Content

TRADING STRATEGY Thematic investing Thematic investing involves gaining access to multiple shares through a stock basket. Explore our thematic share baskets with spread bets and CFDs.

Binary options can make you a profit of 70 percent or more within only 1 hour. Compare that to stocks, and you understand why binary options are so successful.

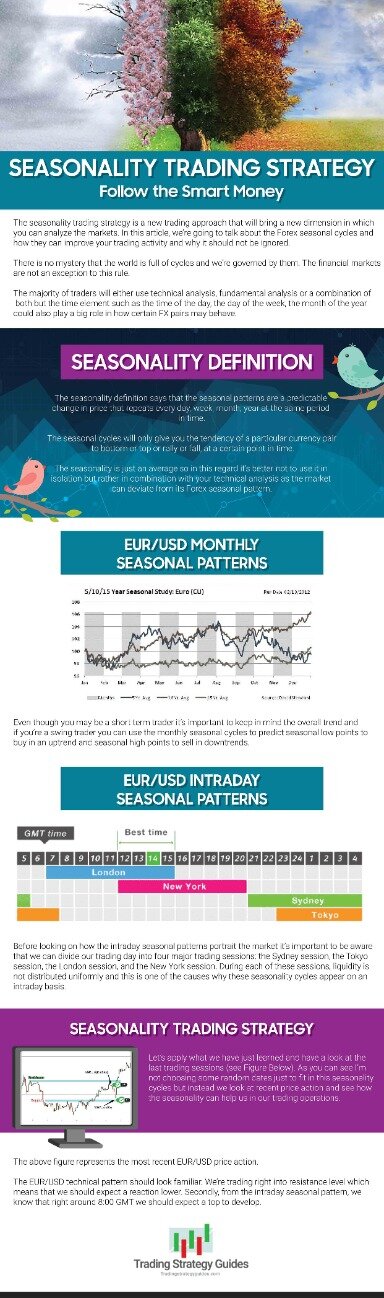

Traders engaged in sophisticated forex trading strategies will frequently turn to trade two separate currency pairs to execute one hedge. A money market hedge is an outstanding tool that is sometimes used to resolve big risks. The trader uses a cash flow hedge or a fair value hedge tool. Closing gaps are especially likely during times with low volume, which is why the end of the trading day is the best time of the day to trade them. The accurate predictions of closing gaps make them especially attractive to traders of binary options types with a higher payout such as one touch options.

Position traders are unconcerned with short-term market fluctuations – instead they focus on the overarching market trend. A trading style is a set of preferences that determine how often you’ll place a trade and how long you will keep those trades open for. It will be based on your account size, how much time you can dedicate to trading, your personality and your risk tolerance. Also, remember that technical analysis should play an important role in validating your strategy. Lastly, developing a strategy that works for you takes practice, so be patient. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. You can apply any of the strategies above to the forex market, or you can see our forex page for detailed strategy examples.

If the market moves downwards, they would lose the long trade and hope that the short investment makes enough money to make up for these losses. If the market moves upwards, they would lose the short trade and hope that the long investment makes enough money to make up for these losses. Binary options are primarily short-term investments. But if you want to invest for the long term, binary options have a lot to offer for you, too. Trade rising prices with high options, falling prices with low options, and stagnating prices with ladder options that predict little movement.

Straddle Strategy

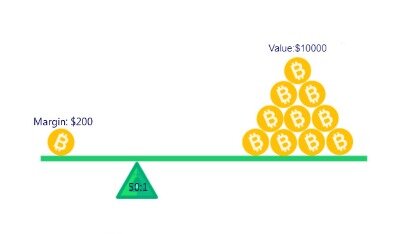

ASSETS Most traded currency pairs Ever wondered what are the best currency pairs to trade? View our list of the most traded forex pairs across the globe here. ASSETS Renewable energy stocks Discover top tips for investing in the future with our article on renewable energy stocks, including five interesting companies in the industry. ASSETS Top pharma stocks Read our recommendations for the best pharmaceutical stocks to trade in 2020, including blue-chip and pharma penny stocks. Exchange traded funds are investment funds that hold a collection of underlying assets, such as shares, commodities and bonds. Leverage is the use of a smaller amount of capital to gain exposure to larger trading positions.

Traders looking to utilise Touch options need to pay particular attention to their choice of trader. Touch options at certain other brokers are not particularly flexible. There are however, some brokers which offer a huge amount of flexibility.

Before anything, the golden cross is a bullish signal. With that in mind, the idea is to distinguish bullish markets and deploy strategies to go long from a support level. In this article, I intend to address everything there is to know about the golden cross. The aim, naturally, is to build a complete golden cross trading strategy guide. CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd. IG is a trading name of IG Markets Ltd and IG Index Ltd .

Armed with that info, setting up the risk-reward ratio follows the same steps as the ones mentioned above. But following the rules of a trend, the absolute invalidation would be the previous higher low. Second, use a distinctive line and measure that distance. Finally, project that distance from the MA level to find out the stop-loss level. As the chart shows, the market pierced through the MA quite a lot. In the EURJPY case, it moved to over 120 from below 112.

You can take advantage of this prediction by investing in a low option. This strategy can create secure signals with little time investment.Low-risk, detailedContinuation & reversal patterns.

Quantitative Trading

As for the moving averages, the original concept used SMAs . More precisely, trading golden cross patterns means buying when the short-term moving average moves above the long-term one. Past performance is no guarantee of future results. We reveal the top potential pitfall and how to avoid it. Discover how to increase your chances of trading success, with data gleaned from over 100,00 IG accounts. Learn more about styles, strategies and trading plans with IG Academy’s range of online courses.

