Content

Yes, Demo accounts are available to be installed onto the MetaTrader 4 trading platform. In addition, copy trading and Expert Advisors are also available for demo accounts, following any necessary purchase from the MetaTrader Market. Demo accounts can be opened in the MT4 desktop platform, as well as the available MT4 mobile applications.What is paper trading?

- CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.67% of retail investor accounts lose money when trading CFDs with this provider.

- 79% of retail investor accounts lose money when trading CFDs with this provider.

- Also keep in mind some exchanges don’t allow credit cards.

- Demo accounts are funded with simulated money, allowing you to gain trading experience without risking real capital.

AGEA is a regulated forex & CFD broker offering multiple trading platforms and account types. Pepperstone offers CFD trading to both retail and professional traders. Clients can trade FX, indices, commodities and shares on MT4, MT5 and cTrader platforms. Hi, I’m Michael and my area of expertise is forex and cryptocurrency trading.

Global Prime is a multi-regulated trading broker offering 100+ markets. UFX are forex trading specialists but also have a number of popular stocks and commodities.

Bityfinex Launches ‘paper Trading’ Demo Account For Novice Crypto Investors

Although it’s an exciting market with a reputation for making the lucky few substantial profits in a short time frame, it is by no means easy to trade bitcoin, and there’s huge risk involved. Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. German holding company with focus on blockchain and cryptocurrencies.

They are more feature-rich than the newly-established trading platforms of physical crypto companies. You may trade any crypto product you like without regard for what you currently hold in your account.

You can visit one of the mentioned brokers above or any other company that you trust. Once you do that head for their homepage where information about a free demo account should be mentioned. In order to create your first crypto position visit the cryptocurrency section, which might be also sometimes located under the CFD or Forex segment. Once you do that you are free to choose your desired coins and start trading with your imaginary funds. If you lose this capital, nothing happens and you can ask for replenishment or open a new demo. Cryptocurrencies are one of the most attractive choices when it comes to investing or trading. They are rightfully called the investment of the decade and many experts consider them to be the future of the financial system.

PLATFORM GUIDE How to create a watchlist Create and customise your own watchlists with saved charts and the ability to sort products by daily price performance. eToro AUS Capital Pty Ltd. is authorised by the Australian Securities and Investments Commission to provide financial services under Australian Financial Services License .

Trading platforms A trading platform is a computer or mobile software program used to execute transactions within the financial markets. This area of the ADVFN.com site is for independent financial commentary. These blogs are provided by independent authors via a common carrier platform and do not represent the opinions of ADVFN Plc.

IG offer spread betting, CFD and Forex trading across a range of markets. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. XM.com Offer a range of Account types and a low minimum deposit to appeal to all levels of trader. With 1000+ markets and low spreads they offer a great service. This cryptocurrencies thing has been going around for far too long for me not to dab into it.

You can then make informed decisions based on today’s market price. The more accurate your predictions, the greater your chances for profit.

Get The Best Out Of Cfd Trading

Market movements – Your demo account server may not take into account interest and dividend adjustments, or out of hours price movements. Drawdowns – Regardless of how effective your strategy is, there will be days where the market feels against you. However, investing in a demo account allows you to practice sticking to your plan and perhaps adjusting your position size until things turn around. Forward testing – Once you have a market and strategy in mind, you can either backtest or forward test your trading plan. While backtesting can prove useful, it lacks the emotional element. Forward testing enables you to put your plan to trade stocks, for example, into action while battling trading pressures in real-time. Calibration – Demo brokerage accounts are the ideal place to fine-tune your strategy.

Understanding and accepting these three things will give you the best chance of succeeding when you step into the crypto trading arena. Do the maths, read reviews and trial the exchange and software first.

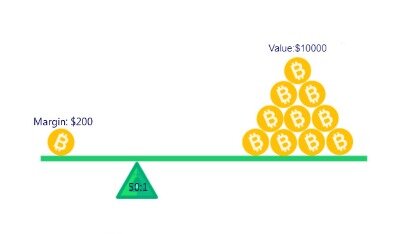

Contracts for difference are investment derivatives that let you speculate on the price movement of investment assets, such as pairs of foreign currencies. You’re betting on how those currencies will move in relation to each other, but you don’t actually own the currencies you’re trading. In contrast, a trader who uses a trade size which only commits $50 into a trade, and loses three trades of equal magnitude just like the first trader, would have lost only $150. The 2nd trader would only need a 17.6% profit to bounce back to the starting level. While our site is free to use, some links to brokers use affiliate links which means that – at zero cost to you – we may earn a commission if you sign up for a broker from our site.

