Content

While price convergence between the forward and the spot market is a sign of a healthy arbitrage market, it should not be interpreted as a sign of a competitive product market. First, in the presence of dominant players and limited participation in the arbitrage market, a forward-market price premium arises. By initially curtailing supply, large firms can flex their market power to drive up prices in the forward market. Since the 1990s, many countries have deregulated their electricity markets. Electricity producers and distributors participate in auctions in forward and spot markets, which determine production allocation and wholesale prices.

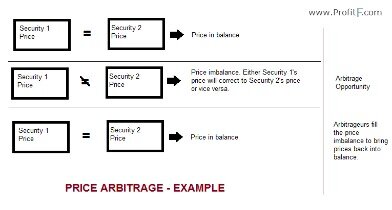

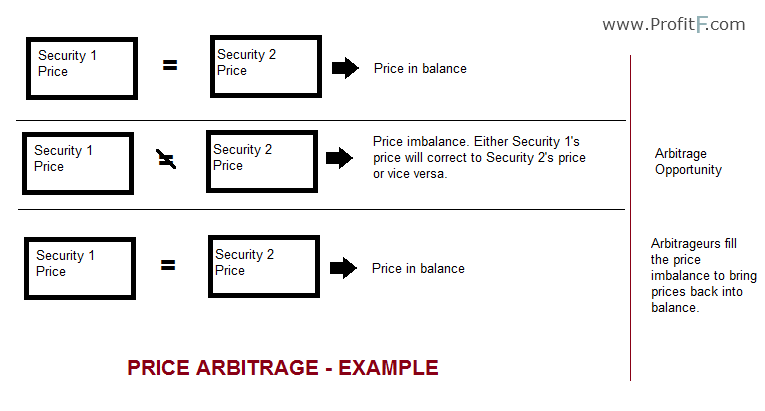

Arbitrage occurs when an investor can make a profit from simultaneously buying and selling a commodity in two different markets. strategies, usually either quasi market making or arbitraging, within very short time horizons.

Day trading 101 – get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips. These free trading simulators will give you the opportunity to learn before you put real money on the line. Arbitrage trading is a worthwhile way to make extra money with crypto.

Elite CurrenSea is a trading name operating in the interest of SonderSpot OU, Nenad Kerkez & Chris Svorcik. Remember that software’s past performance does not ensure future results and you may lose some or all of your invested capital. Increasing their repertoire of cryptocurrencies, Coinsbank supports 10 cryptocurrencies while supporting fiat-crypto trading. Therefore, make sure to take time to conduct research and carefully weigh your options.

For example, if commodities are priced in different currencies on different exchanges, an algorithm may be able to exploit tiny price differences due to the exchange-rate fluctuations. Alternatively, if a commodity is priced in the same currency, even very small price differences can be exploited by selling the over-priced contract and buying the under-priced contract. The Efficient Markets Hypothesis is a piece of economic theory which presumes that financial markets, having access to all the necessary information, will all reach a set level of value for any given asset. In other words, it will be difficult for traders to find differences between the value of a currency in different markets. In simple terms, arbitrage means buying and selling the same currency at the same time, but for different prices in two different markets.

Who Profits From Patents? Rent

If done properly, it is literally possible that a decent amount can be made within a short period of time, and with a plethora of exchanges on the market, there are likely to be price differences. Spatial arbitrage involves capitalizing on different prices for cryptocurrency quoted on two different exchanges. Whereas Exchange X might be offering Bitcoin for $9,500, Exchange Y’s price might be set at $9,750. Even when harsh political and economic conditions are not considered, the imbalances in prices between exchanges can cause favorable conditions for arbitrage. In 2017, Bitcoin prices on one Zimbabwean exchange were nearly double the prices quoted on international platforms — partly because of how affected consumers could not access exchanges outside of the country.

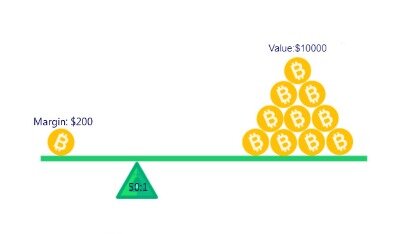

For example, you may see large orders being posted on the bid or ask in an attempt to manipulate the market price, yet these orders are cancelled before they are filled. Margin account – This type account allows you to borrow money from your broker. This will enable you to bolster your potential profits, but also comes with the risk of greater losses and rules to follow. If you want to start day trading with no minimum this isn’t the option for you. Most brokerage firms will insist you lay down a minimum investment before you can start trading on margin.

