Content

When people talk about trading Ethereum, what they are actually talking about is trading ‘Ether’ – a tradable token designed to fuel the Ethereum ecosystem. Ethereum has the potential to be an incredibly disruptive technology because it allows smart contracts to be written into the code on the blockchain. For example, it can be used to record banking transactions, legal contracts, and property deeds. This means that it has applications across a wide range of industries including financial services, law, and real estate. Bitcoin was the first cryptoasset to be launched and remains the world’s largest cryptoasset by market capitalisation today. This is the technology that many popular cryptoassets are based on.

There are a few ways to get exposure to cryptocurrency with existing investment funds. For example, Ruffer Investment Company, an investment trust, announced in December 2020 that it had allocated 2.5% of its portfolio to bitcoin. Its top 10 holdings include Taiwan Semiconductor Manufacturing and Samsung. The concept of digital monies such as bitcoin that people send online is not that complicated in itself — after all, transferring money from one online bank account to another is doing exactly that.

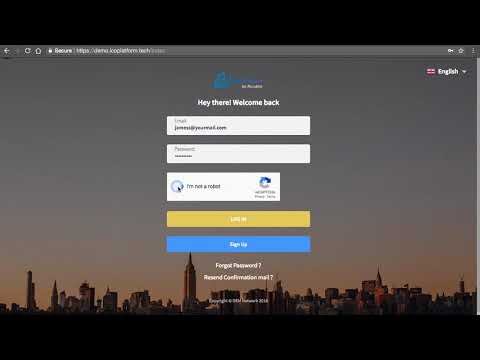

Generally, the more you want to buy, the more paperwork you have to fill in. I’ve also found that in many cases it’s easier to set up an account on your smartphone than it is on your computer, especially with Binance and Crypto.com. One of the major issues with cryptocurrency scams is identifying the true beneficiary of the money that has been paid. In modern cryptocurrency systems, a user’s “wallet”, or account address, has a public key, while the private key is known only to the owner and is used to sign transactions. Fund transfers are completed with minimal processing fees, allowing users to avoid the fees charged by banks for wire transfers. Although crypto wallets are not completely anonymous, tracing the true recipient is difficult. Criminals can use services which hide their IP addresses to prevent their browsing history from being traced and use multiple wallets.

- The price of cryptocurrencies is volatile; some can go bust, others could be scams, and occasionally one may increase in value and produce a return for investors.

- It was recently awarded an operational licence by the Financial Conduct Authority, and is regulated by the New York State Department of Financial Services.

- At the same time, the partial anonymity of cryptocurrency transactions is often used in relation to fraudulent scams.

All Bitcoin transactions are recorded on the blockchain ledger and must be verified, which makes them traceable and highly secure. It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website. A comprehensive list of all Cryptocurrencies available on Investing.com. View market cap, volume, last and change % for each Cryptocurrency – including top Cryptocurrencies such as Bitcoin, Ethereum, LiteCoin and more.

What Is Bitcoin And How Does It Work?

Watch cryptos carefully over the coming year—big things could be on the horizon. Investing in cryptocurrencies can be shockingly lucrative, but the potential pitfalls should cause investors to tread carefully.

As such, transactions that rely on blockchain are practically immune to fraud—they can always be verified multiple times over. Like any other high-income instruments, cryptos are associated with high risk although potential dividend rates muffle “the voice of doubt and fear” in the investors’ minds. Rapid City in America has some of the craziest weather in the world – a bit like how volatile crypto prices can beIf you do invest, be prepared to lose some or all of your money. Investing in anything always comes with risk meaning you can always lose money but the big disadvantage of cryptocurrencies is its extreme volatility. There have also been reports that people have had to wait to get their cash out because of technical snarl-ups. There’s a certain amount of mystery around bitcoin and other cryptocurrencies. Satoshi Nakamoto is the pseudonym used by the presumed person or people who developed bitcoin, created and deployed bitcoin’s original implementation software and conceived the first blockchain database.

Cryptocurrencies are no longer the inaccessible trading grounds of tech-insiders, offering real investment possibilities to real people. Having settled on a trading strategy, you will need to define your ‘close’ conditions – i.e. the point that you will exit a trade.

