Content

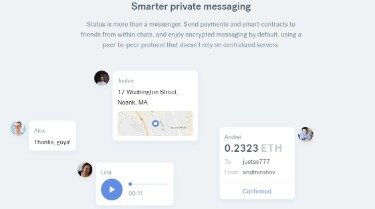

When people talk about trading Ethereum, what they are actually talking about is trading ‘Ether’ – a tradable token designed to fuel the Ethereum ecosystem. Ethereum has the potential to be an incredibly disruptive technology because it allows smart contracts to be written into the code on the blockchain. For example, it can be used to record banking transactions, legal contracts, and property deeds. This means that it has applications across a wide range of industries including financial services, law, and real estate.

To store and use your cryptocurrency you’ll usually need a specialised ‘wallet’ which will have its own unique digital address, allowing you to send and receive cryptocurrencies. So, if you’re looking to buy or invest in Bitcoin or other types of cryptocurrency, you’ll have limited legal protection and a high risk of losing some or all of your capital. Bitcoin is probably the most well-known cryptocurrency but they come in many forms which include Ethereum, Ripple, Litecoin and Bitcoin Cash. These are all types of digital or virtual currency collectively known as cryptocurrencies. The prognosis is quite futuristic but still, it may prove true. In the last 12 months the cryptocurrency market capitalization increased almost fourfold, reaching $764 billion. The total value of all altcoins apart from bitcoin appreciated from $60 billion to $225 billion – by more than 270%.

Why Do People Buy Bitcoins And Cryptocurrencies?

In recent years, interest in cryptoassets such as Bitcoin, Ethereum, and XRP has grown exponentially. A major development in financial technology, crypto has the potential to completely revolutionise the financial services industry. One of the major issues with cryptocurrency scams is identifying the true beneficiary of the money that has been paid. In modern cryptocurrency systems, a user’s “wallet”, or account address, has a public key, while the private key is known only to the owner and is used to sign transactions. Fund transfers are completed with minimal processing fees, allowing users to avoid the fees charged by banks for wire transfers. Although crypto wallets are not completely anonymous, tracing the true recipient is difficult.

Given cryptocurrencies like bitcoin can see their value swing by as much as 15 per cent in 48 hours, it might be sage advice to transfer any gains into something more concrete. Investors can load money onto Revolut from another bank account and exchange up to £1,000 into bitcoin for free. Any bitcoin will be bought and held by Revolut on the investors’ behalf, meaning they won’t actually possess it themselves, but do still have the rights to it, even if they can’t use it to buy anything. And Hong Kong-based Bitfinex charges the same fee, although the account is aimed at higher rollers with investors having to deposit £10,000 at a time and incurring a deposit fee of 0.1 per cent, with a $60 minimum. The same can be said for Bittrex, which charges card and foreign exchange fees, but it also has a similarly low trading cost of 0.2 per cent, or £1 on a £500 trade. Buying the same amount’s worth of bitcoin through Binance would cost £9 with a debit card or nothing with a bank transfer, coupled with a 50p trading fee as it charges just 0.1 per cent on trades of up to 50 bitcoin. As well as that documentation, exchanges may levy a variety of fees depending on the payment method investors opt for.

Saxo Markets assumes no liability for any loss sustained from trading in accordance with a recommendation. Canadian investment company that seeks returns from investing in blockchain technology and cryptocurrencies. Crypto markets are still largely unregulated, making them more prone to market manipulation, and hackers have also managed to gain unauthorised access to digital wallets and cryptocurrency exchanges.

Most importantly, in my opinion, the author goes into heavy detail about the pitfalls, conspiracies, and hazards of investing in the crypto currency market. Making sure to point out what to look for, what to avoid, and how to be relatively safe with your investments in this still-blossoming industry. This is a deep and fascinating exploration into learning how hundreds of thousands of people are making money with digital currency. Mr. Johnson, has skillfully taken the reader through the newly explored waters of decentralized currency investment. One of the best things about day trading is that you can capture a big percentage moves in a very short period of time.

Compare Exchanges

Blockchain groups transactions into ‘blocks’ that are chained together, and uses cryptography to secure and verify all transactions. eToro’s platform is easy to use and offers exposure to a wide range of cryptoassets. You can also gain exposure to cryptoassets through eToro’s CopyPortfolios. Supply and demand can be influenced by many factors including economic developments, media coverage, news in relation to crypto regulation, and investor sentiment. From 12 August 2019, BUY crypto positions with x2 leverage are secured with the real asset. This offering does not apply to clients who are residents of China.

You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. The main risks of trading cryptoassets are volatility risk and leverage risk. On eToro you have the choice of buying cryptoassets outright or trading crypto price movements via CFDs. Not only does the high level of volatility within the crypto market provide plenty of trading opportunities, but you can also trade around the clock, and use leverage to increase your exposure. Cryptoassets are cryptographically-secured digital assets that can be transferred, stored, and traded electronically.

British fund house Ruffer became the City’s first major investment company to buy Bitcoin for DIY investors last year when it added £550m of the digital currency to its funds. There are, however, a number of ways investors can track the value of Bitcoin and other cryptocurrencies via Isas and pensions. It is an idea to test the waters at first and to start off small.

There is no guarantee that cryptoassets can be converted back into cash, which leaves consumers at the mercy of supply and demand in the market. In the last five years alone, the market cap on cryptocurrencies has risen by more than 10,000 percent—an unprecedented leap in the history of investing.

