Content

Established financial institutions such as Fidelity are also beginning to offer bitcoin custody services. The supply of bitcoin is capped at 21 million and its issuance schedule is hard coded and completely uncorrelated. Crachilov argues that changing demand makes it a powerful hedge against currency debasement and inflation.

Bitfinex has partnered with Market Synergy to offer institutional standard cryptocurrency connectivity. HFT firms seeking exposure to crypto can obtain secure connectivity via a FIX feed or ISP link to Bitfinex’s digital asset gateway.

You can use expert tools for coding without any prior knowledge. Quadency has about 12 crypto bots that can be tweaked according to your liking. Simple automated trading software is only available with the free account, while you can get more if you purchase one of their pro or unlimited plans starting from as low as 39.00$ a month. Since its foundation in 2009, ROFX has provided exceptional services to its customers through its automatic trading software. There are no risks involved in investing alongside the EA as the company covered all the losses. With their packages, you can get nearly 10% a month on your initial investment value or more than 100% ROI within a year. Bitcoin is available as a funding option where the minimum cash-in value is at 0.05.

Cryptocurrency Litecoin Arbitrage Trading Binance Software

Make sure to read full our full Terms of Use & Risk Disclosure. Sticking to your trading plan is important but perhaps even more paramount is that you stay ahead-of-the-curve with what’s happening throughout the world.

Spread scalping is the same idea, but with the same broker. Some crypto brokers ban this practice, so make sure your broker allows it if you’re considering this approach. It is a EU regulated custodial exchange as a service that provides a quick and straightforward way to buy and sell bitcoin as well as other top cryptocurrencies. It offers quick user verification and numerous payment options that make it simple, accessible, and easy to use even for beginners. If you’ve already absorbed the key lessons necessary to trade crypto, see the table below.

With triangular arbitrage, a trader tries to find situations where a currency is overvalued in relation to one currency and undervalued relative to another. In practice, however, markets are never 100% efficient all the time due to the prevalence of asymmetrical information between the buyers and sellers within the market. An example of this inefficiency is when a seller’s asking price for an asset is lower than a buyer’s bid price. This situation is known as a “negative spread”, and is one of the main reasons for the appearance of arbitrage opportunities. When a trader uses arbitrage, they are essentially buying a cheaper asset and selling it at a higher price in a different market, thereby taking a profit without any net cash flow.

- Rebalancing, cost averaging, auto-tracking, trade execution, etc., are some of the services under highlight.

- Unfortunately, the South Korean Government eventually caught on and later went on to entirely ban cryptocurrencies, therefore eliminating any more trade exploits.

- ArbiTrade Bot is an automized solution doing arbitrage trading on cryptocurrencies.

- Kloda is a macroeconomist and algorithmic trader with research expertise in arbitrage in high volatility markets.

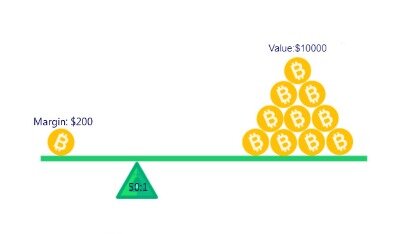

Leveraged trading can maximise profits, which makes it a viable option for more experienced investors. The problem is that leveraged crypto trading can also quickly produce huge losses, particularly in volatile markets such as cryptocurrencies. For this reason, we don’t recommend that beginner investors trade with leverage. As with most things in the universe of trading arbitrage is neither good, nor bad. In some cases, you might even call it good since it maintains the efficient market by removing outliers. Others claim arbitrage is bad because it takes advantage of situations that shouldn’t exist, or that may exist by mistake. At the end of the day traders are out there to make profits, and if they can do so by working with any imbalances that occur then that is simply part of the market process.

You might not have the time to execute everything to perfection. A crypto arbitrage strategy starts by identifying crypto traded on at least two exchanges. It’s possible to arbitrate on a single exchange, however a little challenging. The bot simultaneously buys and sells the same amount of bitcoins from two different exchanges.

How Can You Choose The Best Crypto Bot?

Choose a broker that has a reliable, easy-to-use app, and you can complete your mobile crypto trades quickly and simply. This is the flip side of a buy order, where you’re either cashing in your crypto trade to make a profit, or to cut your losses.

