Content

When you open a position and borrow money from a platform to trade in cryptocurrency, the platform will take measures to reduce their risk of losses. So when the market moves against your bet, the platform might ask you to increase your collateral so that your position is secure. Margin trading in cryptocurrency is similar to margin trading in traditional finance. It allows you to earn huge profits, but there are additional risks as well. When you are margin trading in crypto, you borrow the funds from a third party like a broker or margin lenders.

Some of the largest by market value are Bitcoin, Ethereum, Ripple, Tron, and Bitcoin Cash. As with all trading methods, crypto trading does carry the risk of losses. The more study you put in to learn the tricks of the trade, the better your chances for success. Also, consider using stop-loss orders will allow you to limit the size of your loss, should your trade not pan out the way you’d hoped.

In that case, this can have various impacts relying upon what influences the user employments. On the off chance that the user goes long on Bitcoin with $1,000 utilizing 100x leverage, and the cost of Bitcoin increments by 10%, this influence can drastically build the user benefits. Rather than procuring $100, similar to the user would without consequence, the user will presently acquire $10,000. This adds up to an incredible $9,900 more than the user would gain without power. Telephone calls and online chat conversations may be recorded and monitored.

Mixed Sentiment In The Cryptocurrency Market

Trade a handful of leading cryptocurrency coins against the US Dollar. FXChoice offers trading on leading crypto cross pairs with the US Dollar. Price alerts and Stops, such as Stop Loss and Trailing Stop, will help to manage your risk when trading on these extremely volatile instruments. The purchase of real/cryptoassets is an unregulated service and is not covered by any specific European or UK regulatory framework . Leverage trading Bitcoin or crypto essentially lets you amplify your potential profits by giving you control of between 5 and even up to 100 times the amount you needed to open. CEX.IO offers the full support of FIX API, WebSocket, and HTTP REST API. You can take your automated trading to the next level based on your needs and your goals. We hold ourselves accountable to the high standards mandated by the regulatory requirements.

Deposit & Withdrawal fees – This is how much you’ll be charged when you want to deposit and withdraw money from the exchange. Using debit/credit will usually come with a 3.99% charge, a bank account will usually incur a 1.5% charge. Exchange fees – This is how much you’ll be charged to use their cryptocurrency software.

Should the session’s minimum margin fall below the set threshold, then the trader will need to add more money, crypto, or stocks to the account to settle the difference. If the trader fails to add to the maintenance margin, the position is liquidated. High volatility and trading volume in cryptocurrencies suit short-term trading very well. We also list the top crypto brokers in 2021 and show how to compare brokers to find the best one for you. New traders often feel overwhelmed trying to decipher the complications of margin trading in cryptocurrency. If you have tried to Google how it works, you may have come across a glossary of terms like leverage, shorting, HODL, FOMO, forking, margin calls, and several more, which you have no idea about. No commodity is entirely safe, as they all run the risk of producing losses.

Bitmex Review 2021

As a CMC client, your money is held separately from CMC Markets’ own funds, so that under property, trust and insolvency law, your money is protected. Therefore your money is unavailable to general creditors of the firm, if the firm fails. A commodity is a physical good that can be bought or sold on the commodity market. Commodities can be categorised into either hard or soft varieties. Hard commodities are natural resources like oil, gold and rubber and are often mined or extracted. Soft commodities are agricultural products such as coffee, wheat or corn. 1,000+ ETFs We offer over 1,000 ETFs, enabling you to track common themes, indices or trends in the market.

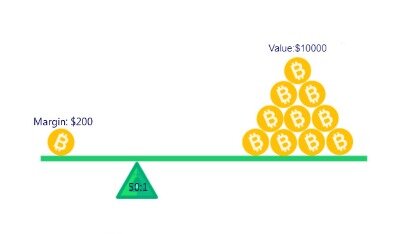

“Leverage” usually refers to the ratio between the position value and the investment needed, and “Margin” is the percentage of the position needed. By leverage trading, traders can gain a lot in a short period. When the Bitcoin price decreased by 10%, then the non-leveraged trade of $1000 would also decrease by $100. Influence is the strategy in which a user borrowed money from someone and then, using this money, increase the investment return. Well, most of the people consider leverage trading highly risky as it can increase the potential profit loss that a trade can make easily. When you put higher leverage it means that your leverage price is higher it means that the liquidation price is higher than the entry price which is in turn very risky. So you have to set up the stop loss to prevent the leveraged position getting liquidated.

