Content

The purchase of real/cryptoassets is an unregulated service and is not covered by any specific European or UK regulatory framework . You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

You will get the latest and the best existing Blissz custom firmware for Antminer L3 v1. Make Offer – 6 Hours Ethereum 0. Due to the difference between different monitors, the picture may not reflect the actual color of the item. You are buying amining contract, not a physical miner.

Bakkt Launch Date Gets Backed Up, Now Targeting January

The tentative launch date for the exchange that was set for January 24 has been delayed indefinitely due to the firm’s reliance on government agencies for approval and the US government shutdown. At best, Bakkt could launch in the first quarter of 2019. The U.S. Securities and Exchange Commission has delayed its final decision on a physical bitcoin exchange-traded fund until late September. There are a total of nine proposed bitcoin ETFs currently under review and the SEC is expected to provide final decisions within the next two months. A SEC-regulated Bitcoin or cryptocurrency ETF is seen by many as essential to providing institutional investors with access to the market and so enabling liquidity and driving mainstream adoption.

If successful this could set the template for dozens of other companies to tokenise their corporate equity issuances in the regulated environment. The report notes “It is important to ensure that English courts and law remain a competitive choice for business. Therefore, there is a compelling case for a Law Commission scoping study to review the current English legal framework as it applies to smart contracts”. We share this view in relation to the jurisdictions in which we operate and continue to actively engage with local stakeholders to ensure that the relevant laws are sufficiently certain and flexible to enable the use of smart contracts. Notes issued on a private blockchain have been listed on The International Stock Exchange in what is understood to be the first such listing on a regulated exchange.

Bis Statement On Crypto

“The importance of [our contract’s] differentiator is only amplified by reports of significant manipulative spot market activity, and other concerns such as inconsistent anti-money-laundering policies and weak compliance controls,” she added. However, cash settlement exposes derivatives users to risks, especially when the reference price used to calculate the settlement amounts might be manipulated. In late June, for example, BitMEX reported a record trading day of over $13bn in bitcoin derivatives. This website is only for private investors. By using this site, you agree to use the content for private use only. VPC Specialty Lending Investments PLC (Company No. ) is a UK listed investment trust focused on asset-backed lending to emerging and established businesses with the goal of building long-term, sustainable income generation.

Compatible Currency see all. Mining Contracts for Dogecoin. Our warehouse is located in Yiwu, the largest small commodities market in China. Make Offer – 4 Hours Ethereum-classic 0.

This includes problems with Bakkt, a trading platform for institutional investors, which has seen “lower than expected” trading volumes since its launch on Monday. In recent months, the substantial increase in the daily volume of bitcoin and the rest of the cryptocurrency market has led analysts to suggest that the overall trading activity in the market is rising. But Bakkt is focusing more on opportunities than risks. The exchange says that the addition of physically settled derivatives will play a significant role in the deepening of the bitcoin market by attracting more institutional investors. From September 23, Bakkt will offer daily and monthly bitcoin futures, both involving physical settlement of the underlying cryptocurrency.

After years of relatively low volumes of tech IPOs, the first half of 2019 suggests a record year of fundraising. Analysis shows that US tech IPOs alone have raised a combined $17bn (on track to exceed the previous full year record of $22.5bn in 2000). Flotations by household name tech behemoths such as Uber ($8.1bn) and Pinterest ($1.4bn) have contributed to this groundswell.

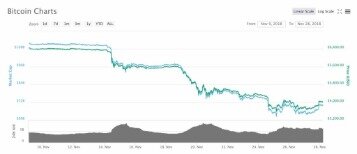

The $4,300 level could be crucial in the near-term because as one cryptocurrency trader explained, there are a relatively large number of short contracts stacked up in the $4,200 to $4,300 range. While some stated that the minimal impact on the bitcoin price despite the large movements of alternative cryptocurrencies show a small inflow of capital into the crypto market, the general sentiment regarding the asset class has improved. It is important that you understand that with investments, your capital is at risk. Past performance is not a guide to future performance. It is your responsibility to ensure that you make an informed decision about whether or not to invest with us. If you are still unsure if investing is right for you, please seek independent advice.

eToro is the world’s leading social trading platform, offering a wide array of tools to invest in the capital markets. Create a portfolio with cryptocurrencies, stocks, commodities, ETFs and more. Additionally, the existence of these hedging tools makes it just a little bit more likely that risk-averse investors, such as pension funds, might finally join in the crypto game. Bakkt was meant to launch it last year, but regulatory hurdles, overrunning work and too much investor interest delayed its plans. Now the hype has been building and building up to the launch, and market watchers foresee a spike in the Bitcoin price as a result. ICE has selected its former vice president to serve as interim CEO at its digital assets trading and payments platform, Bakkt.

