Content

In a country like Zimbabwe, which suffers from hyperinflation, the prices of daily essentials such as food and fuel can become incredibly expensive within just a short time, hours in fact. There have been situations in the past where the natives were forced to carry entire backpacks of money to buy groceries. Such imbalances usually arise in places where the crypto demand is high. One of the most often mentioned examples is the “Kimchi Premium” of South Korea. Local traders on this platform usually end up paying more for Bitcoin in terms of USD that they would have paid in the U.S, Europe and even some parts of Asia.

HollaEx Kit is a complete out of the box crypto exchange. It is the easiest and most practical crypto solution currently out there. Finally, if you aren’t crypto tech savvy you’re going to have a hard time putting it all together and so some technical capabilities might be necessary.

People should keep in mind that traders compete ferociously to get the opportunity to enter these types of markets. Nevertheless, for this very reason, profits are generally slim in arbitrage trading and depend heavily on speed and volume per trade. As a reminder, that is why most arbitrage trading is done by algorithms developed by high-frequency trading firms. Cryptocurrencies have the potential to revolutionize the modern world.

Second, markets are characteristically imperfect and it can be hard to achieve synchronicity between every exchange. For instance, shares in a tech firm might be on sale for $30 on the NYSE, but available for $30.25 in London.

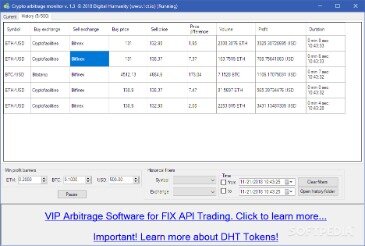

Automated Crypto Arbitrage – Autonomously employed backtested strategies that are operated by an automated script that triggers trades. Manual Crypto Arbitrage – Manual trade management and input on trades. Bitcoin takes the lead as the top crypto in every other thing. You might want to reconsider it for arbitrage due to the slow transaction costs. Consider other altcoins like ETH, with quicker transactions.

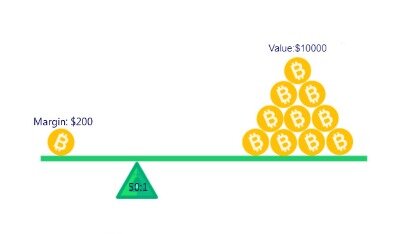

Another very common type of arbitrage trading in the cryptocurrency world is triangular arbitrage. Notably, this type of arbitrage is when a trader notices a price discrepancy between three different cryptocurrencies and exchanges them for one another in a kind of loop. Interestingly, this is a very common strategy in the trading world, but it’s mostly been a tool of large financial institutions. However, with the democratization of financial markets thanks to cryptocurrencies, arbitrage trading might be useful for cryptocurrency traders as well. Notably, in the past few years, spot exchanges have taken markets by storm, adding leveraged derivatives to their suite of trading products. Derivative products have given traders an array of markets from futures and options to better hedge and access market discrepancies for profits across multiple exchanges. But global exchange growth sharing liquidity comes at a fixed cost of parking capital across numerous venues to take advantage of arbitrage opportunities.

Compare Exchanges Side

It’s usually relatively easy, though different platforms will have different policies on withdrawals. It can often take a couple days before you can access your funds, and you’ll sometimes have to pay a fee for withdrawals. Pick a trading platform that best fits your needs in terms of speed and cost of withdrawals. This is simply when you buy some number of crypto units, such as buying one Bitcoin at a price of around $7,000 (as of mid-April 2020).

This site is not intended for use in jurisdiction in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Make sure to read full our full Terms of Use & Risk Disclosure. stories where accounts have been blocked all of a sudden, and more. Therefore, make sure to take time to conduct research and carefully weigh your options. Sticking to your trading plan is important but perhaps even more paramount is that you stay ahead-of-the-curve with what’s happening throughout the world.

- It provides direct market access, allowing traders to trade on 10+ exchanges in one united interface.

