Content

Create a portfolio with cryptocurrencies, stocks, commodities, ETFs and more. To calculate the monthly yield per cryptoasset eToro divides the total number of new coins for the month by the total average daily amount of all eligible staking users. To begin staking, a user needs to purchase and own one or more of the supported cryptoassets. The user then needs to hold the open position of the staked cryptoasset for a certain period of time. Staking with eToro is a process that allows users who own and hold supported cryptoassets to earn rewards – just for holding them. The rewards are more of these cryptoassets, which means that users grow their cryptoasset holdings, using a similar mechanism to the way in which a person can earn interest on money.

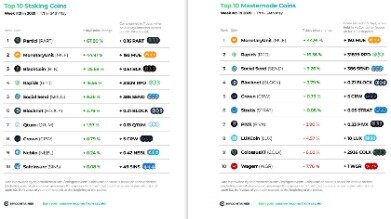

Cryptocurrency staking has rapidly grown in popularity in recent months, as an increasing number of platforms implement staking rewards to help balance the circulating supply, secure the network, and reward users. Where most cryptocurrencies networks are supported by “proof of work”, staking relies on “proof of stake”, allowing blocks to continue to be added without the energy-intensive mining. The price or value of cryptocurrencies can rapidly increase or decrease at any time. Unlike normal money, no bank or government can stabilise the value of cryptocurrency if it changes suddenly. According to POS List and masternodes.online, rewards and earnings for both masternode staking and non-node staking vary significantly between cryptocurrencies, anything from 0.7 percent to well over 1,000 percent. All a network participant has to do is hold the specific cryptocurrency in the network’s dedicated wallet to start earning interest or dividend payouts. eToro is the world’s leading social trading platform, offering a wide array of tools to invest in the capital markets.

We can expect that these companies will launch ETH2 staking products if they have not already. This means maximum TPS improvement over ETH1 is only around 64x at this time, however it’s possible that more shards will be added in the future. Using layer 2 scalability technologies like rollups combined with phase 1, some people are predicting a throughput of 100,000 TPS by the end of 2021, but it is not yet clear when this will be achieved. The only way to get ETH2 tokens for validator collateral is to make a one-way ETH transaction to the deposit contract on the current Ethereum chain, which burns ETH1 and mints ETH2 tokens. (See more info below.) Technically, this generates a new token called BETH which exists only on the Ethereum 2 Beacon Chain, referred to simply as ETH2 in this report. ETH2 brings with it the major improvements of Proof of Stake and sharding.

Masternodes will typically require renting or owning a dedicated server and all the expenditure associated with that. You might be able to stake with any amount, but masternodes sometimes require holdings worth thousands, or even tens of thousands of dollars, to get started.

How To Earn Passive Income With Cryptocurrency

In further testament to the power and success of Ethereum, many of these new blockchains are developing interoperability solutions to Ethereum. It is clear that Ethereum is not going to fade into insignificance any time soon. Remember, all 3rd party validators entail security risk, as delegation is not supported by the base protocol.

Those penalties would, at some point, affect how the staked ether token would trade. Developers use this Platform as a Service network to pay for hosting, and staking users can enjoy the rewards of creating new blocks. These staking coins come into the market in 2018, but users started staking LOOM tokens a year later.

Autofleet, a provider of AI-powered fleet optimization solutions, was selected by Keolis, a public transport operator, to provide its platform for an autonomous electric vehicle project in Gothenburg, Sweden. Shuttle operation began on January 18, 2021 on behalf of local public transport authority Västtrafik. The autonomous shuttle service is the first project in an ongoing collaboration to utilize Autofleet’s platform for management of Keolis’ new mobility solutions. The possibility of long-term gains has also given birth to a number of startups that focus specifically on providing staking services to investors, including Anchorage, Eon Staking Inc., Figment and Staked. Similarly, to apply for masternode status on VeChain , a participant will have to stake 25 million VET ($97,500) to be considered and will have to complete Know Your Customer verification in the VeChain portal. According to Neo’s economic model, the maintainer of a Neo consensus node will be rewarded with network fees. With the advent of large centralized mining pools, the risk of a 51 percent attack on PoW networks is a very real threat.