Please note that in times of high volatility, our minimum spreads can increase significantly. The size of your financial instrument portfolio, defined as including cash deposits and financial instruments, exceeds EUR 500,000 . We may use more sophisticated language when dealing with you as a Professional Client than we do with our retail clients. The detail of Trade Confirmations remain unchanged and are sent by the end of the first business day following the execution of the trade, or earlier. Client money remains segregated from our funds and will be unaffected in the event of our insolvency.

How To Trade Future Contracts On Bitmex?

If you want to learn more about how leverage and margin trading works, how you could profit, as well as the risks involved, read on for a step-by-step guide. Since 2013, CEX.IO has been serving global clients in over 200 countries and territories. We built CEX.IO Broker based on the years of cryptocurrency markets knowledge and experience. That depends on your trading goals, but we strongly advise against leveraged trading of cryptos for beginner investors because of the added risk it brings. There are about 3,000 cryptocurrencies in existence, and you can trade them all. That said, the top 10 make up about 85% of all crypto market value.

This is because CFDs allow you to trade cryptocurrency assets against the value of cryptocurrencies without literally buying them. Some people dismiss it as shy of gambling, while unfair, the characterization does speak for itself when inexperienced traders always surrender to emotional trading with heavily leveraged positions.

- In layman’s terms, the higher the leverage, the sooner crypto possessions might be sold – if the crypto market starts moving off course.

- Such a situation will lead to a “margin call” from your financial intermediary who will ask you to either add funds or to clear a part of your positions.

- This is when you want to buy crypto, but you’re only willing to pay up to a certain price, known as a limit.

Should the value of the real estate property rise, the borrower could sell and make a profit on the purchase price because all they did was pay a down payment. Margin trading uses leverage to get the most out of the trading process in a bull market. This credit used as leverage could however work against this same trader in a bear market. The most useful cryptocurrency trading tutorial you can go on is the one you can give yourself, with a demo account.

Bitmex Review: What Cryptos Are Supported?

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Brokers implement margin trading requirements at different points during the trading process to ensure that the trader has sufficient capital to accommodate the changing nature of the trade. If the client has an insufficient balance, the trade will automatically close out. In case you are wondering how BitMex makes money, then you must know that the exchange does it by providing leverage to traders.

All contents on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalised advice before you make any trading or investing decisions. Daytrading.com may receive compensation from the brands or services mentioned on this website. So, whilst bots can help increase your end of day cryptocurrency profit, there are no free rides in life and you need to be aware of the risks. Perhaps then, they are the best asset when you already have an established and effective strategy, that can simply be automated. Let’s say on your cryptocurrency chart at 250-minute candles, you see 25 candles where the price stays within a 100 point range.

As soon as your account is verified, you can already proceed in depositing funds in it. Swyftx Bitcoin exchange claim that you should also consider the leverage that the exchange offers.

New margin traders should start with demo trading, then low leverage and small position trades for risk management. Opening a margin account, they will deposit a percentage of Ethereum, money or stocks to a margin account upfront. The minimum margin’s purpose is ensuring that the broker will recover some lent assets, crypto or cash should the trader’s strategy fail.

Any client with a notional size above this limit is at risk of having their cryptocurrency positions reduced. Under FCA rules, only professional traders can trade cryptocurrency with derivatives like spread bets and CFDs.

The index captures close to $202Bn of market cap, representing over 83% of the total market capitalisation of all traded digital assets. The index is calculated and managed by BITA GmbH. For further information click here. CFD and Forex Trading are leveraged products and your capital is at risk. Please ensure you fully understand the risks involved by reading our full risk warning.

Past performance of an eToro Community Member is not a reliable indicator of his future performance. Content on eToro’s social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of eToro – Your Social Investment Network.