Content

If you issue a global accounting sales invoice in a foreign currency, you must show the sterling equivalent of the total value of the goods. Even if you sell more than one item on the same invoice, you need only show the total foreign currency and sterling price on that invoice. Global accounting invoices will normally only show a total price for the goods you buy and sell under the scheme. The adjustment required in this paragraph does not apply if the total VAT due on your stock on hand is £1,000 or less.

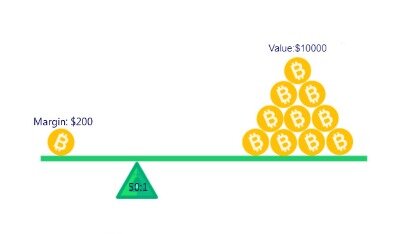

You can expect the type of account you hold with a broker to have an impact on the available margin and leverage. Margin will typically be expressed as a percentage of the full amount of a position. The majority of forex brokers will require anything from a low margin of 0.25%, 0.5%, 1% or 2% up to higher-level margins. A margin account in forex is very similar to one for equities – in a nutshell, the investor takes out a short-term loan from their broker. While trading with leverage can lead to increased profits on successful trades, it also carries the risk of magnified losses.

Margin Trading Vs Short Selling

He has heard that stock can be calculated from his GP Margin but he doesn’t know how to to do that and has asked for our help. If the loan exceeds £75, or the redemption period has been agreed for a time longer than the usual 6 months, then ownership of the pledge does not pass to you at the end of the redemption period.

Learn more about margin in trading and find out how to get started. Your purchase price will be calculated in the normal way (see paragraph 3.2).

The legal definition of works of art includes pictures, paintings, collages and drawings executed by hand by the artist. Craft items and items produced in a technical or industrial context may not be eligible to be sold under the margin schemes. The legal definition of second-hand goods is goods which are suitable for further use as they are, or after repair. In most cases, goods which are second-hand in the ordinary usage of the term will be eligible for the margin schemes.

Because USD/JPY currently stands at 120.00 when the short trade is opened, one pip of USD/JPY for onestandard lotis worth approximately US$8.30, so one pip of USD/JPY for five standard lots is worth approximately $41.50. If USD/JPY goes against this trader and rises to 121, Trader A will stand to lose 100 pips on the trade. This single loss is a drastic hit to the trading capital since it represents aneye-watering 41.5% of their total trading capital. On a market with low volatility, the trader can choose to artificially increase his position sizes thanks to leveraging in order to benefit from low level of variation. On the contrary, in the case of high volatility, the trader will choose to decrease the leverage utilized in order to decrease his exposure to the market.

1 The Meaning Of global Accounting Scheme

TradeZero does give you the ability to put up for credit any unused shares and if these shares are located by another TradeZero client, you can recoup up to 50% of the locate price. TradeZero America Inc.’s mission is to provide stock and options trading services through its full suite of trading platforms. A $50 per execution fee will be charged for any “F” share trades. This means that if you opened a 1 lot transaction on the GBP/USD and the market moved 100 pips in your favour, you would make a profit of $1,000 .

Plus500SG Pte Ltd holds a capital markets services license from the Monetary Authority of Singapore for dealing in capital markets products (License No. CMS ). This means that, for your total spread bet position in this market, the first £10 per point is charged at the initial step margin of 20%. The remaining £7 per point is charged at the second step margin of 30%.

Since margin trading means the use of leverage, to open a position of a certain size, you need funds less than the position size. These funds are taken out of your Usable Margin and moved to Used Margin to serve as collateral for the open position. It is Margin Impact that shows how much money will be moved, hence by how much your buying power will be changed, as the result of this new position. Who is responsible for managing the exercise/assignment risk associated with options? TradeZero clients are ultimately responsible for managing the exercise/assignment risks associated with the positions in their accounts.

The conditions about eligibility of goods are strict to ensure that only those goods which the law permits, and on which there was no VAT to recover are sold under the margin schemes. They prevent businesses from declaring less VAT than is due on goods which are not covered by the schemes. If you sell an item for less than you paid for it, you will not have any VAT to account for on the sale. Without a Margin Scheme, you would have to account for VAT on the full selling price of each item. A Margin Scheme is an optional method of accounting which allows you to calculate VAT on the value you add to the goods you sell, rather than on the full selling price.

How To Choose The Best Leverage Level

The material is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination. IG offers tiered margin rates, which means we apply different margin requirements at different levels of exposure.

You must then enter the sterling amounts in your stock record on an item by item basis. If you buy a number of items at an inclusive price and do not intend to sell them as one lot, you must convert the price to sterling and then apportion this amount between the items. If you’re buying and selling eligible goods in a foreign currency , you must convert the price into sterling in order to calculate your margin. You must keep your stock book up to date and it must include all of the information in the table.

To calculate the amount of margin used, just use our Margin Calculator. So, Forex leverage can be used successfully and profitably with proper management.

This applies to each item you purchase for resale under the Margin Scheme. You may, if you wish, include further information for your own accounting purposes.

76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Once you have opened your position, you might need to add more money if your trade starts to incur a loss and your initial margin is no longer enough to keep the position open.

Test Your Knowledge With An Xstation Demo Account

Winning and losing trades often come in streaks, with more losing streaks than winning streaks. It is extremely important that you do not get too confident with a couple of winners, or get too despondent with a series of losing trades. This broker is being very generous as to how it handles your abuse of margin limits.

If a move against you of 50 pips or less is going to cause you to liquidate your position or worse yet, the margin clerk does it for you, then you are trading too big. For new traders, it is generally better to trade a smaller unit size with a wider stop. Ultimately, margin calls can be effectively avoided by using far less than available leverage to make your trades and monitoring the account balance on a regular basis. I believe that the flexible leverage AND flexible lot sizing conferred by Forex can allow most traders a far safer trading arena than either stocks or futures. A futures trader must use the leverage geared for the contract specified, which can be quite high and dangerous.

If you obtain goods under a transfer of a going concern , no VAT will be chargeable on the transfer. But this does not necessarily mean that you will be able to sell the goods on under a Margin Scheme.

- In that case, you should add the purchase value of goods included in the scheme to your sales figure for the period in which the TOGC takes place.

- That said, while investing is typically less risky than trading, annual returns will still fluctuate and could result in unexpected losses.

- – The answer to the question is that it is hard to determine which is the right leverage level.

- Their margin account will provide more of the assets than they can afford at a go, and the broker will keep the assets bought as collateral.

- Our online trading platform, Next Generation, offers traders the chance to practise first with £10,000 worth of virtual funds.

If stress and anxiety are problems for you, and taking a big financial hit would be very damaging to your life, then you may be better off trading without margin. The primary benefit of trading without margin is the decreased risk. There are many benefits to trading with lower risk, not least of which being your own peace of mind.

Trade your opinion of the world’s largest markets with low spreads and enhanced execution. Whenever you are dealing with your account’s margin, there is always a chance that things can go wrong.