14th August CoinMarketExpert welcomes Guarda Wallet to our list of staking providers. 18th August Binance launches NEM locked staking product with an estimated APR of up to 2.8%. 18th August Polkadot and Cosmos on-chain staking assets debut on Kraken. 19th August Binance launches DEFI staking product starting with DAI. 20th August BitMax rolls out Serum staking with an estimated APR of 4%. 9th September Lukso launching a 50% APR staking program to celebrate KuCoin’s 3rd anniversary.

Staking Ada Coins

These are often arranged ahead of time and are seen as a way of seeding a new cryptocurrency onto a field of users. Airdropped cryptocurrency will usually be worthless, but can often do quite well for something that’s completely free. There will generally be a maturity period, where you will need to stake your tokens for a certain amount of time before you can start earning rewards. If you’re interested in regular cryptocurrency staking then visit CoinMarketExpert’s best staking coins page to compare the best staking rewards offered by various coins and their providers. The value of these freshly minted tokens is essentially derived through the interplay of supply and demand of the network’s listed-token on a cryptocurrency exchange. Guarda Wallet is a trusted staking wallet that allows you to effortlessly stake popular coins such as Tezos, NEO, Callisto, Cosmos, EOS and NEO directly with a blockchain validator. MyCointainer is a revolutionary Proof-of-Stake staking pool which provides an extremely easy to use ecosystem that allows everyone to take advantage of rewards distributions in the decentralized economy.

Third party stalking services are using smart contracts to prevent staked tokens from being stolen by hackers, but the smart contracts might have their own security vulnerabilities. Several companies, including Darma Capital, are planning to offer intermediated staking that would allow users to continue accessing their capital. Through its LiquidStake initiative, both retail and institutional stakers can delegate their capital and maintain the ability to use it as collateral to receive USD Coin loans. Unlike other staking derivative proposals, LiquidStake will not create new tokens to represent the bonded Ether .

ETH2 staking will have to compete with these other use cases, such as interest paid by DeFi projects. Some people think this may yield a conflict of interest, where if DeFi yields are too good, not enough people will stake their tokens to secure the network. The ETH2 development team is exceptionally talented and are making every effort to ensure security of the protocol. They even formally verified the bytecode of the ETH1 deposit contract. However, like any new software, there may be bugs in the different implementations of ETH2 that may result in part of the 32 ETH deposit being slashed .

The list in the table above includes the flexible and fixed staking coins that are available on Pool-X. To learn more about the difference between fixed, flexible, and soft staking on Pool-X, click here.

Therefore, it’s important to wait for several “confirmations” before being sure that your transaction was successful. Corporations that have significant resources started dominating the ASIC industry and deploying development and research. The chips become already outdated by the time they reach the retail market.

Lyfcoin Amazing Staking Capabilities

But let’s briefly break this down starting from first-principle. In the context of cryptocurrency, the term “staking” has the same meaning. Its crypto origins come from the term proof-of-stake, which is a consensus algorithm that is supported by a cluster of nodes that purchase a stake(through buying pre-mined tokens) in a particular network. The point here is that nodes play an important stakeholder role in supporting the growth and prosperity of a particular network.

The next time your friends ask for a great investment idea, share this article with them. Staking crypto coins is a great investment option for crypto users. It makes it easier to earn high-interest rates on your savings, and you can conveniently, securely convert fiat currency into digital currencies. Staking coins utilize a special, more user-friendly blockchain consensus for mining cryptocurrencies called Proof of Stake. In this article, we take a look at five of the best staking coins in 2020 you need to check out.

Even the best of best investors experience an extended period of loss. Having an alternative source of income is one of the ways to survive those loses. You can increase your cryptocurrency holdings by other ways than just investing and trading. These methods can give you an ongoing income akin to earning interest. Also, these ways only require some efforts to set up and maintain. Investing or trading in projects is among some ways of making money in the blockchain industry. Nonetheless, it generally requires a substantial time investment and detailed research and still doesn’t assure a reliable income source.