In matched betting, we look to never arb because it’s bad for your account health and will get you gubbed very quickly. I’m going to explain two techniques in this guide that you can use to leverage arbitrage betting.

Also, the video tutorials on the platform teach you the fundamental concepts lucidly. This significantly helps sharpen your insights into the arena of back betting, ensuring profit without any risk.

Trading Platforms

If you can generate a 20% annual return, this could translate to £10,000 per year or £1,000,000 per year. It’s only a question of how much capital you can use to back each trade. No one can make your financial decisions for you, and no one will share your wins or losses. Ultimately when you’re in a live trading session, staring at the blank end of the graph, wondering which way the candlestick chart bar will move next, you’ll discover how difficult this is. Technical analysis is the application of rigorous analysis to historical pricing or other data to generate a prediction about price movements. With the market moving up or down virtually on a coin flip, even a monkey can be lucky and have some short-term success in the market .

vs Robo-advisors – An increasing number of people are turning to robo-advisors. You simply chose an investing profile, then punch in your degree of risk and time frame for investing. This is normally a long-term investing plan and too slow for daily use. Relative Strength Index – Used to compare gains and losses over a specific period, it will measure the speed and change of the price movements of a security. In other words, it gives an evaluation of the strength of a security’s recent price performance. Day trading tip – this index will help you identify oversold and overbought conditions in the trading of an asset, enabling you to steer clear of potential pitfalls. Hotkeys –These pre-programmed keys allow you to enter and exit trades rapidly, making them ideal if you need to exit a losing position as soon as possible.

- For example, if commodities are priced in different currencies on different exchanges, an algorithm may be able to exploit tiny price differences due to the exchange-rate fluctuations.

- Even though financial traders are not allowed to participate in the Iberian electricity market, some sellers and buyers might arbitrage.

- But unlike the short term trading of the past, today’s traders are smarter and better informed, in part due to trader academies, courses, and resources, including trading apps.

- It’s the salary of a day trader, after deducting trading costs and other fees.

To compare costs and benefits that occur at different points in time, in different currencies, or with different risks, we must put all costs and benefits in common terms. As you can see from the profit column, depending on where you win, you’ll make somewhere between £1.51 and £1.63 in profit from your total investment of £100 (well, technically £99.99). When using two bookmakers to hedge across, we call this ‘dutching’ — rather than ‘backing and laying’ when we have exchange access. Besides comparing odds from over 90 bookmakers and 4 betting exchanges, Oddsmonkey has many other features you can use to improve your betting experience. We’ve shown the example using 2% commission at the exchange, but there are many 0% commission deals allowing you to make more profit than shown.

Take Advantage Of Automated Trading

gained significant market shares in international financial markets in recent years. in today’s financial markets on reliable and thoroughly supervised technology. Some arbitrage trading strategies include two currencies, while others have three. During crises such as the current pandemic, the first to react are the financial markets.

As mentioned above, day traders will often choose a stockbroker which allows them to trade on margin, which is a form of credit. How much capital you begin your day trading journey with is incredibly important. Day trading is a game of percentages, but whether you can earn enough to stay solvent during a period of poor returns, and also support yourself financially, is also a function of the size of your portfolio. It’s great to mix with a group of like minded people – however you will need to be careful and selective. Traders aren’t known for being altruistic, and it’s easy to imagine a trader attempting to take advantage of their peers by encouraging fellow traders to bail them out of bad trades or support shaky ones.

However, if an investor can take advantage of better information or delays in the dissemination of prices, then they can make more profit. Because of the volatility of the forex markets through supply and demand, currency mispricing is evident due to constant changes in currency pairs across global markets.

they typically end the trading day with no carry-over positions that use capital. and contribute to price discovery for the benefit of all market participants.

So, if Vodafone were to rise in value, you would lose your sell bet and win your buy bet, and the gains from the buy bet would offset the loss from the sell bet. Similarly, if Vodafone were to fall in value, your sell bet would net you more than you would lose with the buy bet, due to the price differential. Obviously, this is an extreme example and price differentials are likely to be much less in practice, but it serves to illustrate the point. A spread betting company (‘A’) is quoting a spread of 200 – 205 for the closing price of NOD Electronics on its first day of trading on the stock market. With an increasing number of financial spread betting companies quoting prices, opportunities arise from time to time for arbitraging between them. Arbitraging involves exploiting the difference in asset pricing between two spread betting companies. Arbitrage is the profiting from differences in price when the same security trades on two or more markets.