- Or the company may be poorly managed and better unlock or realize its value under new stewardship.

- finder.com compares a wide range of products, providers and services but we don’t provide information on all available products, providers or services.

- Live Bitcoin Arbitrage Table, traders can see what available brokers are offering for Bitcoin.

- Broker A reflects a higher trade volume while the price of one BTC offered by the broker is $11,500.

This is also a short-term trading strategy, albeit with a slightly longer timeframe than day trading. When swing trading crypto, you’re holding for somewhere between one day to a few days, in an effort to profit from price changes, otherwise known as swings.

In the end, PixelPlex representatives have noted that their crypto arbitrage solution is easy to integrate and carry over to any business environment. Elon Musk’s influential Twitter activity has shifted the value of several companies and cryptocurrencies by almost $12 billion on average. We explore the latest statistics in the world of cryptocurrency including who is and isn’t buying cryptocurrency, as well as who has made their millions off these virtual currencies.

The Potential Benefits Of Arbitrage

In the end, you should be able to trade and make profits through the strategy. PixelPlex developers have pointed out that one of the most important features of their platform is the built-in arbitrage bot, as it does crypto trading itself and helps users to make a profit. Only channelling your money into one exchange, or one particular cryptocurrency, is risky. As more traders become aware of the potential advantages of arbitrage, there may be increased competition for trades.

Its second is the Digital Gold Institutional Fund, which tracks bitcoin and has returned 200% net since its launch last May. It uses sophisticated execution algorithms to minimise unwanted execution price impact, especially critical for large trading volumes. Investors buy at a fair market price without a bid/ask spread and with a daily liquidity profile. Kloda is a macroeconomist and algorithmic trader with research expertise in arbitrage in high volatility markets.

Once you’ve chosen an exchange that suits your goals, the next step is to set up an account. You’ll need to provide contact information, verify your identity, and set up a method of deposit. We discuss the different deposit methods you can use below.

If you are on a personal connection, like at home, you can run an anti-virus scan on your device to make sure it is not infected with malware. Another way to prevent getting this page in the future is to use Privacy Pass. New strategies to crypto arbitrage are also coming up, and ones that do not involve exchanges. This peer-to-peer Bitcoin marketplace directly links buyers with sellers and enables BTC to be bought using over 300 payment methods. If done properly, it is literally possible that a decent amount can be made within a short period of time, and with a plethora of exchanges on the market, there are likely to be price differences.

Another issue is the user experience or UX is completely different from any other finance platform which may alienate your users/customers. Case in point, try building apps with your own bank account. Or if your a business try building your own financial solutions. All of the above examples are important but what’s more important than all of those examples is money. Climate technology has the potential to provide unlimited upside as the world adapts but assessing the potential opportunities is no easy feat. CMC Markets does not endorse or offer opinion on the trading strategies used by the author. “The reason we are called Nickel is that if you add a little of it to steel you get a higher-grade.

Use your credit or debit card to buy bitcoin and other cryptocurrency without having to verify your identity. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options.

So we are at your disposal even in questions of a full investment portfolio. Telling you which currency exchange is the best, where and how can you exchange between traditional and digital currencies. Our webpage, bitcoinportal.co.uk is an official partner of the software developer P.L.A. Consultuting LTD from Estonia. The conditions of these arbitrage-trading packages are the same as the ones offered by P.L.A. Consultuting LTD. Of course we give you extra knowledge and support. These data come from our own investments, which we are satisfied very much, therefore we are willingly share our results and experience with you.

Unbiased Facts About Crypto Trading Part 3: Will Crypto Replace The ..

