Content

He talked about a friend of his, a university professor earning 2.5 million bolivars per month. Nowadays, that’s enough for about one kilo of meat or a dozen eggs per month. Julian said even the wealthy are now restricted to what their ID cards say they can and cannot buy. “You can only buy products at protected prices on a particular day of the week. Years ago, if I went to the supermarket looking to buy chicken on a Thursday but they ran out, I had to wait a week to try to buy chicken again,” said Gomez. Venezuelans now must scan their Fatherland Cards to receive government benefits including subsidized food, medicine, and cash bonuses.

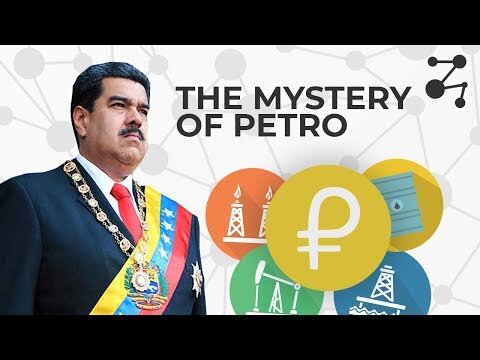

There are also fears that the creation of petro is little more than a desperate bid to raise money, and that it will quickly lose much of its value, leaving investors out of pocket. However, Venezuela’s opposition-led parliament considers petro’s IPO to be “a forward sale of Venezuelan oil,” and “tailor-made for corruption”. The government of the crisis-hit country says it was created in order to help overcome financial sanctions imposed by the US and the EU. “We now have the first-ever state-sponsored cryptocurrency. But it’s not exactly time to celebrate,” crypto expert Juan Villaverde said in a blog post for the financial rating agency. Within a month of launching, US President Donald Trump signed an executive order that banned Americans from investing in the cryptocurrency. Cryptocurrencies are also notoriously volatile in price, with bitcoin fluctuating in value between $5,000 and $20,000 since last December. The currency overhaul will also be supplemented by a massive increase for the minimum wage, higher corporate tax rates, and increased subsidies for gas prices.

Send’s private presale is closed; the company sold 43.4 million SDT tokens and raised $4 million USD. The public presale begins this month with 26.6 million more available tokens, and the resulting token supply will help determine the network’s starting consensus price. The network will officially launch once it hits $100,000 in accumulated transactions.

Ms Morden says the petro cryptocurrency and the Savings in Gold programme are a distraction. According to statistics website Coin Dance, the weekly trade of bitcoins in bolivars grew 58-fold since the beginning of this year, as people searched for new ways to store value amidst growing inflation. “The government says each unit of the petro is backed by oil,” says Mr Tapscott. “But we have no proof at all. There is very little technical information about it.”

Can Gdpr Pull Blockchain Out Of The Tech Shadows?

Choosing cryptocurrencies such as bitcoin in Venezuela over the bolivar is just another survival strategy. Venezuela is a powder keg for the duality of this still-young technology. The government has embraced cryptocurrency as an answer to hyperinflation and sanctions, exerting centralized control over how it’s used to ensure the Petro’s supremacy. At the same time, the Venezuelan people endure crackdowns and persevere, seizing upon the crypto’s decentralized nature to hold onto a shred of control over their own money.

Robert Greenfield of ConsenSys agrees that stablecoins or semi-stable coins like Send might hold the most promise as crypto solutions for starving economies like Venezuela’s. “Stablecoins can start to enable more frictionless remittances in the way people were promising when Bitcoin came out 10 years ago that really didn’t materialize,” he said. “It needs to be a way not just to get bolivars into people’s hands but to bypass the need to use bolivars in the first place.”

Venezuela’s economic crisis has triggered mass immigration to neighboring Colombia and other nearby countries. For those still living under the Maduro regime, often the only way to get by is to find creative means to skirt the government’s strict economic policies, which selectively control the country’s food supply for political ends. For the moment, Camacho is acting as the superintendent of crypto in Venezuela.

Agriculture minister Freddy Bernal said people had become emotionally attached to the rabbits and were keeping them as pets. Last year, the government announced a pilot programme to distribute rabbits to the population, extolling the virtues of its meat. Earlier this month, the government launched its Savings in Gold programme, allowing Venezuelans to buy certificates that entitle them to 1.5g or 2.5g gold bars. The country claims to have the world’s fourth largest gold mine, although currently Venezuela is not even in the top ten list of gold producing nations. For years, Venezuela has been in the headlines for its economic woes, including chronic shortages of food and medicine.

