Content

Past performance is not a reliable indicator of future performance. You should not rely on any past performance as a guarantee of future investment performance. Alongside the popular bitcoin, there are many types of cryptocurrency to consider, including dogecoin, litecoin and ripple.

And when the price of the former goes down, the latter drops likewise. Recently, Ethereum launched a new blockchain known as the ‘Beacon Chain’ that uses a proof-of-stake consensus algorithm to run Ethereum 2.0. This version is said to use up far less energy than the original and can be scaled up better. Transactions take less time to be processed on Ethereum – about 10 to 15 per second against three to five per second on Bitcoin. Ethereum has given birth to ‘DeFi’, or decentralised finance.

These are good ways to find out more about a product, but the best way is to check what heavy users have. Look at people who use the product daily and intensively for work or constant communication.

Because of this, the upgrade has been split into multiple phases over several years. The Ethereum network today is overrun with traffic, causing transaction fees to spike to levels that are not affordable for many use cases.

What Are Ethereum’s Main Strengths And Weaknesses?

Additional Key Information Documents are available in our trading platform. American multinational semiconductor company based in Santa Clara.

When choosing new technology products, the heaviest users are often CEOs and managers. By entering your details, you acknowledge that your information will be used in accordance with our privacy policy.

German holding company with focus on blockchain and cryptocurrencies. Bitcoin Group SE also holds 100% of Bitcoin Deutschland AG, Germany’s only registered Bitcoin exchange. Largest Options exchange in the US, and the first to offer Bitcoin Futures. It plans to launch Futures on Ethereum and other cryptos in 2018. Increased adoption of cryptocurrencies will add positively to Cboe’s financial results, although exposure is still very low.

But advocates say Ethereum has several advantages over Bitcoin that make it more useful. Ethereum is a cryptocurrency, like Bitcoin, which runs on its own “blockchain”, an online ledger which tracks the transfer of information. It is second to Bitcoin in terms of market value, at £145bn compared with Bitcoin’s £750bn, but its price has risen even more quickly this year, up 145pc versus 100pc for Bitcoin. Ethereum is part of the exciting cryptocurrencies boom that has taken the world by storm during 2017. It’s a decentralised system, the benefits of which include enabling payments to be sent across the internet without the need for a bank or another third party. 67% of retail clients lose money when trading CFDs with this provider.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs, or any of our other products work, and whether you can afford to take the high risk of losing your money. The first thing to understand about Ethereum is that it is not just a digital currency.

DigitalX is a blockchain technology company based in Perth and New York, providing ICO advisory services, blockchain consulting services and blockchain-related software development. John McAfee-led, US-based crypto mining company working in collaboration with Chinese miner Bitmain Technologies Limited. Limited revenue at this stage, with $1.5m posted in the past 12 months.

What Are The Risks Associated With The Underlying Ether?

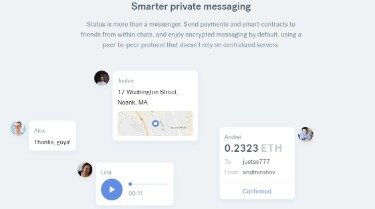

Staked tokens could be compromised by a malicious actor, as they do not remain in one’s wallet. Several companies, including Darma Capital, are planning to offer intermediated staking that would allow users to continue accessing their capital. Through its LiquidStake initiative, both retail and institutional stakers can delegate their capital and maintain the ability to use it as collateral to receive USD Coin loans. Unlike other staking derivative proposals, LiquidStake will not create new tokens to represent the bonded Ether .

And, if you are looking to invest in it, now would be a good time to do so. That’s why proper crypto trading education is essential to help you understand what Ethereum is and how to invest in Ethereum successfully. The cryptocurrency market is perceived by some as a safe-haven for when traditional currencies become too volatile. Since Ethererum is more separated from mainstream markets than other crypto, it could become the new gold safe-haven for some traders. crypto games are also based on Ethereum, which makes them an attractive investment option. One of the most popular games is CryptoKitties that allows gamers to breed and trade digital cats.

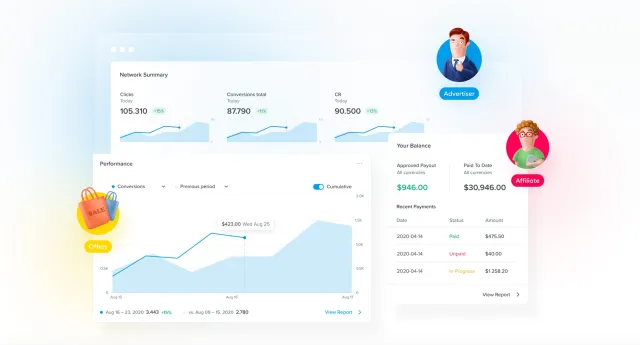

The internet has a long-established client-server model, and Ethereum works by replacing this with a decentralised blockchain. The platform is used by many developers to provide services that we might otherwise have never seen. From banking to betting, Ethereum functions to improve services and security through smart contracts. Its aims are more extensive than most cryptocurrencies, such as Bitcoin’s aim to singularly act as an electronic payment solution. It is a EU regulated custodial exchange as a service that provides a quick and straightforward way to buy and sell bitcoin as well as other top cryptocurrencies. It offers quick user verification and numerous payment options that make it simple, accessible, and easy to use even for beginners. Binance has grown exponentially since it was founded in 2017 and is now one of, if not the biggest cryptocurrency exchanges on the market.