Most of the time, this involves buying and selling the same asset as Bitcoin on different exchanges. Lead-Lag analysis data shows that most arbitrage opportunities are found in spot exchanges, while derivative markets lead price discovery. This further establishes why on-chain statistics by Chainalysis show that the majority of Bitcoin flows are, to and from spot exchanges . This volume into spot markets comes despite derivative exchange trading volume dwarfing what is seen on predominantly retail and semi-professional exchanges. There is no central body that serves as a price correcting party in the cryptocurrency markets since they are decentralized and deregulated, which creates an extraordinary amount of crypto arbitrage trade opportunities. With the recent surge in trading volume on global cryptocurrency markets, many exchanges have struggled to keep up with demand. There have been numerous instances of delayed withdrawals, which could be highly problematic if you’re looking to move funds as quickly as possible.

This is a form of liquidation arbitrage but involves a more conservative version of the strategy. Net-net is defined as net working capital minus the long-term portion of debt – i.e., debt with maturity of greater than one year in the future . A catalyst generally needs to emerge to push the market in the right direction rather than rudimentary measures of a particular security being cheap. There is one interesting twist when it comes to how arbitrage can appear in methods of payment. While Bitcoin can be cheaper to get using a bank transfer, a premium is usually charged when gift cards are used as a payment method — and Paxful says it grants crypto fans the chance to capitalize on these margins. Arbitrage has been with us for centuries and is beginning to take shape in crypto, but opportunities can be rare.

You see, in a market where the only constant is price changes, headline risk may produce unforeseen adverse implications on the working conditions of bots . Through innovations in technology, day traders can not only participate with a more seamless arbitrage trading experience but also can benefit from the increased accessibility.

Meanwhile, Bitcoin has also been described as a risky product. “We are also seeing a rising investor demand to create a more diversified fund looking at other crypto coins, beyond pure-bitcoin implementation,” Crachilov explains. Its first product came in June 2019, with the market-neutral Digital Asset Arbitrage Fund.

Transaction times can also vary depending on the coin you’re transferring – for example, Ether transactions are processed much more quickly than BTC transfers. To place arbitrage trades, you’ll need to store coins on crypto exchanges so they’re ready for use whenever you need. There have been plenty of examples of exchanges getting hacked, not to mention some stealing money from customers, so you’ll need to be aware of this risk before getting started. However, arbitrage opportunities also exist in the opposite direction, where you would buy on a smaller exchange and sell on a larger exchange. The recent surge in the popularity of cryptocurrency has led to a dramatic increase in trading volumes on many exchanges around the world. Those exchanges are not linked, and a low trading volume on some exchanges can mean that the price listed doesn’t adjust to the exchange average immediately.

Buy low, sell high – cryptocurrency arbitrage sounds easy in theory, but that isn’t always the case. Check out our numerous crypto trading guides, right here on our site.

Uniswap is the first majorly successful decentralized crypto exchange or DEX. Uniswap is simply a set of programs that run on the Ethereum blockchain which allow for decentralized tokens to be swapped/traded. So what are the best free crypto software solutions out there?

You should consider whether you can afford to take the high risk of losing your money. Contrary to the market speculations, crypto arbitrage has witnessed massive success. It has proven a way to make some extra money without putting much effort. Considering that digital money is not subjected to social influences, and no-one controls them, people are highly inclined towards their potentials to increase in value in the near future. With the right profit, it is a credible way to boost the capital. Similarly, it is all about speed, and you will make money quicker with regular trades.

No commodity is entirely safe, as they all run the risk of producing losses. Moreover, history tells us that cryptocurrencies can also be quite volatile, testing traders’ nerves. That said, volatility can also give you more chances to capitalise on big price swings, if you do the work necessary to prepare and are patient when you trade.

For instance, some exchanges aim for simplicity, allowing you to buy just a few cryptocurrencies using fiat currency. Others will offer a huge range of trading options, including trading a wide variety of crypto pairs. Figure out whether your crypto-trading goals are simple or more varied when picking an exchange. Exchange– A cryptocurrency exchange is a platform that enables you to trade crypto as Bitcoin in exchange for other currencies, be it fiat currency or other cryptocurrencies.

The ultimate aim of statistical arbitrage is to generate higher than normal trading profits for larger investors. It is worth noting that statistical arbitrage does not lend itself to high-frequency trading.