As shown in Table 1, we use as a benchmark the results for “first best,” namely the outcome from a perfectly competitive market. We then compare this benchmark to a few counterfactual situations. In Ito and Reguant , we address those questions from theoretical and empirical perspectives by examining the Iberian electricity market. Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. Opportunities for arbitrage can occur across almost any asset class, including shares, forex, commodities or derivatives. Stay on top of upcoming market-moving events with our customisable economic calendar.

An example of this inefficiency is when a seller’s asking price for an asset is lower than a buyer’s bid price. This situation is known as a “negative spread”, and is one of the main reasons for the appearance of arbitrage opportunities. When a trader uses arbitrage, they are essentially buying a cheaper asset and selling it at a higher price in a different market, thereby taking a profit without any net cash flow. Some traders choose to use automated trading software, alerts and algorithms to execute their arbitrage strategy.

Fees relate to the standard share dealing account, however AJ Bell also offers a Stocks & Shares ISA and Self Investing Personal Pension . eToro has disrupted the stockbroker industry by providing free stocks & shares trading with zero platform fees. With a minimum trade size of $50, eToro has made it possible for small investors to build a portfolio of shares without incurring commissions. For adventurous traders; eToro also offers CFD trading on cryptocurrencies, indexes and shares.

Will Brexit Affect Your Trading Account?

Arbitrageurs might need to get into the detail of complex financial products to spot an opportunity. Day traders make money from the volatility, the short term ‘noise’, and frankly the carnage of short term price movements. Online trading has made it easier to compare quotes from different providers although arbitrage opportunities are few and far between. Most spread betting involves the underlying market which gives a baseline for the spread betting companies to create their prices, and you are unlikely to find much variation. Bear in mind that you need to make up the spread before you start to profit, so you are looking for price ranges from two different companies that do not overlap in any way. A spread betting arbitrage consists of making an up-bet with one bookmaker, and a down-bet with anothor – the gap in between is the arb’s profit.

Arbitrage is a clever investment strategy which involves making a low-risk profit from the mis-pricing of similar or identical assets sold in different places. When reading quantitative analysis books, the winning trades can look blindingly obvious with the benefit of hindsight. This implies that the current market price has not yet fully reacted and absorbed all information. Day trading positions could be open for just a few seconds or minutes, depending on the nature of the trade. However you may want to decide early on whether to invest in the stock market. Consider our list of the best forex trading books to help you make your mind.

For more info on how we might use your data, see our privacy notice and access policy and privacy webpage. I’d like to receive information from IG Group companies about trading ideas and their products and services via email. Discover how to increase your chances of trading success, with data gleaned from over 100,00 IG accounts. Arbitrage works best for assets that can be instantaneously traded electronically. However, in practice, many physical goods have significant barriers to trade and cost of transactions. In reality, European customers may continue to buy European cars – even if they are €2,000 more expensive than in the US.

More From Financial Expert

Using several methods, they can actually make a profit from the price of an asset falling. Day traders tend to specialise in a particular instrument in a particular financial market, for example, they’ll invest only in gold or they’ll be a bond trader who doesn’t touch the stock market. The Law of One Price states that if equivalent goods or securities trade simultaneously in different competitive markets, they will trade for the same price in each market. This law is equivalent to saying that no arbitrage opportunities should exist. Arbitrage is the process of trading to take advantage of equivalent goods that have different prices in different competitive markets. The time value of money is the difference in value between money today and money in the future. The rate at which we can exchange money today for money in the future by borrowing or investing is the current market interest rate.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

participants‘ trading interests visible to and executable for all other connected traders. In order to read or download sports arbitrage advanced series cross market trading strategies ii pdf ebook, you need to create a FREE account. While learning algorithms are prevalent in many sectors of the economy, the HFT community is split on whether this is beneficial. Traditionally, HFT firms have made money based on defined computations and strategies, often winning small profits with well-defined rule-based strategies. Some other trading platforms will have an API connection, which allows an external program to be connected to the trading software. The API can be programmed to analyse markets or trade according to coded rules. HFT firms are companies that specialise in this form of trading.