The volatile nature of cryptos means the prices keep shifting. This leaves a short window where you can buy it at a lower price and sell it at a higher rate. You can’t trade cryptocurrency directly from your PayPal account, but it is accepted as a payment method on some brokers and exchanges. The way it would work is, if it’s a broker or exchange that accepts PayPal for funding purposes, you could use your PayPal account to make deposits into either your brokerage or exchange account. Check out our PayPal guide to see which brokers and other services allow you to use PayPal to fund your crypto trading account.

Experienced traders, especially those who know how to spot an opportunity when they see one often have significant levels of success. While it might be easy to take advantage of a 20% margin between a buying price and a selling price, it’s only reasonable to find out whether or not the effort of completing a transaction will be worthwhile. Cross-border arbitrage can be much harder due to KYC regulations. Regulations are often stringent and traders can only transact upon providing a valid government-issued ID or other documentation to prove their identity.

Challenges Of Manual Arbitrage Trading

When compared to other investment industries like Forex, Stocks, or commodities, cryptocurrencies tend to exploit more market inefficiencies as a result of being unregulated and newer. Quasi-Automation Arbitrage – Identifies arbitrage trade opportunities and alerts traders through semi-automated scripts, trades are not automatically executed. When compared to other forms of investment, cryptocurrency trading can be categorized as a relatively new method of investing.

“Set it and forget it” is the motto of such automated software. These bots trade using technical terms such as indicators and signals. The strategies utilized by this automated software also differ technically, and they do not require any download. As a hub for HFT in crypto, Bitfinex is providing a host of proximity hosting services to meet this growing demand.

Manual Crypto Arbitrage – Manual trade management and input on trades. The Weston Hospicecare will provide acknowledgments to donors meeting tax requirements for property received by the charity as a gift. However, except for gifts of cash and publicly traded securities, no value shall be ascribed to any receipt or other form of substantiation of a gift received by Weston Hospicecare. The Weston Hospicecare will accept donations of cash or publicly traded securities.

However, before deciding to participate in Foreign Exchange trading, you should carefully consider your investment objectives, level of experience and risk appetite. Keeping this in mind, never invest more money than you can risk losing. The risks involved in trading may not be suitable for all investors. ECS doesn’t retain responsibility for any trading losses you might face as a result of using the data hosted on this site. ECS does not gain or lose profits based on your trading results and operates as an educational company. Elite CurrenSea is a trading name operating in the interest of SonderSpot OU, Nenad Kerkez & Chris Svorcik.

If you’re a beginner in the crypto space who wants to make money trading crypto, using a CFD broker means you won’t have to go through the process of buying and holding actual coins. This is because CFDs allow you to trade cryptocurrency assets against the value of cryptocurrencies without literally buying them. Wallet– A crypto wallet is a digital device, program, or service which stores the keys used to receive, spend, and track ownership of cryptocurrencies, including Bitcoin. Having your own wallet provides a more secure platform for your Bitcoin than just leaving it in the custody of an exchange.

Before trading cryptocurrencies online make sure you investigate and perform background checks into the legitimacy of exchanges. Within the financial markets, arbitrage trade opportunities are more than plentiful since the emergence and wide-scale adoption of over-the-counter trading.

Once you’ve chosen an exchange that suits your goals, the next step is to set up an account. You’ll need to provide contact information, verify your identity, and set up a method of deposit. We discuss the different deposit methods you can use below. They specialize in selling bitcoins for credit card to nearly anyone in the world. It offers a wide range of payment methods and has good prices.

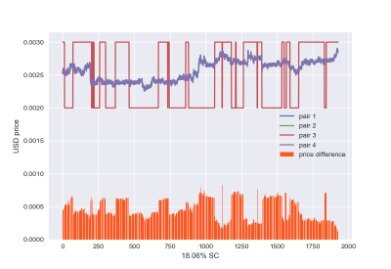

Automated crypto arbitrage has skyrocketed in terms of demand and application. While the price of BTC climbs from $11,500 to $12,500 on Exchange A, less trade volume is met on Exchange B causing the price of BTC to climb on Exchange B from $11,510 to $12,400. While Broker B sees less trading volume, there is a slackened demand or surge in the price of Bitcoin on Broker B due to decreased demand-pull. The influx of buyers with Broker A leads to a surge in BTC prices on that platform.