Content

Then the digital currency you’re looking to invest in may only be using internal exchanges that aren’t open to everyone and therefore not transparent – if this is the case then you should be questioning your purchase. And again if the ICO window is short, for instance lasts no longer than days, then it’s best to steer clear to avoid trouble. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

One of the reasons for the popularity of ICOs is the ease of the whole process. It’s important to ensure online security protocols when using ICO. The best way to keep safe is to do due diligence before investing. The only way to follow is by investing what you are willing to lose.

Tim Enneking, managing director of a digital currency hedge fund that invests in ICOs, has provided more specific guidance on the matter. He maintains that investors should look for teams that not only have a strong track record, but that have built up experience in the market they are looking to target. There are many entrepreneurs who claim that their project will change the world. By fostering a healthy scepticism, investors can avoid putting their hard-earned money in to startups that have not fully fleshed out their ideas. Because there is an abundance of these token sales, and many of them do not succeed, picking out the right ones can be daunting. Fortunately, a wide range of investors, analysts and market experts have weighed in on the subject, providing best practices for evaluating ICOs.

The pandemic has locked people down and brought technology to the fore. Interaction via a virtual space is now the norm and this is normalising the virtual environment. The following year, a small-scale frenzy brought venture capital led investments to prominence. Back in 2017, when bitcoin was riding high on a wave of euphoria, initial coin offerings were along for the ride. Anyone and everyone were talking crypto, and then the boom and bust was over in a flash.

The graph below (source cryptocompare.com) shows the performance of EOS versus bitcoin since its ICO on July 26th, 2017. Soon after EOS started trading on Bitfinex, its price rose through the roof. As the ICO market matures, it is likely to become much more heavily regulated. But for now, you need to do your own regulation to sniff out the scams. The ICO investment screening process I described above can help with this – although there are no guarantees.

Cryptocurrencies have a limited supply due to controlled circulation, which enables the eventual actualization of theoretical limits. In comparison to other financing methods, ICOs offer both significant advantages and certain disadvantages for both firms and investors, concerning risk and reward potential. IPOs dilute existing shareholder ownership and may offer dividends to investors, while debt financing entails guaranteed principal repayment to investors. In contrast, ICOs can be perceived as sales of the expectations outlined in white papers issued by firm founders. The issuer believes that the cryptocurrency purchased by investors will become more valuable as demand increases due to more consumers seeking to use it in online activities and transactions. However, these benefits, including convenience and minimal obligatory financial risks enjoyed by companies, do not come without the added risks and disadvantages to investors. While government instruments like U.S BitLicenses exist, their contexts have been “extremely broad, wide-reaching, and extraterritorial” (Swan, 2015, p. 87).

Blockchain, Cryptocurrency, And Ico

Due to this lack of regulatory oversight, all it took was a simple marketing campaign and false white paper claims to engineer a scam which essentially robbed investors of their money. Organizations like OneCoin, on the other hand, prove that traditional financial crime models such as Ponzi schemes could be reintroduced under the guise of ICOs, and it would be even more difficult for investors to discover the true nature of such entities individually. In summary, information asymmetry is a key disadvantage to investors hoping to invest in ICOs. Therefore, evaluations of ICO projects should be carried out to minimize the risks of investors through elimination of such asymmetry, and synchronized regulatory oversight appears to be the ideal outcome to facilitate a fairer transaction process. Another country, in contrast, is China, which has famously or infamously banned ICOs since it realized the threats of inflating tokens, fraudulent funding schemes and possible market bubbles, while without the appropriate regulatory tools to solve the problem . This approach chosen by the Chinese government is to solely focus on pure blockchain applications, while waiting for other governments to experiment with the token regulations first .

- The employees of FXCM commit to acting in the clients’ best interests and represent their views without misleading, deceiving, or otherwise impairing the clients’ ability to make informed investment decisions.

- Those who believe in the cryptocurrency ecosystem are also more likely to invest.

- It is essentially a crowdfunding measure and involves creating a new cryptocurrency which acts as a token, the purchase of which is then used to fund the development of a project.

- If the blogger knows that his/her content is valuable, then he/she can directly monetize their content for cryptocurrencies for giving full access to matter to the concerned reader.

