Content

“Stablecoins continue to develop and be the potential solution to the problems of volatility and credibility for cryptoassets. In contrast to cryptos, stablecoins have actual assets behind them, like regular currencies,” he says.

- However, cryptocurrency ETFs allow you to track multiple digital coins and tokens all at once, saving you a whole lot of time and hassle.

- Please don’t interpret the order in which products appear on our Site as any endorsement or recommendation from us.

- If you are wondering whether digital currencies like bitcoin and ethereum are a wise asset group to invest your money in, this article will come in handy.

His work has been published in numerous reputable industry publications. Francisco holds various Cryptocurrencies but has no bias in his writing. Verge, it’s worth noting, suffered multiple exploits over the years, so much so the price of XVG was mostly unaffected by the news. Finally, the Swiss canton of Zug started accepting both BTC and ETH for tax payments.

This further underlines the point that while many of the companies in the index are developing blockchain uses, their prices are driven by other factors. Over the course of 2020, the ETF returned in sterling terms around 15%. Not bad, but way behind the Invesco ETF. Largely this is because the company has had no exposure to the sort of bitcoin-related high-flyers found in the Invesco ETF. American multinational semiconductor company based in Santa Clara. Develops computer processors and related technologies that are integral to mining cryptocurrencies.

Where Does That Leave Bitcoin?

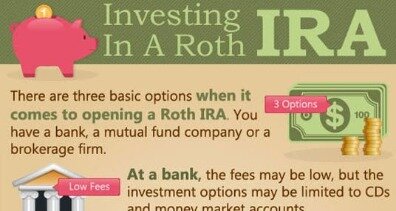

BTC enables investors to gain access and exposure to the price movement of bitcoin in the form of a traditional security without buying, storing and safekeeping bitcoin directly. BTC’s purpose is to hold bitcoins, which are digital assets that are created and transmitted through the operations of the peer-to-peer bitcoin network, a decentralized network of computers that operates on cryptographic protocols. The investment objective of BTC is for the shares to reflect the value of the bitcoins held by BTC, determined by reference to the bitcoin index price, less the BTC’s expenses and other liabilities. The activities of BTC include issuing baskets in exchange for bitcoins transferred to the BTC as consideration in connection with the creations. There are a few ways to get exposure to cryptocurrency with existing investment funds. For example, Ruffer Investment Company, an investment trust, announced in December 2020 that it had allocated 2.5% of its portfolio to bitcoin.

While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products. Please don’t interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don’t provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Finder.com provides guides and information on a range of products and services. Because our content is not financial advice, we suggest talking with a professional before you make any decision. Wondering what leveraged ETFs are and whether it’s worth investing in them?

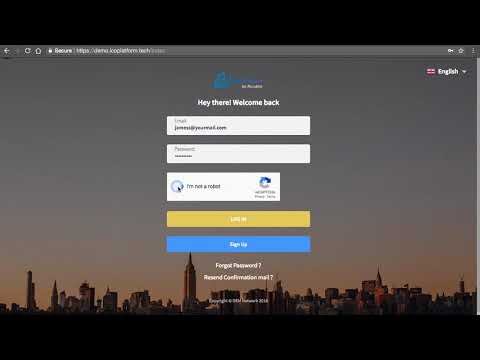

Other ways to buy include the digital currency app Ziglu and on the investment platform eToro. Unlike direct investment in Bitcoin, investors do not need to go through the challenges of setting up a cryptocurrency wallet or trading on unregulated cryptocurrency exchanges. Millions of investors’ existing brokerages or banks are already set up for trading ETFs, so this means no additional steps are necessary to start trading Bitcoin through ETFs. So it is clear that the ETF certainly has plenty of bitcoin and cryptocurrency exposure. However, it is still by no means a bitcoin or cryptocurrency “pure play”.