- This, in turn, lowers the probability of being selected to validate the next transaction and also dilutes the price of all the tokens traded on the secondary market.

- Chinese e-commerce platform Dmall E-commerce Co has hired Bank of America, Goldman Sachs and JPMorgan for a U.S. initial public offering of over $500 million, three people with direct knowledge told Reuters.

- The miners earn 60 percent of block rewards, and DCR holders can obtain voting tickets for all open network proposals.

- And the largest airdrop in crypto history – a $125 million giveaway – is still ongoing as of February 2019 and it only requires you to download the Blockchain.com wallet.

Once phase 1 comes along and rollups move to eth2 sharded chains for their data storage, we go up to a theoretical max of ~ TPS. ETH2 is built for Ethereum and at this point, ETH2 becomes Ethereum. This is the moment of grand success as we anchor Ethereum fully into its new reality.

Each 32 ETH2 requires another validator instance to be configured and deployed, although these instances can share resources. Those with less than this amount, or those that are not technically able or willing to run their own node, will need to lend their tokens to a pool , a process called delegation. Unfortunately, ETH2 is pure proof of stake, without delegation, a mechanism which allows a token holder to safely delegate tokens to a 3rd party for staking. Since delegation is not implemented by the protocol and must be added by 3rd party smart contracts, this results in additional security risks and high commissions. It is worth noting that ETH2 has been designed to support hundreds of thousands of validators, far more than other blockchains, and an exceptional amount of decentralization.

Voting service providers charge about five percent of rewards for staking on behalf of users. The tool you use to freeze your tokens will automatically predict your rewards every week. Users stand to gain significantly by staking NOW tokens, yielding high interests, weekly rewards, and demanding little principal investments. Now, without further ado, let’s review the best staking coins in 2020 worth your time and fiscal investment. Staking is an innovation that allows users to reap maximum gains from their digital investments. Users can earn passively when their nodes validate and add blocks to blockchain networks. The following cryptocurrencies have buybacks and token burns as a feature.

Afterward, they need to connect their wallets to the LOOM Basechain Wallet for staking. It supports Solidarity dApps running on side chains of the crypto network. This platform allows different application developers to personalize their consensus-building mechanisms. Users can earn ten percent annual interest, 5.46% staking on StakingRewards.com, or eight percent on Binance. Algorand facilitates 1,000 transactions per second, attracting them because of easy user experiences. It transcends bordered economies and bypasses the need for financial regulators and other third-parties. ALGOs are great staking coins because of the low transaction costs involved.

11th March Near Protocol locked staking product launches on Binance today. 14th March Binance US has been added to our list of staking providers.

These tokens are actually a proportion of the newly minted tokens in the network. Essentially, in a Proof of Stake consensus mechanism, nodes participating in the forging process of a particular blockchain network will be required to purchase pre-mined tokens as a stake. In laymen terms, staking is the process of keeping funds in a cryptocurrency wallet to help the underlyingproof-of-stakeblockchain network operate more efficiently and securely. NOW tokens may be staked by performing a ‘Freeze’ transaction. From the moment of the transaction confirmation, the amount of tokens that you have sent is staked and you can begin earning rewards.

If this is of interest to you then check out our list of the best stablecoin savings accounts, where it is possible to achieve an APR above 15% . We are also tracking the best bitcoin savings accounts, with yields of up to 10.20% currently attainable. 11th August Waves Protocol joins Pool-X Soft Staking platform with an expected staking APR of 4%-7%. 29th October Binance Staking has rolled out the second batch of “Super Rewards”, today so you can stake EOS, DASH and ARPA to earn an APR of up to 25.49%. 31st December DOT Staking and $10,000 Prize Pool Campaign launched on KuCoin’s Pool-X platform.

PoW relies on the proof that a certain amount of work has been done to verify transactions. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. If money is removed from the position, thereby increasing the leveraged value, the eligible staking amount decreases immediately. Dave is a Diamond club member, so he gets 90% of the staking yield. The average daily amount is the basic amount on which the calculations are made to get the individual user’s monthly reward.