Such risks includes the risk that you may be following/copying the trading decisions of possibly inexperienced/unprofessional traders, or traders whose ultimate purpose or intention, or financial status may differ from yours. Past performance of an eToro Community Member is not a reliable indicator of his future performance. Content on eToro’s social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of eToro – Your Social Investment Network.

We’ll never share your email address and you can unsubscribe at any time. By entering your details, you acknowledge that your information will be used in accordance with our privacy policy.

The price of Bitcoins, on the other hand, has been very volatile. Whilst this has lead to the price rising sharply there have also been very sharp falls; consequently Bitcoins are not for the faint hearted. Currently the biggest downside to Bitcoin is the volatility in its price. The key advantage is being able to store, receive and transfer money outside the traditional banking system. This can offer potential cost savings and, due to the encryption of Bitcoins, could arguably be more secure. Exchange them for another currency – for example Sterling, US Dollars, Euros, etc. via an online Bitcoin exchange.

Bitcoin has reached a new record high after Tesla revealed it had bought $1.5 billion of the cryptocurrency. But while investor interest is surging again, regulatory warnings are getting louder. Consumers have been warned of the possible risks from buying, trading or holding virtual currencies such as Bitcoins by a European financial regulator.

The Market

Inside you will learn everything you ever wanted to know about the technology that powers cryptocurrency and how to tell a Bitcoin from a Litecoin, from an Ether, and why that distinction matters. You will also learn how to choose the most promising contenders for the Next Big Thing and not lose your shirt while taking advantage of the high degree of volatility that the market is currently experiencing. This ultimate real estate blueprint will unlock the keys to the very lucrative real estate market. When it comes to reliable investment opportunities, real estate is one of the most time-tested of all options, having been successfully turning a profit as long as the concept of land ownership has existed. As such, it is one of the core asset types that professionals recommend for any portfolio regardless if the holder is just starting out or simply looking to diversify. Discover the key strategies that professional traders utilize to make a lot of money trading in the stock market.

To ‘mine’ for Bitcoins you use your computer to solve complex calculations which you are then rewarded for with Bitcoins. This might sound a very easy way to make money but unfortunately it’s not as simple as it sounds. Without specialist computer hardware you may find that you’re spending more on your electricity bill powering your PC than you are earning in Bitcoins.

This means that you can potentially profit from both upward price movements and downward price movements. If the price of the cryptoasset rises while you own it, you’ll profit. Unlike most cryptoassets, XRP doesn’t use Blockchain to reach a network-wide consensus for transactions. Instead, an iterative consensus process is implemented, which makes it faster than Bitcoin but also makes it more vulnerable to hackers. Litecoin is a cryptocurrency that was set up in 2011 by Charlie Lee, a former Google employee. It was also created as a result of a hard fork with Bitcoin.

“Stablecoins continue to develop and be the potential solution to the problems of volatility and credibility for cryptoassets. In contrast to cryptos, stablecoins have actual assets behind them, like regular currencies,” he says. However, the cryptocurrency has made steady gains before, such as at the end of 2017 – before collapsing in 2018 . Since 2009, a wide range of challenger cryptocurrencies, dubbed altcoins, have arrived on the scene. Receive regular articles and guides from our experts to help you make smarter financial decisions.

With bitcoin rising in popularity across the United Kingdom, businesses and entrepreneurs are ensuring that they’re open to crypto payments across the board. it is great preparation for when digital money might go fully mainstream in the years coming. In the meantime, do take an in depth look at investing in cryptocurrency, and tread carefully. it’s an exciting, growing marketplace, but one which carries lots of risks. Cryptocurrencies are digital ways for people to make money and to exchange assets online; however, there has been lots of negative press coverage of the topic which isn’t helping the reason behind this new type of currency. Investing in cryptocurrency is one among many options for investing your money today.

- Secure online services that allow you to convert money back and forth between conventional currencies and various cryptos are beginning to pop up, and merchants are beginning to accept Bitcoin as payment for goods and services.

- Cryptocurrencies are only a digital representation of value which isn’t issued or guaranteed by a central bank or public authority.

- Through this, you can learn to spot trends in the price fluctuations of various cryptocurrencies.

- Even seasoned cryptocurrency investors make mistakes sometimes.

- The main advantage of this approach is that you own the cryptoasset outright.

- Launched in 2015, Ethereum is a programmable blockchain technology that enables decentralised blockchain-related applications to be built and run without any downtime, fraud, or interference from a third party.

On January 3, 2021, its value soared above $34,000, meaning the cryptocurrency had gained almost $5,000 in the first few days of 2021. Then on February 9, 2021, its value briefly hit a new record high of $48,000 after electric-car maker Tesla revealed that it had bought $1.5bn of the cryptocurrency and pledged to start accepting it as payment for vehicles. It is important that you understand that with investments, your capital is at risk. It is your responsibility to ensure that you make an informed decision about whether or not to invest with us. If you are still unsure if investing is right for you, please seek independent advice.

Knowing that cryptos are volatile isn’t supposed to stop you from investing in them; it’s supposed to prevent you from mistaking a sudden spike in the market for a sure thing. Instead of pouring your money into every new token that experiences a bump, look for tokens with a long history of appreciating in value. To understand cryptocurrency, you have to understand blockchain. Blockchain is the technology that makes cryptocurrencies secure and anonymous. Basically, blockchain provides a digital record of transactions, and stores copies on multiple devices across a global network whenever the record is updated.