Here’s why we’re unlikely to see a state-backed cryptocurrency anytime soon and why Venezuela is the last place you’d expect it to work. The government has allowed Petro use within the local stores via biometric apps, but the number of people who were flocking the stores was so high that these transactions have called off. This situation got even worse not only due to the “bumpy” adoption of Petro but also because President Mauro ordered 1 million oil barrels to kept on hold. At the same time, the government announced the change in payment policy. President of Venezuela, Mauro, said that he had ordered 100 million Petros with the proper sustenance of Venezuelan oil wealth. Venezuela’s economy depends on crude oil, and the country exports large quantities of it every year. “At every turn, Maduro’s government has demonstrated its partisanship, its corruption, its lack of transparency and its willingness to manipulate fiscal, currency and monetary policy.

“When your political capital is weakened borrowing from countries like Russia and China, you risk giving over your sovereignty or being put into a coup situation,” he continued. “The white paper doesn’t explain how the token works within a broader system; it doesn’t talk about the crypto economics, or the distribution and scalability of ownership across a population that’s more or less starving,” said Greenfield. “They’re using oil as a physical asset but don’t explain the economic policies around how that’s going to be tracked. You almost know for certain that it’s fraud.” “The government has changed where the assets are based multiple times,” said Robert Greenfield, the global social-impact technical lead at ConsenSys, a blockchain software company that builds decentralized apps and services on Ethereum.

Tesla Buys $1 5 Billion In Bitcoin, Boosting Price

Raising billions of dollars in capital through Petro sales gives the authoritarian government an out. “Venezuela has a longstanding tradition of taking over people’s Bitcoin miners and essentially siphoning any type of value that comes from it,” he said. The white paper briefly mentions the use of pre-mined ERC-20 tokens and Ethereum-based smart contracts. But the Maduro government sowed confusion soon after the white paper’s release by announcing an abrupt switch to the NEM Mosaics blockchain platform instead. Independent research institution Brookings concluded not only that the Petro circumvents sanctions, but went as far as saying it undermines other cryptocurrencies by centralizing and manipulating a technology meant to be decentralized. Venezuelans have good reason to be skeptical of cryptocurrency as a blanket answer to the nation’s myriad problems. “We know the government will keep trying to block it; to shut us down. But once people are familiar with this platform, it’s going to be a way to be free.”

“Venezuela will create a new cryptocurrency,” Maduro told his live studio audience during the five-hour broadcast, which also included Christmas songs and dancing. The petro would help Venezuela “advance in issues of monetary sovereignty, financial transactions and overcome the financial blockade,” he said. Venezuela’s existing currency, the bolívar, is rapidly dropping in value, reducing the monthly minimum wage to just over $4.30 and plunging millions of Venezuelans into poverty. But Venezuelan president Nicolás Mauro thinks that a new digital currency could revive the country from economic collapse and help it sidestep US sanctions.

The Venezuelan government says petro holders will be able to exchange it for goods and services, similar to bitcoin. However, many people consider bitcoin to be more of an asset than a currency, because it can be much harder to spend than traditional money. The president of Venezuela has announced a radical economic reform that will see the country’s currency tied to the government’s own petro cryptocurrency.

“We are focusing on Venezuela because if we can use blockchain and digital money to solve the people’s needs in this country, we can scale the protocol worldwide.” “The challenge with any crypto project, especially any kind of currency or electronic unit of value, is that you need a lot of people to believe in the same idea for it to take off,” said Torrenegra. “People are afraid their money’s going to be worth less tomorrow, so they buy dollars.” The platform can now connect users’ accounts to banks, online wallets including PayPal and Venmo, gift cards, cash networks such as Western Union, and of course, cryptocurrencies; it has a recent partnership with Zcash. AirTM gives users a cloud-based dollar account to deposit and withdraw local currency, send and receive payments, and save money by transferring funds from local bank accounts. Blockchain technology gives Venezuelans a way to exchange and store value, free of transaction fees and government exchange-rate manipulation.

Bitcoin V Bolivar: Can Cryptos Save Venezuela?

Stable Coins development could also be of help for the general population in economic and/or political uncertain countries. If the fiat money is converted into Stable Coins it will ensure that the value of money is preserved.

This puts him in charge of the small nation’s native digital currency, the oil-backed Petro. As mentioned, any information that leads to his arrest or conviction will be rewarded with $5 million, according to the ICE announcement. In the long term, with more Stable Coins from various other currencies being made available, exchanges could become more liquid, enabling greater efficiency in the crypto ecosystem. Risks for companies dealing with cryptocurrency to fiat gateways will also be reduced as they no longer need to worry about banking relationships and can instead just focus on maintaining a cryptocurrency wallet. To improve the user experience, money transfer companies should be encouraged to start integrating cash to crypto features in their respective locations. Overall, consumers will benefit the most from this increase in competition with more options in providers and more locations to conduct their exchanges locally. Cross-border payments and converting cryptocurrency to cash should be made more convenient for users across the world.