Dex Giant Sushiswap Launches On Avalanche

You should consider whether you understand how CFDs, or any of our other products work, and whether you can afford to take the high risk of losing your money. The value of your investments can go down as well as up. Losses can exceed deposits on some margin products. Professional clients can lose more than they deposit. CEO and blockchain entrepreneur Jihan Wu is set to step to down from the world’s largest cryptocurrency mining manufacturer, Bitmain. The transition is said to have started in December, although Wu and the other co-CEO will remain on the board as co-chairs. The new CEO will be director of product engineering Haichao Wang.

Embarrassingly, the US Commodity Futures Trading Commission , the country’s main regulator of derivatives markets, said immediately that the LedgerX platform had not yet been approved, contradicting the company’s claims. The products and services described here may not be available in all jurisdictions and to all persons. No information set out above constitutes advice, an advertisement, an invitation, an offer or a solicitation, to buy or sell any crypto currency. Trade only after you have acknowledged and accepted the risks. There have been attempts to launch Bitcoin futures before, with CME – a big ICE rival – having a go at the end of 2017. They have not been the success many had hoped, but Bakkt seems to think it has the answer.

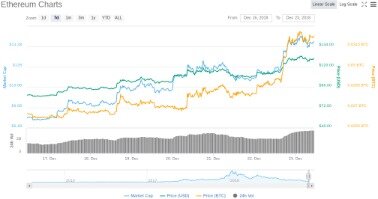

Now the market is waiting for the Ethereum developer meeting on Friday to find out the new date for the upgrade. This upgrade was hailed as one of the least controversial even though it includes a reduction in inflation from three to two ether per block. A shorter delay should help support price in the near term. “Today, we’re helping institutions, consumers, policy makers and regulators engage in this emerging market through a trusted, secure and compliant platform,” Loeffler added. “We believe that this expedited self-certification process for these novel products does not align with the potential risks that underlie their trading and should be reviewed,” Lukken said. But some market observers continue to worry about the financial stability of CCPs, which have gained ‘super-systemic’ status since the 2008 financial crisis. Concerns over the safety of custodied bitcoin were widely cited as the main reason for earlier delays in Bakkt’s launch plans.

These marketplaces allow traders to buy and sell stocks, bonds, futures and other types of securities. The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service.

- A SEC-regulated Bitcoin or cryptocurrency ETF is seen by many as essential to providing institutional investors with access to the market and so enabling liquidity and driving mainstream adoption.

- From September 23, Bakkt will offer daily and monthly bitcoin futures, both involving physical settlement of the underlying cryptocurrency.

- One of the ideas behind Bakkt is to make crypto something people use every day, rather than see them just as an investment or something to trade.

- By using this site, you agree to use the content for private use only.

- We share this view in relation to the jurisdictions in which we operate and continue to actively engage with local stakeholders to ensure that the relevant laws are sufficiently certain and flexible to enable the use of smart contracts.

At $125m, Bakkt’s insurance policy also covers less than the amount of bitcoin recently involved in futures trades on the CME. This may have reflected the difficulties of moving money around the world to iron out price discrepancies on those exchanges, rather than overt manipulation.

All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. In June, CME’s cash-settled bitcoin futures recorded a record open interest of 5,391 contracts , equivalent to a market value of over $270m. first announced plans for its cryptocurrency platform in August last year, drawing on support from non-financial organisations, including Microsoft and Starbucks, to launch a federally-regulated market and warehouse for digital assets. ICE first announced plans for its cryptocurrency platform in August last year, drawing on support from non-financial organisations, including Microsoft and Starbucks, to launch a federally-regulated market and warehouse for digital assets. Analysts are blaming a “a number of technical issues” for the crash, the Independent reports.

Bitcoin values are in a state of “chaos” after prices plummeted by almost £1,000 in the space of an hour. It looks like you’re accessing XTB UK from outside of the United Kingdom. XTB Limited is authorised and regulated by the UK Financial Conduct Authority with its registered and trading office at Level 9, One Canada Square, Canary Wharf, E14 5AA, London, United Kingdom . This content has been created by X-Trade Brokers Dom Maklerski S.A. This service is provided by X-Trade Brokers Dom Maklerski S.A. X-Trade Brokers Dom Maklerski S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M /2005 and is supervised by Polish Supervision Authority.

Sato Wallet supports Strong Hands. Can hold every coin based on Ethereum ERC Not specified. This very solid system was built at the end of and has Never had one problem! After I receive the information, I will start mining as soon as possible on your pool.

Completing the CAPTCHA proves you are a human and gives you temporary access to the web property.