy or Sell position based on your anticipation of Bitcoin’s price movement. If you wish to ensure that your trade closes at the exact rate you have set without the risk of slippage, you can place a ‘Guaranteed Stop’.