Rapid City in America has some of the craziest weather in the world – a bit like how volatile crypto prices can beIf you do invest, be prepared to lose some or all of your money. The value of your investment may fall as well as rise and you may get back less than your initial investment. With Spread bets and CFDs your losses may exceed your deposits. Just like other investment in currencies, buying Bitcoin in anticipation of an upward movement in price requires research from investors on the fundamental value of the currency. This analysis can be harder to make for Bitcoin as it is not used as a mainstream means of payment or linked to a specific economy.

Sonnenshein said Grayscale was “of the belief that a bitcoin ETF would be something that would be well received by the investment community.” The company – which runs the $37 billion Grayscale Bitcoin Trust – recently posted a number of ETF-related job adverts. It sparked speculation that Grayscale could be about to file for an exchange-traded fund, although it has not yet done so. Grayscale is interested in filing for a US bitcoin ETF if regulators give the green light, its chief executive says. Grayscale’s CEO said the firm would be interested in filing for a bitcoin ETF. The $37 billion Grayscale Bitcoin Trust is currently the world’s biggest crypto fund. Michael Sonnenshein said he thought it is a matter of “when, not if” the US approved a bitcoin ETF.

Under no circumstances should you make your investment decision on the basis of the information provided here. In this investment guide you will find all physically backed ETNs that allow you to invest in bitcoin. Bitcoin is the oldest cryptocurrency and has been used since 2009.

Bitcoin Etfs

The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on the purchase of such products. When choosing a Bitcoin ETF or ETN one should consider several other factors in addition to the methodology of the underlying index and performance of an ETF. For better comparison, you will find a list of all Bitcoin ETFs/ETNs with details on size, cost, age, income, domicile and replication method ranked by fund size.

In some cases, we may provide links where you may, if you choose, purchase a product from a regulated provider with whom we have a commercial relationship. If you do purchase a product using a link, we will receive a payment.

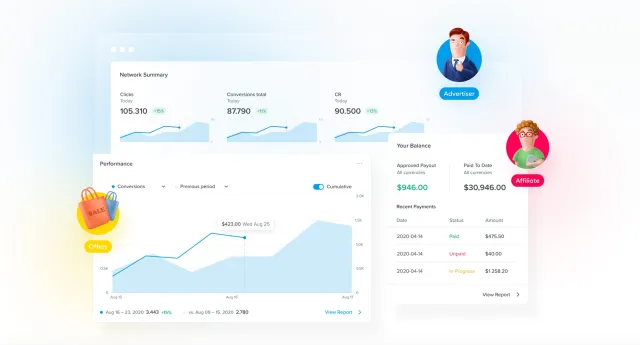

ETF units can be bought and sold on securities exchange markets, but brokerage fees apply. Just like shares traded on an exchange, the price of an ETF fluctuates throughout the day as investors buy and sell units. You purchase units or shares in the ETF, which owns a collection of cryptocurrencies. If the value of the digital coins owned by the ETF rises, the value of your investment unit also increases.

Interest In Cryptocurrencies Has Surged Recently As Prices Have Risen, But What Are The Risks And Costs Of Buying Bitcoin?

It said Bitcoin was a tool to diversify the funds and act as a hedge against low interest rates. Times Money Mentor has been created by The Times and The Sunday Times with the aim of empowering our readers to make better financial decisions for themselves. We do this by giving you the tools and information you need to understand the options available.

ETFs make it simple to gain exposure to digital currencies without going through the hassle of owning any coins. However, with exchanges like Huobi Pro and OKEx now launching their own index funds, you may need to register for an account on the relevant crypto exchange in order to trade these funds.

Which one you choose to go with will depend on which features you are looking for. The electric car-maker’s SEC filing shows it has bought up to $1.5 billion of the leading cryptocurrency in January, and may be investing in more. Cryptocurrencies are famous for their volatility and can experience substantial price fluctuations in a short space of time. If the market moves against you, the value of your crypto ETF units could take a sharp dive. Cryptocurrency exchanges and wallets are susceptible to hacking attacks and theft. Buying units in a crypto ETF protects you against these risks as you don’t actually own any digital coins. Learning how to buy and store cryptocurrency can be a confusing and daunting process.