Gemini, founded by the Winklevoss brothers , is a digital exchange that allows customers to buy, sell and store cryptocurrencies. It was recently awarded an operational licence by the Financial Conduct Authority, and is regulated by the New York State Department of Financial Services. Experts believe recent jumps in the price has been due to a wave of money from both institutional and private investors, spurred on by the coronavirus pandemic. If you are wondering whether digital currencies like bitcoin and ethereum are a wise asset group to invest your money in, this article will come in handy. “Regardless, crypto is volatile, and most retail investors are looking at a medium-term strategy.

Is It Better To Buy Or Trade Cryptocurrencies?

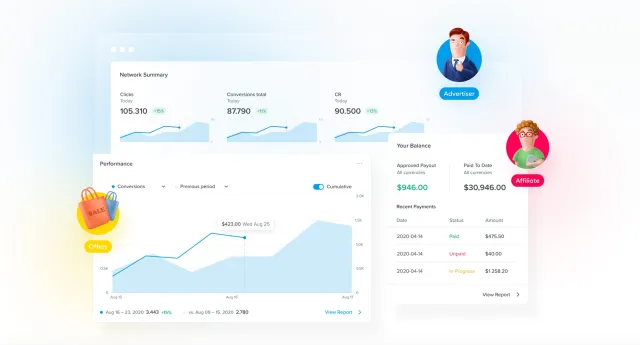

As 2021 begins, the often-volatile market for cryptocurrencies and blockchain stocks has been hot. The corporate acceptance rate is accelerating among leading firms like MasterCard, BlackRock, Bank of NY Mellon and even Tesla, lending increased legitimacy to digital currencies and blockchain platforms. Join SupraFin’s CEO and other CMU alumni leaders in the blockchain field on this online event, titled “What’s Ahead for Cryptocurrencies and Blockchain?. Hence, the SupraFin platform was designed to democratize cutting edge analytics and algorithms to help anyone create and buy a risk-adjusted diversified portfolio with the best cryptocurrencies. And while there are no fees to buy cryptocurrency, how much investors get for their money is affected by a 0.75 per cent spread which eToro charges. This means they will no longer be able to buy into products based on the current or future price of bitcoin, like investment tracker funds which do not hold coins themselves.

innovation professional (tech & fintech), angel investor, and NED. More than 12 years of experience in strategic business development and innovation at HSBC, Barclays Wealth Management, Lloyds Banking Group, Dell EMC, and Oracle. Enterprise and Innovation Board Member at Hertfordshire Local Enterprise Partnership.

Apply Your Strategy By Placing Trades

statistics show that in June and July 2018 people lost more than £2 million to cryptocurrency scams – that’s over £10,000 per person. Mining involves teams of computers solving mathematical problems. When the problem is solved, tokens for whichever cryptocurrency was being worked on are created, for example a bitcoin, and the computer that got the solution gets the new token. A blockchain is a historical record of each transaction verified by each computer in the network. The verification is done after every transaction, for example when a cryptocurrency was sold and which account was credited.

CFDs are financial instruments that enable traders and investors to profit from a security’s price movements without actually owning the underlying security. There are a number of tax advantages to trading over investing. You don’t have to pay capital gains on the profits of trading cryptocurrencies, whereas you do if you profit from buying and selling cryptocurrency direct. In the last five years alone, the market cap on cryptocurrencies has risen by more than 10,000 percent—an unprecedented leap in the history of investing. Knowing that cryptos are volatile isn’t supposed to stop you from investing in them; it’s supposed to prevent you from mistaking a sudden spike in the market for a sure thing.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Any form of investing or trading involves risks and crypto trading is no different. For those interested in a more passive approach to investing in cryptoassets, eToro also offers a range of crypto-focused CopyPortfolios. These are essentially crypto-based investment funds that are managed by eToro’s investment committee. There are literally thousands of different cryptoassets available to traders and investors today. eToro’s platform is easy to use and gives traders the choice of buying cryptoassets outright or trading cryptoasset price movements via Contracts For Difference . To trade cryptoassets, you need an account with a trading platform that offers access to the crypto markets.