- As I already mentioned look out for where they’re registered, is it a remote, far flung tax haven, if so what are they hiding exactly?

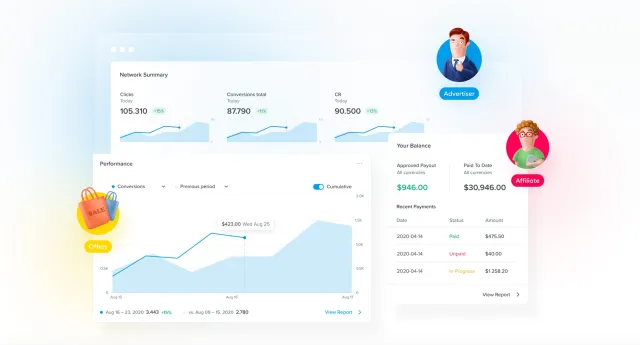

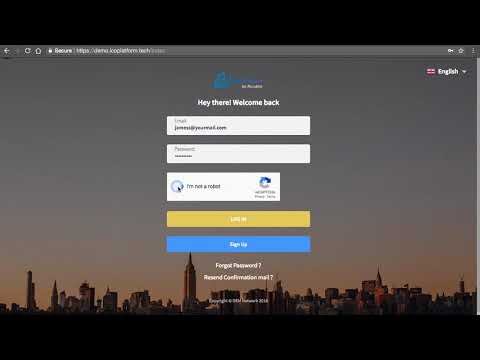

Capital.com is known for having an easy-to-use, intuitive interface platform that is available on desktop, IOS and Android. All that is needed to join the cryptocurrency world is a smartphone.

Truths And Falsehoods Of Blockchain

No matter how much research you do, there is still a chance the ICO could tank miserably, meaning you could lose most if not all of your investment. It might sound silly, but a good name can add huge hype to an ICO and a cryptocurrency. Neo, Next, Ethereum, Stratis, Golem and Waves all have great names and their ICOs did rather well. The whitepaper, website or both should explain the business model and give a detailed timeline of upcoming project targets. ICOs are a thinly regulated way for companies to raise millions from unsuspecting investors.

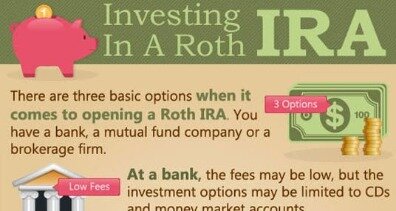

Entrepreneurs have used these offerings to raise money by issuing digital tokens. Initial Coin Offering is currently the top rising means to raise funds by companies. Companies are starting up use cryptocurrencies to raise funds. They sell investors tokens of the crypto and, in turn, gain a stake. Investing in bitcoin and cryptocurrency in general is not much different from investing in stocks. With cryptocurrency, you need to open an account with an exchange.

The blockchain is a distributed ledger system that was designed to be both decentralised and immutable, and it provides the foundation for the majority of digital currencies. Whitepapers frequently contain many important details on a project. This document will likely include the idea behind the project, the underlying technology and also how the token sale will work. The details surrounding sales of digital tokens are frequently complicated, and may require the more in-depth nature provided by a whitepaper to explain.

In third position come the family offices, organisations dedicated to managing the wealth of one or more families. They are used to investing in products on the traditional financial markets but for some time now a few have been in the cryptocurrency market. Many are in Switzerland, for example, but a few French family offices are involved too. The second sub-category concerns non-specialist funds that have begun to invest in cryptocurrencies and ICOs in recent months. In the United States, for example, we have funds like Sequoia Capital and Andreessen Horowitz which have all invested in recent months in various projects which have issued major ICOs.

Understanding And Investing In Icos (initial Coin Offerings)

As the name suggests, stablecoin is essentially cryptocurrencies without the price volatility, as stablecoins are often portrayed as being pegged to some certain legal currencies, such as the US dollar. While some are optimistic that this new type of cryptocurrency would be the savior of this seeming trembling sector, others have been critical about this product. The reason behind such critical views reside in how stablecoins are created, and there are three primary forms. The market has responded to the fundamental conflicts discussed previously in many ways since the early stages of ICO. One significant trend is the separation between projects of pure blockchain application and those involving tokens. While the regulation paradox has caused much uncertainty in approaches different governments around the world take, countries have been quite in synchronization on their enthusiasm about the technological application. For instance, the financial technology sector has been eager to explore how blockchain could transform the financial infrastructures, improve their efficiencies and lower the costs.