In 2018, MPs called cryptocurrencies a “Wild West industry”Extreme volatility is perhaps the most defining factor of the cryptocurrency market. To put bitcoin prices into investment profit and loss terminology, if you had invested at the start of 2020, you would be sitting on a 300% profit by the end of the year. However, if you’d invested at the start of 2018 and sold at the end of the year on New Year’s Eve, you would have lost 73% of your money as the bitcoin price collapsed. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider.

In the UK, most ETFs are “passive” investments – this means they track the value of an underlying asset or index. Meanwhile, active ETFs are those where the fund manager is actively trying to outperform the market or achieve an objective other than tracking a particular index. The U.S. Securities and Exchange Commission is a federal government agency responsible for protecting investors and promoting fairness in the United States’ securities markets. It also has the responsibility of approving ETFs to be listed for trade on US stock exchanges. The SEC is yet to approve any crypto ETFs and has rejected several applications in the past, but it has delayed making a decision on the latest round of proposed crypto ETFs until September 2018. Traditional ETFs often include an extensive range of securities to help achieve diversification of risk. However, the earliest versions of crypto ETFs only provide access to a limited range of digital currencies.

One Bitcoin ETN share provides exposure to approximately 1/20th of a Bitcoin, while one Ether ETN share provides exposure to approximately 1/10th of Ether. Grayscale made a push to convert GBTC into an exchange-traded fund in 2017, but voluntarily pulled out of the process.

As both the ETF and index’s literature make clear, companies deemed to have the potential to participate in the “blockchain ecosystem”, but that do not have any direct involvement with bitcoin or cryptocurrencies, are also included. But while the ETF’s name suggests its focus is on blockchain companies, the ETF tracks the Elwood Blockchain Global Equity Index. The index’s literature makes it clear that companies explicitly involved with cryptocurrencies are also included. For example, the index describes itself as giving exposure to “listed companies that participate or have the potential to participate in the blockchain or cryptocurrency ecosystem”. It is important that you understand that with investments, your capital is at risk. It is your responsibility to ensure that you make an informed decision about whether or not to invest with us.

The information and commentaries are not intended to be and do not constitute financial, investment or trading advice or advice of any sort offered, recommended or endorsed by SCML. You can buy and sell ETNs just like stocks, without needing to own the physical cryptocurrency or open an exchange account.

Additional Key Information Documents are available in our trading platform. Visit the Support Centre to find answers for our most frequently asked questions. If you are still unable to locate an answer to your question, you will also find contact details for your local Saxo office to speak with a representative. Accepts Bitcoin and owns Medici Ventures, its blockchain subsidiary. The ETNs own the underlying physical coins and aren’t traded on leverage, which would amplify your risk. Through our Classic account, we offer you access to two Exchange Traded Notes that track the movement of Bitcoin and Ethereum against the USD (BTC/USD and ETH/USD). The information published on this website is accurate to the best of our knowledge.

Bitcoin is “mined” by computers solving complex calculations which get gradually harder over time. There are currently 18.5m Bitcoins in circulation and the final ones are expected to be mined in 2140, meaning that there is still plenty of time for companies involved in the process to make a lot of money. Bitcoin is nearing an all-time high on the news that major companies, such as Tesla, Mastercard and JP Morgan, are embracing the digital currency and a wave of mass adoption could be around the corner. However, the cryptocurrency has made steady gains before, such as at the end of 2017 – before collapsing in 2018 . Since 2009, a wide range of challenger cryptocurrencies, dubbed altcoins, have arrived on the scene. Please note this article does not constitute investment advice. Investors are encouraged to do their own research beforehand or consult a professional advisor.

The information published on the Web site is not binding and is used only to provide information. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information.