These derivatives can magnify the gains and, more importantly, the losses investors incur. From 6 January Britain’s financial regulator will ban the sale of cryptocurrency derivatives to retail customers, over fears that they could cost casual investors massive losses. These trading costs can eat into how much bitcoin someone ends up buying, in the same way that dealing fees on DIY investment platforms can affect how many shares or funds investors end up with. The most common place to purchase bitcoin and other cryptocurrencies is what is known as a cryptocurrency exchange.

The exchange then keeps a record of everyone’s requests – made up of loads of buy and sell orders for different currencies, prices and volumes – in a database called an order book. Ponzi scams usually involve making strong or unrealistic claims about the returns you are able to make by investing in cryptocurrencies. They often have referral programmes to encourage investors to sign up their friends and families. Second, the cryptocurrency marketplace is a target for fraud, so extra caution is needed. Also, many exchanges have been subject to cyberattacks during which people who have left their holdings on these exchanges have lost them. There are literally hundreds of different cryptocurrencies available, and all have different values. Think of them as a type of unregulated digital money although most are not particularly easy to spend, and all carry a high level of risk.

From 3 September 2017, non-leveraged BUY crypto positions are secured with real assets. Any such positions opened before this date were upgraded to real assets on 13 May 2018. For example, if you buy $1,000 worth of Bitcoin CFDs, you will profit if Bitcoin’s price rises, however, you won’t actually own any BTC tokens. When you buy a cryptoasset this way, eToro purchases the tokens on your behalf and registers them in a segregated account under your name.

To make money from investing in cryptos, you’ve got to carry out a deep study on the plain coins. This way, you’ll be more informed about the coins you would like to invest in and understand the utility it contributes to the cryptocurrency world. SupraFin was created when the founders realized the cryptocurrency industry (e.g., Bitcoin, Litecoin, Ethereum, etc.) had great potential. These are platforms, mobile apps and websites which allow investors to purchase bitcoin with government, or fiat, money or with another cryptocurrency. Money held in cryptocurrencies is unprotected and the coins are among the most volatile investments around, buying bitcoin can still be complex and may be difficult for casual investors to get their head around. While traditional financial products have strong consumer protections in place and are overseen by regulators such as the Financial Conduct Authority .

Gordon Ramsay Restaurants Lose Out On £60m Trade Thanks To Covid

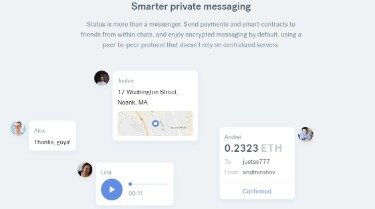

As well as providing secure storage for your cryptoassets, the eToro Wallet allows you to send and receive cryptoassets to and from other wallets, and convert one cryptoasset to another cryptoasset. Ripple was created as an international payment system designed to help banks and financial institutions move large amounts of money around the world. It enables institutions to transfer any currency across the network at a fast speed, with a low cost. This direct-to-bank settlement eliminates intermediate financial institutions and currency exchanges. Bitcoin Cash is a cryptocurrency that was created as a result of a ‘hard fork’ with Bitcoin in December 2017.

The blockchain is the decentralised, infallible ledger that registers all transactions of cryptocurrency – eliminating the need for regulation by region, or involvement from agents or nation states. This is an essential USP of cryptocurrencies as a whole, and what sets them apart from their traditional rivals, known as fiat currencies – like the dollar. Our experts are constantly analysing the latest trends in the cryptocurrency markets. Read the latest features from our team here to help devise the perfect trading strategy.

“Prices last year were positive – bitcoin appreciated 270 percent whilst Ethereum delivered 450 percent growth, and Litecoin 191 percent. “The current banking industry charges a lot of fees, and crypto can achieve transfers faster and at a much lower cost. From 2014 to the beginning of 2018, oil prices didn’t change by more than 10% in one day unlike the value of Bitcoin which changed significantly – rising by 65% in one day and falling by 25% on another.