Cryptos like Bitcoin are only partially anonymous—they require a registered Bitcoin address, but this address does not have to be connected to a legal name or physical location. Bitcoins are stored in digital wallets, which can be accessed by anyone with the required code. Many other cryptocurrencies adopt this model, and certain tokens even offer complete anonymity for users. To understand cryptocurrency, you have to understand blockchain. Blockchain is the technology that makes cryptocurrencies secure and anonymous.

In the case of ICOs, investors are expecting the cryptocurrency or token they receive to go up in price as the project develops into a working product. While investing in an ICO can be very profitable, there is also a lot of risk involved, as with investing in all start up companies which is essentially what an ICO is. Therefore, it is vitally important to know how to choose a proper ICO and how to avoid scams and weak projects. In order to read or download cryptocurrency investing bible the ultimate guide about blockchain mining trading ico ethereum platform exchanges top cryptocurrencies for investing and perfect strategies to make money pdf ebook, you need to create a FREE account. In order to read or download cryptocurrency investing bible the ultimate guide about blockchain mining trading ico ethereum platform exchanges top cryptocurrencies for investing and perfect strategies to make money ebook, you need to create a FREE account. To investors, this specific case also raises questions about cryptocurrencies themselves. Most legitimate cryptocurrencies today are tied directly with certain cloud applications, in which they are used primarily as transaction media.

On the back of the rise of cryptocurrencies, initial coin offerings have become an attractive means of fundraising, especially over the last year. The emergent phenomenon of ICOs could prove a viable alternative to venture debt or equity financing.

As virtual currencies started to become increasingly popular, the US Senate asked several agencies about their existing regulations and upcoming plans regarding cryptocurrencies. The Department of Homeland Security , Federal Reserve, and SEC were among the agencies that the Senate reached out to . The DHS responded by immediately declaring cryptocurrencies as not only a threat, but also a way for criminal organizations to take advantage of the anonymity and ease of transferring money.

All you need to get started is a bitcoin wallet or crypto wallet. intelligenthq.com is a digital innovation business network that provides intelligence, education for professionals, businesses, startups and universities. intelligenthq.com is a platform about business insights, tech, 4IR, digital transformation and growth, executive education and change through the social media for businesses – both startups and corporations. IntelligentHQ is working hard, to become a trusted, and indispensable source of business news and analytics, within financial services and its associated supply chains and ecosystems. IntelligentHQ leverages innovation and scale of social digital technology, analytics, news and distribution to create an unparalleled, full digital medium and social business network spectrum. IntelligentHQ is a Business network and an expert source for finance, capital markets and intelligence for thousands of global business professionals, startups, and companies. You should always know and understand what you’re investing in, which is why you should read the whitepaper or at least a summary of it.

The major problem with this form of stablecoins is that it requires some central organization to process all transactions, which is against the principle of decentralization. Meanwhile, since the first money used as collaterals cannot be reinvested by the collateral holders, it would cause significant wastes of capital. The second form of stable coin uses cryptocurrency as the collateral, meaning that investors would deposit some amount of cryptocurrency assets into a smart-contract account to receive some quantity of stable coins. However, due to the fact that cryptocurrencies are volatile, this type of stablecoins is often “overcollateralized,” which means the ratio between received stablecoin to the deposited crypto-collateral can be incredibly low.

How To Invest In A Cryptocurrency Initial Coin Offering And Stay Safe

In comparison, blockchain startups raised only US$1 billion from venture capital firms. Trade your opinion of the world’s largest markets with low spreads and enhanced execution. Even though most people relate the success with the crypto boom, there’s more to it. The different countries are still working to come with regulations. They don’t have records an investor can use to understand the company’s performance. As a new development, blockchain technology is yet to become mainstream.