Test platform of a broker where you might trade in the future with your real funds. Get a real touch how cryptocurrency market works and behaves in certain situations. Shrimpy handles a total volume of 1 billion US dollars and more than 120K executions each day. Keeping customers’ security in mind, it offers automated strategies, copy trading platforms, and portfolio management. Quadency has about 12 crypto bots that can be tweaked according to your liking. Simple automated trading software is only available with the free account, while you can get more if you purchase one of their pro or unlimited plans starting from as low as 39.00$ a month.

How Do I Start A Demo Trade?

Learn how to use our client sentiment tool, which gives an overview of what traders are investing in right now. Our platforms are battle-tested and have been in development throughout FXCM’s 20 year history.

FXCM’s minimum trade sizes are designed to allow clients to manage their exposure and trade comfortably. Any positions held past 5pm EST may be subject to a “financing charge” which reflects in an FXCM account as “rollover.” Visit our CFD Product guide for more information. As long as there is sufficient margin in your account, you can hold your position indefinitely. Get a feel for the platform by signing up for a Free Practice Account. Trade commission free with no exchange fees—your transaction cost is the spread. FXCM’s Enhanced CFD Execution means you trade without minimum stop distances on most products, including BTC, LTC and ETH. Control and scale your position sizes with small contract sizes.

With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. Recent customer care issues have severely damaged the reputation of the brand. Forex broker Videforex accepts deposits in a range of cryptocurrencies.

What Is A Cryptocurrency?

Luckily for us, there is a practice account called a demo account offered by many companies where risk-free trading is possible. Forex trading demo accounts are trading simulators or practice accounts that mimic real accounts, except that they are funded with fake money. It’s a great way to get a feel for how a trading platform works. Plus, if you’re new to investing, a demo account enables you to get used to the speed and intricacy of forex trading without incurring any actual risk. Another disadvantage with demo accounts is that some of the elements of real-money trading are missing.

Cryptocurrencies are virtual currencies that typically use a decentralised network to carry out secure financial transactions. With Plus500’s trading platform you can trade Crypto CFDs – such as Bitcoin, Ripple XRP, Ethereum and more – by speculating on their price movements, without actually owning them. If you anticipate a particular price shift, trading on margin will enable you to borrow money to increase your potential profit if your prediction materialises. Exchanges have different margin requirements and offer varying rates, so doing your homework first is advisable. Bitfinex and Huobi are two of the more popular margin platforms. By looking at the number of wallets vs the number of active wallets and the current trading volume, you can attempt to give a specific currency a current value.

An MT4 demo account that does not expire could well prepare you for any number of potential markets. Also, you can switch from Real Money mode to Demo by hitting ‘Switch to Demo Mode’. Not to mention, you can reset Plus500 demo accounts if you want a fresh start. Another key selling point of Plus500 demo accounts is that they do not expire, meaning you can practice indefinitely. For demo accounts using CFDs only, Plus500 is worth considering. IC Markets forex demo account also has no time limit or expiration. So, you don’t have to put real capital on the line until you feel confident.

It is your responsibility to ensure that you make an informed decision about whether or not to invest with us. If you are still unsure if investing is right for you, please seek independent advice. Saxo Markets assumes no liability for any loss sustained from trading in accordance with a recommendation.

Trading Forum

John McAfee-led, US-based crypto mining company working in collaboration with Chinese miner Bitmain Technologies Limited. Limited revenue at this stage, with $1.5m posted in the past 12 months. However, he was unable to gain an agreement with the Bitcoin community so he proposed the development of a new platform with a more general scripting language. XTB Limited is authorised and regulated by the UK Financial Conduct Authority with its registered and trading office at Level 9, One Canada Square, Canary Wharf, E14 5AA, London, United Kingdom . Use the link below to create your account through our application.