Venezuelan cryptocurrency usage spiked in 2016 and 2017, when inflation began to worsen dramatically. But the uptick coincided with last year’s Bitcoin price frenzy and wild price fluctuations throughout the market. Venezuelans are already petrified of their money losing value overnight.

2venezuela Pegs Bolivar To Cryptocurrency To Save Country From Ruin

Right now, local cryptocurrency dealers are offering petro at half rates. Even the Venezuelan population is fed up with Petro and wants it removed. Throughout history, people in certain places have undergone a process which economists like to call the “discovery of advantages of backwardness”.

The main goal that Stable Coins strive to create is an optimal currency in terms of price stability, scalability, privacy, decentralization and redeem ability. Stable Coins promise many of the same benefits as other cryptocurrencies – like cheap transactions and rapid settlement – without the price volatility typically found in the crypto markets. Through that combination, Stable Coins could satisfy the demand for high-quality fiat currencies in parts of the world with limited access to the global financial system. Crypto backed coins are considered transparent because transactions are recorded on the public blockchain with full transparency and accountability. They are efficient in the sense that conversion from one crypto to another is quick as it occurs on the blockchain. This volatile nature is one of greatest criticisms directed towards the crypto market.

He suspects the numbers can be chalked up to money laundering, or could be outright fabrication to drum up investor interest. Maduro claimed the presale raised $735 million in one day and a total of $5 billion on more than 186,000 certified Petro purchases over a period of approximately three weeks. At the time, there were only 4.2 million tokens transacted, which would mean buyers accepted a price point of $173.80 per token — the highest token presale price in history.

- “We now have the first-ever state-sponsored cryptocurrency. But it’s not exactly time to celebrate,” crypto expert Juan Villaverde said in a blog post for the financial rating agency.

- Maduro has ordered government services, the tourism industry, airlines, and border gas stations to start accepting cryptocurrencies.

- If you’d bought a coffee using bitcoin at the beginning of this year, the café would now be selling that coffee at a tenth of its previous bitcoin price if it wanted to keep things the same in real terms.

- The Chamber of Deputies, which is dominated by his governing Colorado Party, voted 42 to 36 to reject impeachment.

Greenfield said he’s been working on a guide for how to spot fraud in crypto white papers, and the Petro exhibits telltale signs. The startup’s grassroots campaign aims to expand Send’s network both by convincing local businesses to accept SDT as currency and by recruiting local “WeSend agents” to do the exchanges from SDT to bolivars. “AirTM is a platform where people who have dollars can sell them to people who want them freely, without restrictions. It caught on like wildfire because people were desperate to get dollars,” said Galindo. ” it was already considered hyperinflation. The first dollar we allowed people to exchange was worth 490 bolivars. Now it’s worth two million bolivars or well above it.”

The NEM Foundation released a statement confirming the Venezuelan government’s intent to use NEM’s blockchain but also stressed that the Foundation has no direct involvement in the Petro’s development. It’s also unclear how exactly the asset is tied to oil, particularly in light of Maduro’s latest proclamation that the Petro will also be anchored to the physical Bolivar Soberano currency. In reality, the Petro is a means for the cash-starved government to bypass international sanctions without providing much tangible benefit to its struggling people.

In the cryptocurrency world, very few trust any official information released about the petro so far. The point of an ICO is to raise funds to create a new digital asset, such as a cryptocurrency. Some of them are attractive because the high volatility in their exchange rates can produce great returns.

They take techniques that have worked well in more advanced parts of the world and apply them in less developed regions. The changes they introduce make those techniques work so well that a region, which was once the periphery, becomes a centre in its own right. In Venezuela, fintech, and more specifically cryptocurrency, is increasingly popular. This will ensure that the buyer always has a return value adjusted to the value of his investment. “The most important contribution of petro to the cryptoassets’ market and the new digital economy will be the support offered by a sovereign state,” reads the website for petro. The Venezuelan government is officially launching the pre-sale of the cryptocurrency today.

“Through ICOs, cryptocurrencies have shown that start-ups have been able to circumvent traditional finance and fundraising by reaching a global audience through technology and pitching their ideas directly. President Maduro has also promised there will be almost 100 million coins available, to the value of $6billion. The cryptocurrency has since dropped to $11,000, suggesting President Maduro may have missed the crypto boat. The announcement of the creation of the new crypto token was made at the end of 2017, as bitcoin hit record highs of $20,000. But embattled President Nicolas Maduro believes he has a cunning plan to fix his nation’s woes by hopping on the back of the bitcoin bandwagon and creating his very own virtual currency. Crime rates have soared, the nationalized oil industry continues to collapse, and power and internet outages have grown more frequent, and often last for multiple hours a day. The value starts with international transfers and asset conversion protected from hyperinflation, but ultimately, he said, you still run into the crypto-to-cash problem.