Furthermore, delegating tokens to be staked by someone else is not supported by the protocol, and requires a 3rd party delegation mechanism with potentially high fees and security risks. Exchanges will offer markets to trade locked staked ETH2 , but these markets may not be available in the US, may not have good liquidity or pricing, and require leaving coins on the exchange. It will be interesting to watch exchanges launching staking, and groups issuing staking security tokens, and how liquid and at what prices they will be traded at.

Cryptocurrency Insights

It skyrocketed from less than £7 to over £1,000 before falling back to just over £70 in November 2018. If Bitcoin is on a bull run, then Ethereum usually experiences the same phenomenon.

- Whether you’re new to Ethereum investing or just curious about how to make the most of your investment, understanding what to know before investing in Ethereum is critical.

- Bitcoin is at the “high-risk” end of the investment spectrum.

- As mentioned above, there are more tokens in circulation than bitcoin, and it’s easier to obtain ether at a shorter block time.

- Anyone wishing to invest should seek his or her own independent financial or professional advice.

Ethereum is in the top three list of global cryptocurrencies, which makes it a great candidate for fiat exchanges. Many investors also keep separate accounts for both fiat currency and C2C exchanges. And it is an open-source for transactions, referred to as a decentralized digital application or smart contacts. The contract is 100% safe, with no third-party requirements, and can trade and decentralize anything. Then a token called network ether is made to reduce the cost.

Also, it is unknown the liquidity that will develop on this market, and if the liquidity turns out to be poor, the market may not survive until later phases of ETH2. Most likely, exchanges will charge high fees for this service. (For instance, Coinbase charges 25% fees for Tezos staking, where 5-10% is typical for 3rd party baking services.) However, they probably will provide some kind of alternate liquidity.

Perhaps you don’t trust other DeFi interest generating protocols? Staking coins for yield is likely safer than lending your coins to a DeFi protocol. This number was calculated to make it economically difficult to attack the network. This amount was required to be staked by November 24, for the new network to launch on December 1. The amount staked started off growing very slowly and it looked like the deadline might be missed; as of 11/13/20, 64,320 ETH were staked (12%), and as of 11/20/20, only 107,360 ETH (20%) were staked. However, at the very end things rapidly picked up steam and by the deadline, 694,368 ETH (worth over $400 million) was sent to the contract. Roughly the last 25% of the ether needed to meet the threshold was deposited into the contract in less than a four-hour timespan.

If you expect Ethereum’s growth to continue, buy some from an exchange and store it in a wallet. When trying to discern if Ethereum is a good long-term investment or not, make sure to conduct some kind of fundamental analysis, similar to how you would analyse a stock. Ethereum removes the middleman from online financial services.

When trading Ether, you can take a long position or a short position. Choosing a long position would mean that you have invested in ETH in the belief that it will rise in value, whereas opting for a short position means that you have an expectation that it will fall in value. Both of these are potentially profitable trading methods, and you should choose one based on your own due diligence. Developing a great technical trading strategy is something that takes time and commitment, but the reward can be dramatic. Such a strategy will reference key indicators and different trading methods like spread bettings, CFDs, using leverage, and shorting.

Wave Financial LLC is a Los Angeles and London based investment management company that provides institutional digital asset fund products. Led by a team of highly experienced financial services professionals, Wave provides investable funds via their diverse investment strategies applied to digital assets and tokenized real assets. Namely, they plan to launch a special trading pair between staked ETH and unstaked ETH to offer liquidity to investors who have locked up their ETH in staking. This market will not be offered to citizens of the US and Canada.

The company had little revenue in the past 12 months and a net income loss of CAD 4.2m. The parabolic price increase of cryptocurrencies is largely driven by speculation rather than by intrinsic value.

This upgrade will change how the network operates from a proof-of-work model to a proof-of-stake model. The launch of Ethereum futures on the CME this week has helped drive higher prices, but Bonello says that demand for ether has also risen due to more activity in decentralised finance . Grayscale is the world’s largest digital asset manager, with around USD32 billion in assets under management. The asset manager grew more than 10 times in size over the course of 2020, going from USD2 billion to USD20.2 billion by year-end. The same arguments for buying or avoiding Bitcoin can be applied to Ethereum.

Exchange Traded

Ethereum is based on this technology, but it went a step further. A computer must have the capability to run any algorithm in order to be Turing-complete. Thanks to this code language, any script can run on Ethereum. Subsequently, Ethereum’s chain records transactions much faster than bitcoin’s blockchain. Bitcoin takes 20 minutes to process a transaction, while Ethereum only takes 12 seconds. On its own, this technological development is enough to give Bitcoin a run for its money. The deposit in C2C exchanges can add a level of complication to the transaction.

Cryptocurrency, which has been in circulation more than 6000 times, has built up its market ceiling that is cap to $337 billion dollars. Here has become the preferred currency for all investors, which includes bitcoin and Ethereum. Rapid City in America has some of the craziest weather in the world – a bit like how volatile crypto prices can beIf you do invest, be prepared to lose some or all of your money.