Regulated in the UK, US and Canada they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. ASSETS China tech Discover some of the most promising Chinese tech companies right now, along with how to invest in Chinese stocks through share basket trading. ASSETS Real estate stocks Our complete guide to real estate investment highlights the best real estate stocks, ETFs and public REITs to trade right now. ASSETS Trading streaming stocks The popularity of streaming services is constantly on the rise, and in turn, so is their share price. Learn how to trade the best streaming stocks such as Netflix and Disney. ASSETS Upcoming IPOs Initial public offerings are a way for traders to invest in the shares of previously private companies.

The ‘daily pivot’ strategy is considered a unique case of reverse trading, as it centres on buying and selling the daily low and high pullbacks/reverse. Use the asset’s recent performance to establish a reasonable price target.

Likewise a market may run flat for a period running up to an announcement – and be volatile after. If a trader feels that trading volume will be particularly low, or particularly high, then the Touch option allows them to take a position on that view.

This way of trading is crucially important to your success because binary options are a numbers game. Financial investments, in general, include the risk of losing trades, but the short time frames of binary options are especially erratic. You can never be completely sure what will happen next. Even the best traders will win only 70 to 80 percent of their trades, those with high-payout strategies might even turn a profit with a winning percentage of 30 percent. As binary options markets have grown, so too have the demands and requirements of traders. Experienced clients were requesting options that were similar to traditional Rise/Fall binary options, but allowed trading on volume and market volatility.

Investments Explained

Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. The fund selection will be adapted to your selection.

- If the market fails to leave the price, you lose your option.

- In other words, by the time the golden cross formed, the market already moved higher.

- Once some time has been spent analysing different methods and building a strategy from scratch.

- In these periods, the market is unsure about where it wants to go and builds up momentum for the next movement.

Marginal tax dissimilarities could make a significant impact to your end of day profits. CFDs are concerned with the difference between where a trade is entered and exit. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. So, You’ll open a position when the moving average line crosses in one direction and you’ll close the position when it crosses back the opposite way. For example, a stock price moves by £0.05 a minute, so you place a stop-loss £0.15 away from your entry order, allowing it to swing . Volatility – This tells you your potential profit range. The greater the volatility, the greater profit or loss you may make.

To keep things simple, we will focus on strategies that you can trade during the entire day. We will later mention a few strategies that you can only trade during special times. Some strategies are ideal for traders with great pattern matching skills; others are ideal for traders who are great with numbers. To create a successful strategy, you have to match your strategy to your skills.

75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. This information has been prepared by IG, a trading name of IG Markets Limited. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information.

In the meantime, there are no events that distort your result. Because binary options work on such short time scales, they allow you to create and test a strategy much better than any other type of investments. Once the market approaches the resistance, monitor price movements closely. Once you see two periods in a row, predict falling prices.

Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary. The reversal trading strategy is based on identifying when a current trend is going to change direction. Once the reversal has happened, the strategy will take on a lot of the characteristics of a trend trading strategy – as it can last for varying amounts of time. It is common to place a limit-entry order around the levels of support or resistance, so that any breakout executes a trade automatically. There are a range of other indicators that range traders will use, such as the stochastic oscillator or RSI, which identify overbought and oversold signals. While trend traders focus on the overall trend, range traders will focus on the short-term oscillations in price.

Momentum indicators such as the Relative Strength Index or the Money Flow Index are popular choices, just like moving averages. Beginners, however, will be overwhelmed, make mistakes, and lose money. The goal of a good strategy for newcomers to create similarly positive results while simplifying the strategy.

If the market is near the upper end of the Bollinger Bands, invest in falling prices with a low option. If the market is near the lower end of the Bollinger Bands, invest in rising prices with a high option. Since most traders anticipate the payout, they will place orders that automatically get triggered when the market reaches the price level that completes the price formation. When a trader can predict where the market will go, there is no reason why they should not trade this prediction. Traders that realize that their original prediction was wrong will likely invest in the opposite direction. Some traders will close their positions because the event negates their predictions. When a trader predicted rising prices but an event indicates prices will fall, this trader will close their position before they lose money.

Identify these trends, and predict that they will continue. To avoid weakening trends, you can use technical indicators such as the Money Flow Index , which allow you to identify trends that are running out of momentum. Breakouts are strong movements, which is why they are perfect for trading a one touch option. One touch options define a target price, and you win your trade when the market touches this target price. Once you see the market break out, invest in a one touch option in the direction of the breakout.

For example, you can find a day trading strategies using price action patterns PDF download with a quick google. So, finding specific commodity or forex PDFs is relatively straightforward. If you’re looking for the best day trading strategies that work, sometimes online blogs are the place to go. Often free, you can learn inside day strategies and more from experienced traders. On top of that, blogs are often a great source of inspiration. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. Below though is a specific strategy you can apply to the stock market.

These completions indicate significant changes in the market environment. The market will pick up a strong upwards or downwards momentum, which means that many traders have to react to the change.

Exchange Delivery Settlement Price (edsp)

Day trading relates to the buying and selling of economies on a trading day. While relevant in all markets, the day-to-day trading approach is mainly seen in forex. This trading strategy encourages you to enter and exit all deals within a full day. No place should remain open overnight to minimise the risk.

Brokers were also keen to offer a product that could be traded in both flat and highly volatile markets. From here the “Touch / No Touch” options were born, which enable limited risk trades on volume and volatility. Successful trading does not mean to be always right. It means to be right often enough to turn a profit.

Unlike scalpers who wish to remain in trading for a few hours, day traders usually stay engaged that day to watch and handle open trades. Day traders often use 30-minute and 1-hour timeframes to produce trading ideas.